Change in UK consumer preferences show need for more cheese

Thursday, 6 February 2020

By Hannah Clarke

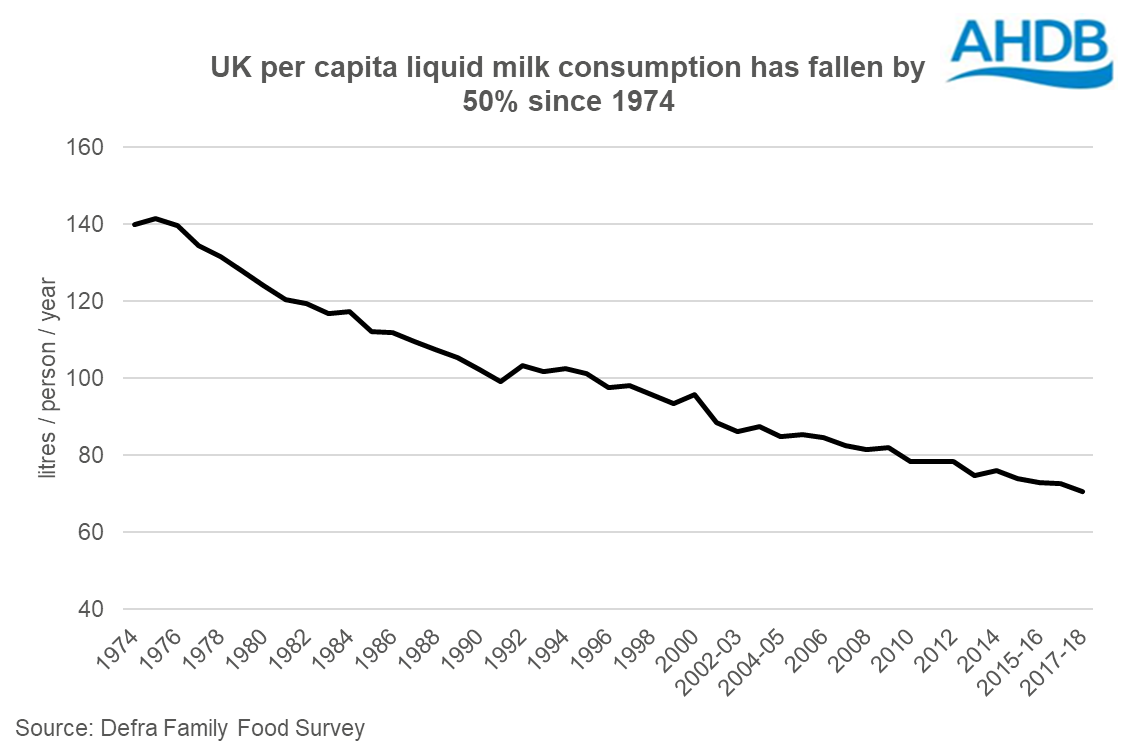

According to the Defra Family Food Survey, UK consumers have shifted how they consume their dairy. While 98.5%³ of UK households still buy liquid (drinking) milk, making it a firm favourite in shopping baskets, per capita consumption has dropped by just under 50% since 1974. Average per capita consumption was 140 litres per year (2.7 litres per week) in 1974. Fast forward to 2018 and average per capita consumption is 70 litres per year (1.4 litres per week).

Overall consumption of liquid milk in the UK has only declined marginally over recent years. In total, retail sales volumes of cow’s milk in 2019 were down 1.5% compared to 2015³. This is a small reduction when compared to the drop in per capita consumption as population growth has helped to boost overall sales.

In contrast to trends in liquid milk, consumption of value-added dairy products like cheese are enjoying growth. This has influenced how processors are using raw milk delivered off farms. In the ten years to 2019, the volume of raw milk going for liquid manufacture has dropped by 720 million litres, while the volume going into cheese has risen by 1.09 billion litres.

These shifts in dairy consumption will require changes in the supply chain and in processing capacity to ensure the right products are manufactured to meet demand. Some processors have already adapted their pricing mechanisms for milk, shifting their focus towards milk constituents rather than volumes.

What has caused the liquid decline?

The decline in per capita consumption in the UK is similar to the trends seen in the US. According to Kantar¹, this decline can be linked to reduced consumption of ‘host foods’ such as tea, coffee, and breakfast cereals. The uptake of plant-based alternatives in recent years is also contributing to the reduced consumption of cow’s milk. However, plant-based alternatives still only account for 4.6% of volume sales of all milk².

As in the US, falling consumption of liquid milk - in combination with other economic factors - are pressurising the margins of UK liquid milk processors. Manufacturers in this sector will need to continue to innovate and add value, while clearly signposting health and quality credentials to reignite growth.

- Kantar, 2019, Dairy Strategic Review

- Kantar, 52 w/e 29 Dec 19 (total animal and plant-based alternatives)

- Kantar, 52 w/e 29 Dec 19 vs 3 Jan 16

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.