Cattle prices steady week ending 29 January

Wednesday, 2 February 2022

GB deadweight prime cattle prices slipped by 0.8p/kg in the week ending 29 January, to average 405.7p/kg. The market has been trading sideways for a couple of months now, more or less within a 2p range, implying that supply and demand are in tune with each other. Prices for heifers and steers both softened a touch.

For more detail on deadweight cattle prices click here

In contrast, prices for young bulls and cows both rose, overall cull cows fetching 274.7p/kg. It is around this time of year that processors lightly turn to thoughts of summer, and laying down stocks of burgers to meet seasonal demand.

Estimated slaughter of prime cattle was 29,900 head steady on last week; 11,000 cows were killed, 300 fewer than last week.

A closer look at regional cattle prices

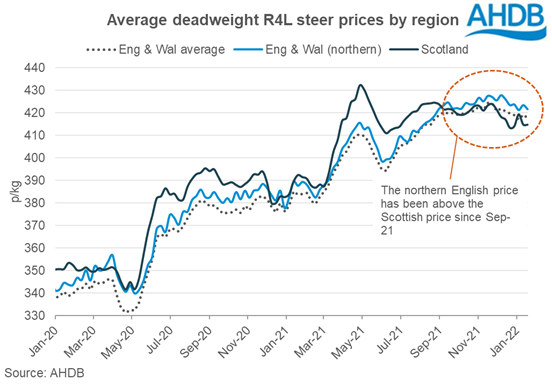

Market prices are driven by the supply and demand for cattle, and often trends seen at a national level are also seen more locally. However, we can see some regional differences that have appeared in price trends more recently. Most notable is the convergence of cattle prices in Scotland with those in the North of England, and subsequent fall below.

As is well documented, cattle prices across GB have generally appreciated over the last couple of years, driven by a combination of tighter supply overall (traceable all the way back to the Beast from the East) and a shift in demand into retail due to the pandemic (benefitting domestic cattle in particular).

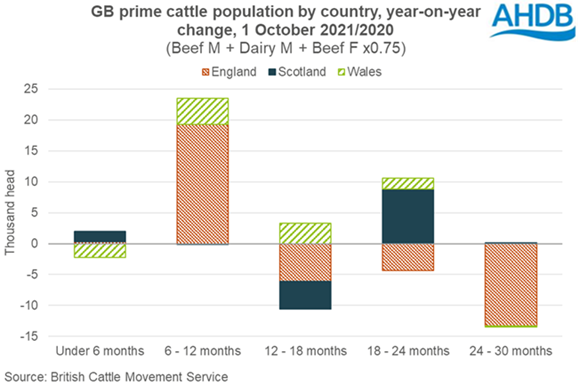

If we look at supply on a more granular level, we can see that while the supply of cattle in GB overall remains relatively tight, more recently this does appear to have been expressed in English cattle numbers in particular. On 1 October, Scottish cattle numbers in the 18-24 month age group were slightly higher than the same point a year ago.

There will be several factors at play possibly affecting the relative prices of cattle in neighbouring regions, including for example covid related staff levels in particular abattoirs, and changes in contracted volumes, as demand moves back from retail into foodservice. But by itself, this chart implies that the relative weakness in Scottish cattle prices could last a little longer.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.