Global dairy product innovations roundup 2019-20

Friday, 3 July 2020

In mature product categories, such as dairy, innovation is critical to drive consumer interest and to distinguish a product from its competitors. In the 52 weeks to 26 January 2020, the dairy category in Great Britain grew in value but declined in volume, highlighting a need for continued innovation to drive volume growth.

With the big four supermarkets rationalising ranges to compete with the discounters and dairy products face increasing competition from dairy-free alternatives, new product development (NPD) faces a harder challenge to gain shelf space. This means new products need to be stronger than ever, ensuring they meet the consumer’s needs and demands.

This article summaries some of the key innovations in the global dairy market and the consumer needs behind them.

Key shopper need:

Novel flavours

According to Global Data in 2016, 72% of UK consumers often/sometimes try new varieties of cheese. While traditional dairy varieties such as cheddar drive the most volume, novel varieties offer something different for consumers and can create new interest.

Image source: GlobalData’s Product Launch Analytics

Image source: GlobalData’s Product Launch Analytics

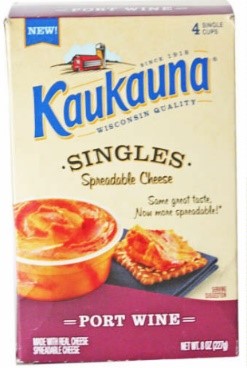

Many brands are therefore bringing out cheese and processed cheese with novel flavours, such as US companies Tillamook and Kaukauna who produce cream cheese which comes in a variety of flavours including Seriously Strawberry and Aged Cheddar and Port flavour spreadable cheese (above) respectively. Here in the UK, Asda now sells white chocolate stilton and Castello has produced ann extra creamy brie with Chilli. (Left)

Need: Convenience

Snacking/lunchboxes

Mintel’s Kids Snacking report from November 2018 found that 69% of parents buy yogurts or fromage frais for their children to snack on, and 56% buy cheese or cheese snacks. This means innovative dairy products are a fantastic way to draw in family shoppers.

Image source: GlobalData’s Product Launch Analytics

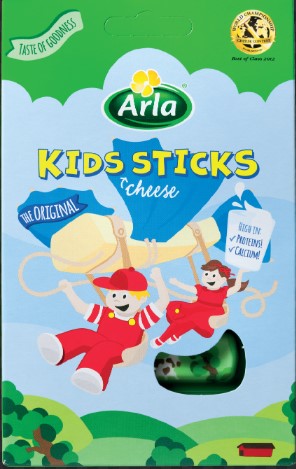

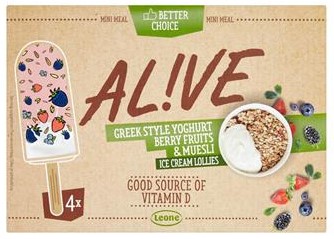

According to Mintel, just a third of cheese buyers eat it alone as a snack, so products such as Kids Sticks (from Arla in India, right) are a good way to try to grow this market. Cheese is deemed to be a healthy snacking choice for children by 55%, making Dairylea Lunchables Streetfood pizza (left) a popular lunchbox filler. Yogurt is perceived as healthier than other sweet snacks by 79% of buyers, a sentiment which ALIVE, based in Slovenia, are tapping into with their Greek yogurt ice cream bars with granola (far right)

Image source: GlobalData’s Product Launch Analytics

Need: Flexitarians

Meat free dairy alternatives

Mintel Attitudes towards healthy eating from February 2019 showed 28% of consumers have actively eaten less meat in a typical week, with 23% of consumers viewing a plant-based diet as being good for you. However, 32% view it as boring and 28% think there is a limited range of plant-based foods.

Image source: GlobalData’s Product Launch Analytics

Dairy alternatives

Mintel reported that 23% of consumers had tried plant-based milk alternatives in the past three months, up from 19% in 2018. The Mighty Society has launched a range of pea milks, including chocolate-flavoured milk, and a banana and oat pea milk (right).

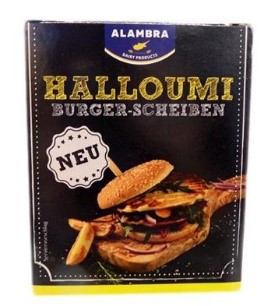

In the UK, Eurilait Ltd recently launched an Original Barbeque Cheese Steak (left) aimed at those reducing or completely cutting out their meat intake. Along similar lines, Petrou Bros Dairy Products in Germany have launched a halloumi burger (below). Offering a whole cheese steak to replace a beef burger is a new positioning for the category.

Image source: GlobalData’s Product Launch Analytics

Image source: GlobalData’s Product Launch Analytics

Need: Health

Gut health and live probiotics

According to Mintel, 68% of consumers recognise that looking after gut health is important for maintaining overall health, with one in five consumers saying they actively include foods in their diet that support gut health.

Image source: GlobalData’s Product Launch Analytics

Image source: GlobalData’s Product Launch Analytics

Brands are now producing a wide range of probiotic dairy products such as Malaysian product Befine (top left), which is enriched with probiotic and contains 0% fat and 0% cholesterol. GoodBelly probiotic yogurts (left) contains 11g of protein as well as added probiotics. Australian brand Always Fresh (above) has created a range of flavoured gluten-free cultured dips, including caramelised onion and goat cheese, baby beets, mint and goat cheese and feta and cashews. These all have live probiotics as well as 4.3g of protein per serving.

Need: Health

High protein

The low-carb, high-protein Keto diet was the most popular diet related search term in January 2020, according to Google Analytics. Mintel reported that 28% of consumers viewed this diet as being good for you and 26% said it was good for weight management.

Image source: GlobalData’s Product Launch Analytics

A range of high protein dairy products is now available, including ice cream, milk and cheese to support this lifestyle.

Halo Top ice cream is a low-calorie/reduced-carb range with 5–10g of carbohydrate and between 410 and 630 calories per pint

Left: + Protein milk from the Dutch Lady is 40% protein. Below: Arla’s protein cheese only has a 5% fat content and 34g of protein per serving.

Graham’s family dairy also offers a wide range of high protein items, including yogurt (22g of protein) and milk with 40g of protein per bottle.

Image source: GlobalData’s Product Launch Analytics

Need: Health

Lactose free

According to Mintel in 2020, 8% of consumers avoid lactose due to allergy/ intolerance, 7% avoid it for other reasons (e.g. ethical, vegetarian), and a further 11% avoid it as part of a healthy lifestyle, meaning almost a quarter of the population can be targeted by lactose-free products.

Image source: GlobalData’s Product Launch Analytics

Because of this, many new products are emerging into the marketplace, including a ‘half and half’ lactose milk from Live Real Farms, which is half dairy and half almond milk. Large, well-known brands, including Cathedral City and Philadelphia, (left) have also produced their own versions.

Green Valley Creamery is a dairy in California, with both cows and goats producing only lactose-free products, including kefir, cream cheese and cottage cheese, along with milk, butter and yogurt.

Need: Health

Lower sugar and fat

Image source: The Food People trendhub

The Mintel Kids Snacking report from November 2018 stated that 42% of parents say it is important to choose snacks for their children with low/no sugar, and a third choose snacks that come in a single portion, making low/ no sugar yogurts the perfect snack.

Müller claims to have developed two yogurt strains which are less sour tasting when combined, meaning less sugar is needed to improve the flavour. Ben & Jerry’s has just launched a new ice cream, Moo-phoria, which has 128–132 calories and 50% less fat than similar ice creams.

Need: Sustainability

According to Mintel, a third of dairy drink buyers are interested in products in a bottle/pot made wholly/partly of recycled plastics. Mintel reported that the amount of packaging waste generated by yogurt/yogurt drinks is a concern for three quarters of consumers, while 16% of buyers deem it worth paying more for yogurts/yogurt drinks which detail on pack how they support the environment.

This consumer sentiment has increasingly been a driver for brands to invest in more sustainable packaging and methods of production. Tetra Pak has become the first packaging company in the food and beverage industry to use plant-based polymers derived from sugar cane, and Lewis Road Creamery is reducing plastic packaging with rPET bottles made from 100% recycled plastic. Arla is going greener with aluminium-free fibre-based lids created by Walki Group. Valio and Stora Enso have teamed up to distribute 10,000 wood fibre-based reusable lids.

The Finnish dairy manufacturer, Valio, is aiming to be carbon neutral by 2035 – over a quarter (27%) of milk, milk drinks and cream users are interested in products with a guarantee of sustainable farming, according to Mintel.

Need: Something different

New ways to enjoy dairy are always emerging as consumers look for something new and interesting to try.

Some examples of these are:

- Pick and Cheese, a conveyor belt cheese bar in London, which works like a sushi bar except that all the dishes are cheese based.

- Fromaggio, by Glen Fedor, is a cheese maker for the home, allowing people to make their own cheese from scratch in their kitchen.

- In Perth, Australia, the world’s biggest cheese fridge, has been opened, selling cheeses of all shapes, flavours and sizes.

- Dessert bars are popping up all over cities, selling ice creams, smoothies, milk shakes and other dairy sweet treats.

- Companies, such as Crave’s Brothers and Quickes, are now selling cheese boxes offering a selection of different cheeses delivered to your door.

- Nightfood, in the US, has created an ice cream with ingredients specifically designed to initiate a more natural sleep.

Arctic Buzz is an alcohol-infused ice cream with a range of different flavours, with an ABV of 6 – 9%.