Chinese pig prices strengthen

Thursday, 15 September 2022

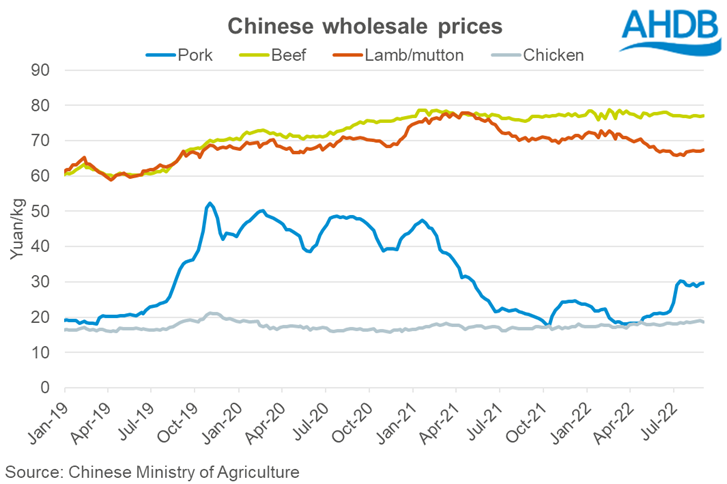

After showing tentative rises through early April, Chinese pork prices picked up pace through the spring and into summer. This growth has been reportedly spurred by tighter pig supplies, partly as producers held back pigs, and partly from stronger consumer demand. According to government reports, authorities are encouraging producers to maintain production and releasing stocks in an attempt to curb price inflation.

The Chinese government recently announced that pork bought into storage would be released onto the market from September in time for heightened demand from autumn festivals. Demand continues to be affected by the uncertain COVID-19 situation, with restrictions still in place across parts of the country.

Chinese pig production increased during the first half of 2022, with slaughtering up 8% versus the same period a year ago. Profitability had been challenged during this time, but the recent price rises have reportedly improved the situation for producers. Indeed, government data shows the breeding sow inventory has been increasing month-on-month since May.

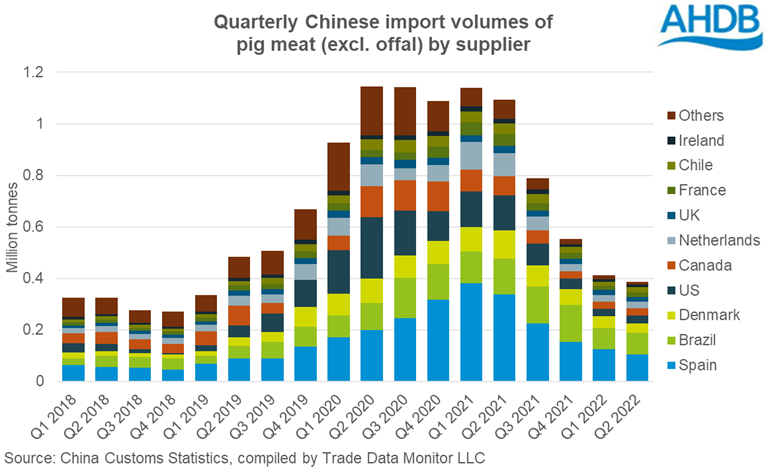

Meanwhile, China’s pig meat import volumes during the second quarter were much lower than in previous years, although in line with the level recorded in quarter one. For the first half of the year, imports were down 64% compared to the same period in 2021 at 799,000 tonnes (-68% from EU). All main suppliers to China have sent less, Spain in particular. Imports are expected to improve somewhat in the second half of the year, as consumer demand improves, and higher domestic prices encourage imports. However, import demand is expected to stay significantly lower than 2021.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.