EU rapeseed prices continue surging: Grain market daily

Wednesday, 6 October 2021

Market commentary

- UK feed wheat futures closed lower yesterday. The Nov-21 contract closed £2.45/t lower, at £200.05/t. The drop follows six sessions of gains, which have seen the contract move up from £194.15/t on 27 September.

- The move lower in UK prices followed a similar move in Paris milling wheat futures, the Dec-21 contract closing €2.50/t lower, at €262.75/t.

- EU trade data shows soft wheat exports to be ahead of the pace required to meet the EU estimate of 30Mt this season. In the week ending 4 October, EU soft wheat exports totalled 8.07Mt. To reach the EU export forecast for this season, the EU needs to exports c. 560Kt of soft wheat per week.

- Next Tuesday we will be hosting out annual Grain Market Outlook conference. To watch a livestream of our event, sign-up here.

EU rapeseed prices continue surging

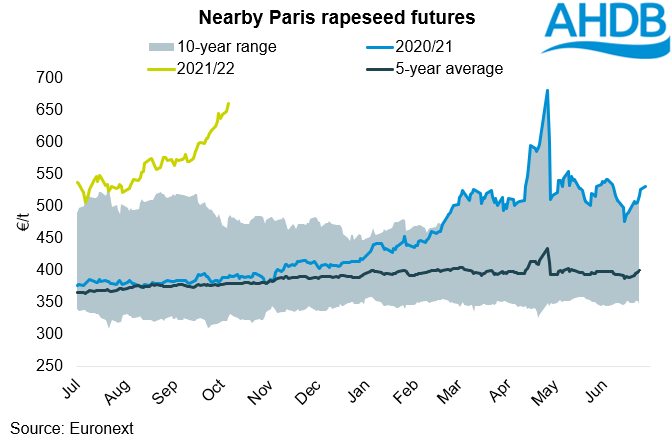

For the past six months, EU rapeseed prices have continued to surge. Yesterday, the Nov-21 Paris rapeseed contract closed at €662.00/t (£563.25/t). The strength in EU markets continues to be reflected in the UK market, with prices for domestic rapeseed, delivered Erith (Nov), quoted at £549.50/t, on Friday. These elevated prices offer a good opportunity for growers who have faced challenging production economics in recent years.

Support looks set to continue. There is little relief for the tight market until the Australian crop comes online. Beyond that we must look to information about Northern Hemisphere new crop (2022/23).

Since 6 October 2020, nearby Paris rapeseed futures have gained €272.25/t. Tight supply and demand in the EU last season was exacerbated by tight supplies of sunflower and palm oil. As a result, EU opening rapeseed stocks for 2021/22 are seen at just 500Kt.

As a result of the lower opening stocks, even with an uplift in production in the EU in 2021/22, ending stocks are expected to remain tight and imports high, supporting prices.

The import situation for the EU hasn’t been helped by the tight outlook for Canadian canola production following dry weather. Canada, the top exporter of rapeseed, has seen its canola production fall by 34%, to 12.8Mt. Exports from the North American nation are expected to decline by 45%, to 5.8Mt.

With global export availability tightened by a lack of Canadian supplies, the price for rapeseed globally has continued to surge.

Further support has been seen within recent days with global vegetable oil prices. This includes palm oil, supported by tight outlooks and firm crude oil (Refinitiv).

Where next for rapeseed price?

For rapeseed, support seems likely until the Australian canola harvest starts in earnest (November-December). Australia is forecast for a bumper crop which may relieve some pressure on markets.

Beyond that information about any area response to high prices will be a key watch point. Stratégie Grains estimate a year-on-year increase in rapeseed area in the EU for 2022/23. Crucially, this is set to remain below the five-year average.

For the UK the first indication of an area response will be seen in the AHDB Early Bird Survey, with results due mid-November.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.