China’s demand supporting oilseed prices: Grain market daily

Tuesday, 8 February 2022

Market commentary

- UK feed wheat old crop futures (May-22) prices climbed £1.40/t yesterday to close at £218.95/t. New crop futures (Nov-22) also gained £1.40/t to close at £198.10/t. This follows global wheat trends.

- However, with the next world agricultural supply and demand estimates (WASDE) due out from the USDA tomorrow (09 Feb), it is expected there may be some profit taking today that could pressure prices.

- Malaysian palm oil futures (May-22) fell 0.8% yesterday. This follows reports that stocks at the end of January were likely flat, yet production and exports were down to an 11-month low. Further data is due on 10 Feb.

Revisions to animal feed usage data

Following data revisions to GB animal feed figures, due to new data being received, the updated numbers have been compared to those published on 27 January 2022. While these do result in changes to total animal feed usage, these changes are minimal at less than 1.5%.

After an extensive gap analysis on behalf of the industry, we continue to increase accuracy of supply and demand data.

All updated data will be reflected in the AHDB March official balance sheet, which shall also include a refresh on historic data for the past 2 years.

It’s important to consider that we could see a further tightening in domestic ending stocks for this season (2021/22) with updated domestic usage. The next balance sheet publication will reflect an updated view of domestic supply and demand.

China’s demand supporting oilseed prices

Chicago soyabean (May-22) futures gained $10.56/t from Friday, to close yesterday at $582.79/t. This contract has been reaching record highs in the past week and from Friday-to-Friday gained $30.22/t. The nearby contract closed yesterday at an 8-month high for Chicago soyabeans.

What has been driving prices? Well, South American weather is still a key market driver. Dry weather has been causing concerns to soyabean yields in South America. Expectation is for the USDA to lower their forecasts in the next world agricultural supply and demand estimates (WASDE) due out tomorrow (09 Feb).

In turn, support has been given to soyameal prices too. Yesterday, Chicago soyameal (May-22) prices gained $11.13/t to close at $497.99/t.

Chinese buying supporting beans and meal

With focus on reduced South American supplies, expectation is for increased US demand as a result.

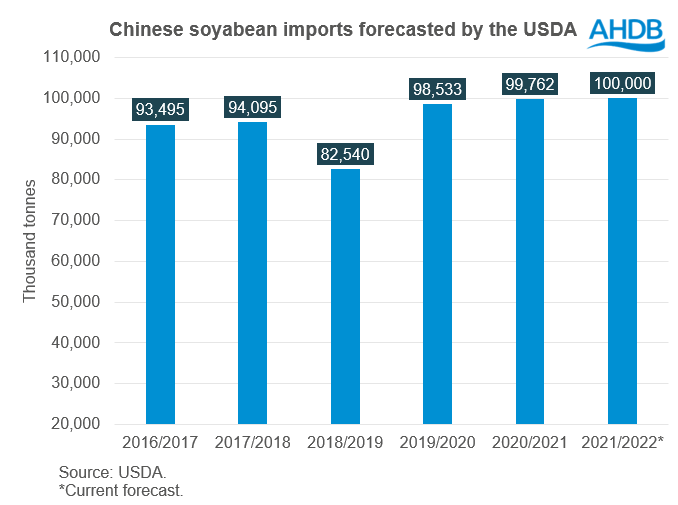

China is the world’s largest soyabean importer, with primary use to crush and feed their pig herd. For 2021/22 marketing year, Chinese soyabean imports are forecast at 100.0Mt (USDA).

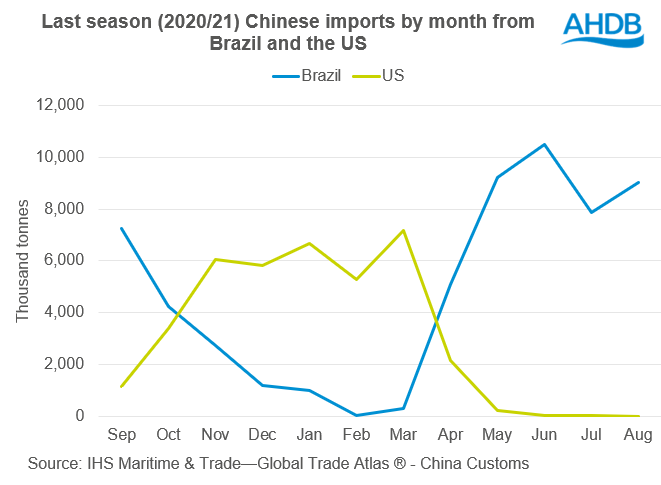

The most prominent origins for Chinese imports are the US and Brazil (IHS Maritime & Trade—Global Trade Atlas®), following seasonal output trends.

We may see US imports dominating for an extended period this season, should South American supplies look to be significantly reduced. Logistics out of South America are also key, with last season’s dry weather impacting on the Parana River for Argentinian exports.

Season to date (July to December), Chinese soyabean imports reportedly totalled 47.6Mt (IHS, China Customs).

For the US specifically, season to date (1 Jul to 27 Jan), total commitments are at 25.4Mt for China. As well as an additional 2.0Mt total commitments to an unknown destination (often thought to be China).

We have seen many flash sales reported in the past week for US soyabean sales to China and unknown destinations, lending further support to high prices with continued strong demand.

What does this mean going forward?

For the next 2 weeks, Brazil and Argentina look to remain dry. The Argentinian soyabean crop especially faces a ‘make-or-break’ period, according to Refinitiv, with rainfall erratic and only likely towards the second half of February.

Should the USDA follow expectations and reduce crop prospects for 2021/22 South American production, we could see the global supply and demand picture tighten further. Especially if China continue their import campaign at pace, in turn lending to price support.

This will likely support the wider oilseed complex, including rapeseed prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.