Brewers find growth in low- and no-alcohol beer

Tuesday, 7 January 2020

For many, January represents a time of change, with people more inclined to focus on a healthier lifestyle – New Year, New You. One category affected by this change is alcohol, with many consumers choosing to either cut down or give up completely. This, coupled with an increase in teetotalism among the younger age groups in Britain, has resulted in a significant growth in the low- and no-alcohol beer market.

A growing market

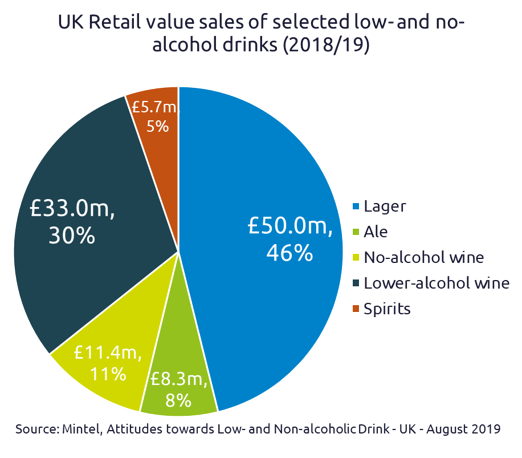

The value of the low- and no-alcohol drinks market is growing – with retail sales up 37% to £108 million in the year ending May 2019[1]. To put the growth into context, in 2018, low- and no-alcohol lager and ale alone grew 39% in value – compared with the total beer market which grew 3.9% between 2017 and 2018[2].

While low- and no-alcohol beer takes up a small share of sales in retail outlets such as supermarkets (1.1% share of all beer sales), the demand and appeal of this product provides opportunities for brewers to grow – both in short-term sales and in bolstering long-term brand image.

Moderation is key

Reducing or omitting alcohol is a trend that has grown in popularity over the past decade. According to ONS/Foresight Factory, 22% of GB consumers aged 16+ were expected to be teetotal – rising from 20% in 2008. And that figure is expected to grow, with younger age groups in Britain leading the way. As a result of this growing trend, Dry January is also growing in popularity. According to IGD[3], 11% of consumers took part in 2019, with younger consumers again leading the charge, with 19% of 18–24-year-olds saying they participated.

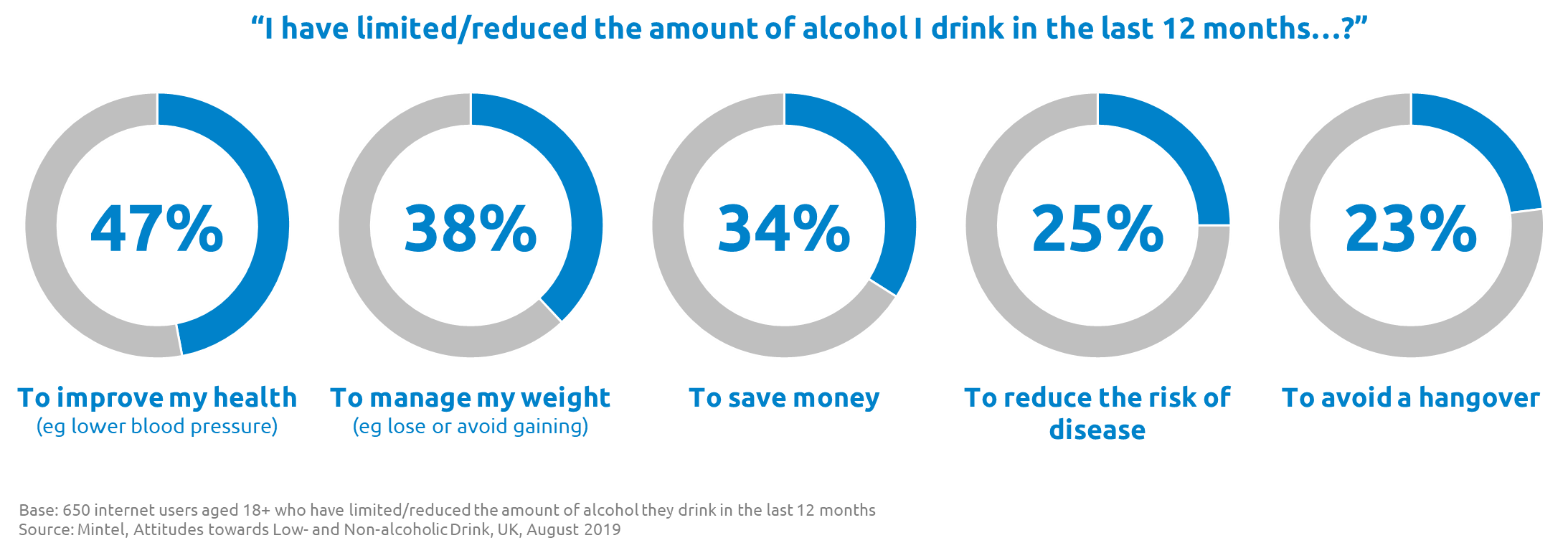

The main reason for people choosing to moderate their alcohol consumption is to improve overall health, followed by weight management. Therefore, alternatives to alcoholic drinks must deliver on health needs.

Addressing both legislative requirements and consumer trends

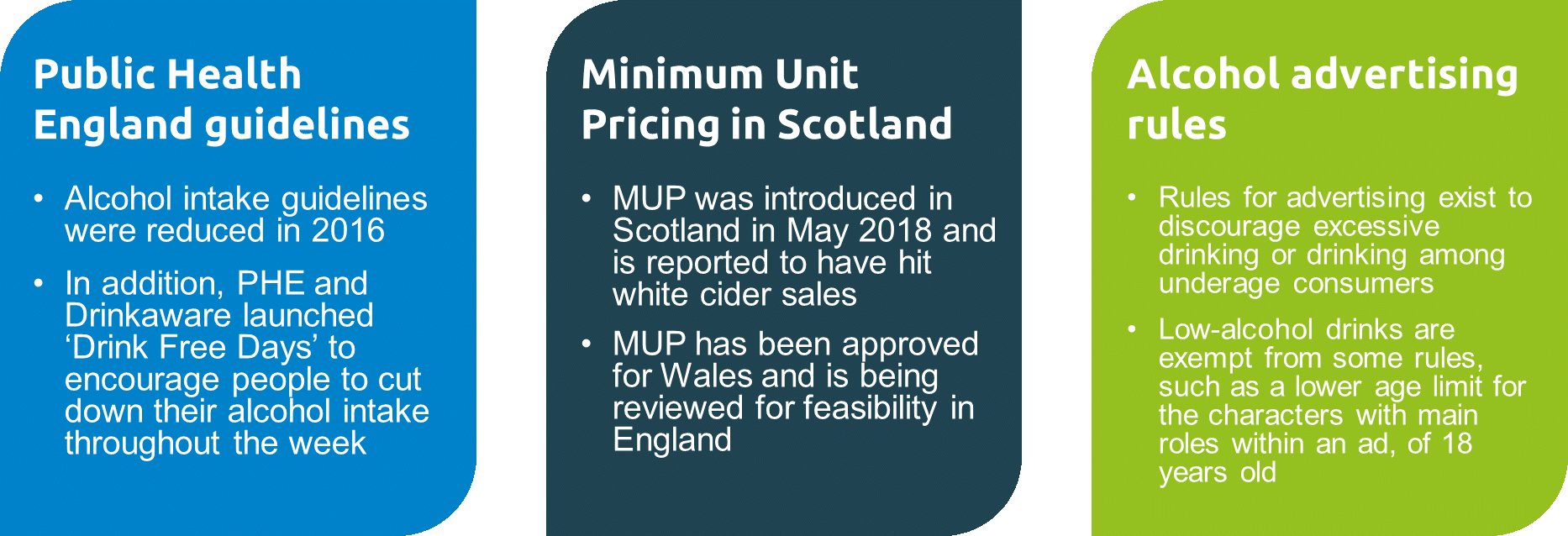

Government guidelines are cited by just 12% of reducers as a reason for limiting alcohol intake[1]. However, these guidelines and legislative requirements still impact brewers, with several changes taking place in recent years:

Opportunities for further growth

There are numerous challenges for the low- and no-alcohol beer market. Health is one, with more consumers scrutinising the health credentials on pack. Brewers could appeal to health-seeking shoppers by signalling reduced sugar and calories on pack.

Labelling and descriptors also need clarity. Drinks from which alcohol has been extracted, and that contain no more than 0.5% ABV, can be labelled de-alcoholised, while beer with an ABV exceeding 1.2% and not exceeding 2.8% attracts a lower duty (and therefore creates an opportunity for improved margin).

Improving the image of low- and no-alcohol beers is also a challenge; 43% of 18–34-year-olds who drink alcohol agree that not drinking alcohol in social situations is awkward[1]. This could be a longer-term challenge to change this mindset, possibly through ad spend on alcohol-free beer, but this has only really come through since 2017.

Quality and cost are also a challenge, with many consumers concerned about compromising on taste. And while 38% of adults would be willing to pay the same price for low- or no-alcohol drinks as alcoholic versions, saving money was given as a reason for reducing alcohol consumption by 34% of consumers who have limited/reduced alcohol intake[1]. Therefore, low-alcohol ranges must offer a reasonable price point for these shoppers.

Summary

- Low- and no-alcohol beer remains a small, but growing, part of the category that provides brewers with a route to growth, around legislative impact and advertising constraints

- Address barriers to consumption, particularly when it comes to health, as this is the main reason for moderating alcohol consumption

- The low/no-alcohol shopper will often be the same shopper who buys alcoholic versions, so drive engagement with shoppers so as not to lose them altogether, such as via sampling or price promotions alongside standard equivalents

[1] Mintel, Attitudes towards Low- and Non-alcoholic Drink, UK, August 2019

[2] Mintel, Alcoholic Drinks Review, UK, February 2019

[3] IGD, Veganuary and Dry January – the shopper opportunity, February 2019