Challenging export season, strong import flow: Grain market daily

Friday, 15 August 2025

Market commentary

- Nov-25 UK feed wheat futures closed at £169.40/t yesterday, up £0.40/t from Wednesday’s close. The May-26 contract gained also £0.40/t over the same period, ending the session at £181.15/t.

- Domestic wheat markets followed European prices up yesterday. Paris milling wheat futures (Dec-25) rose by 1.0%, supported by short-covering and growing expectations of export demand for French wheat. In contrast, Chicago wheat futures (Dec-25) fell by 0.7%, pressured by expectations of ample global supply.

- Paris rapeseed futures (Nov-25) rose by €2.00/t to close at €475.75/t, supported by a weaker euro against the US dollar. Winnipeg canola and Chicago soyabean futures (Nov-25) lost by 0.8% and 1.5% respectively.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Challenging export season, strong import flow

The latest trade data from HMRC, published yesterday, provides a full-season overview of UK grain and oilseed exports and imports for 2024/25 (July 2024 – June 2025). So, how did the trade levels perform?

A weaker export campaign

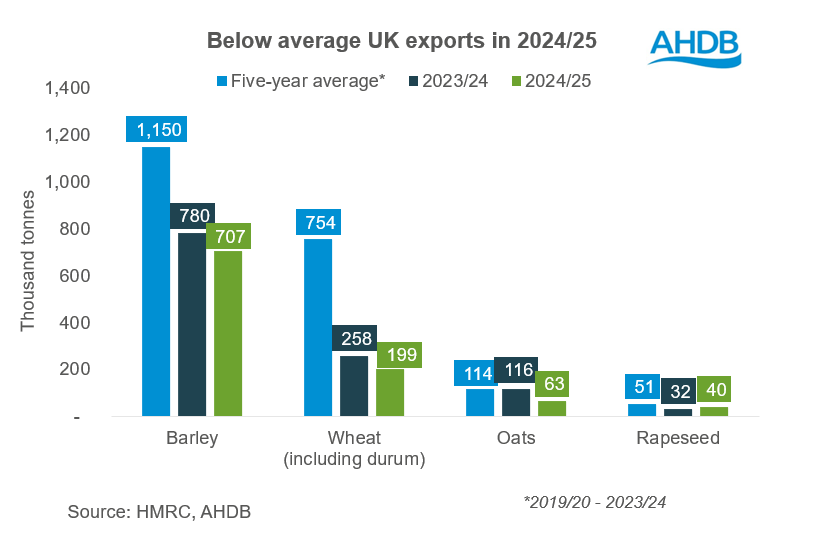

The UK exported below-average volumes of wheat, barley, oats and rapeseed in 2024/25, marking a lacklustre season overall. A combination of challenging weather conditions resulting in tighter domestic supplies and reduced price competitiveness contributed to the subdued export performance.

In 2024/25, UK barley exports totalled 706.6 Kt, down from five-year average of 1.15 Mt, and the lowest volume since 2012/13. The decline in export was further compounded by a recovery in Spanish barley production and lower domestic nitrogen contents hampering trade into the EU where nitrogen requirements for malting barley are higher. Both are key markets for UK barley exports. However, the total exceeded AHDB’s May balance sheet estimate of 650 Kt, as exports improved in the closing months of the season, potentially linked to sterling easing against the euro.

Wheat exports (including durum) totalled 199.4 Kt in 2024/25, well below the five-year average of 753.8 Kt, though close to forecast levels. Oat exports in 2024/25 dropped to 63.2 Kt, the lowest since 2020/21. For rapeseed, exports in 2024/25 totalled 39.8 Kt, the highest in three years, though still fell short of the five-year average of 51.3 Kt.

Stronger wheat and maize imports

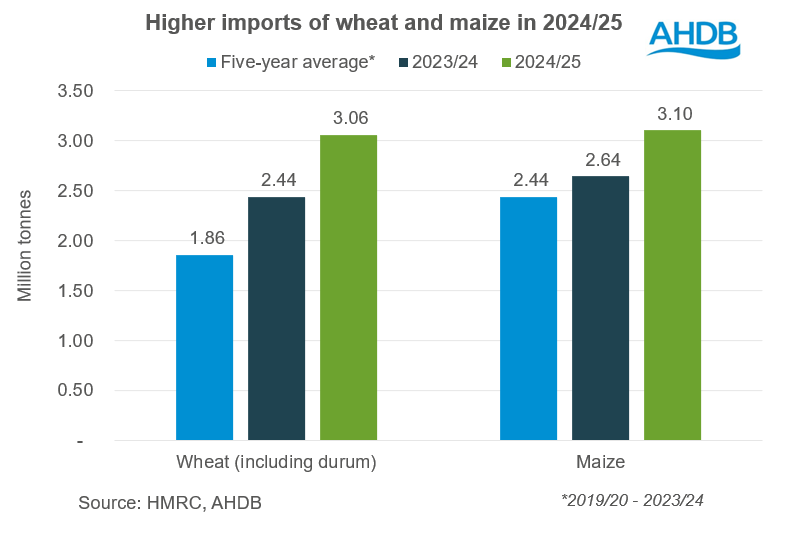

While exports slowed, imports of wheat and maize remained strong throughout the 2024/25 season and reached the highest levels since at least 1992/92 (start of electronic records).

In 2024/25, UK wheat imports (including durum) totalled 3.06 Mt, up 26% on 2023/24 and 65% above the five-year average. This rise is partly due to reduced domestic output of higher-protein wheat, with a substantial part of the imported grain expected to be of milling quality. The final figure is also close to AHDB’s May estimate of 2.90 Mt.

Maize imports also climbed, totalling 3.10 Mt in 2024/25, up 17% on the previous year and 27% above the five-year average. The uplift reflects strong global availability and more competitive pricing compared to domestic wheat, particularly earlier in the season. The final figure exceeded the 2.83 Mt expected in May.

Looking ahead

Looking forward, relatively large carryover stocks of wheat, barley and oats are expected to enter the new season (2025/26). However, export potential and import requirements will depend on the quality and final size of the UK crop, plus developments in global markets and the UK's ability to remain competitive.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.