Carcase balance again, and the future of retail prices

Tuesday, 2 June 2020

One of the impacts that coronavirus had on the beef sector was on carcase balance. When the foodservice market closed, much of the beef demand that transferred across to the retail sector was initially for mince. This left processors with quite a few unsold steaks, and a significant reduction in the overall value of the carcase. The market has been able to adjust over time to address this imbalance, which has included reductions in the price of steaks. This raises the question of carcase value, and what factors might influence it in the future.

Even before coronavirus, retail demand in the UK had been moving towards mince, which partly explains the low farm gate prices in 2019. However, we also need to consider the global landscape. At the end of the year, the Brexit transition period will come to an end, and the UK will further part company from the EU. This brings with it the ability to sign trade agreements with other countries, and the potential opportunity to secure new outlets for UK beef. However, in order to do so, the UK will need to compete on price across a range of beef products. At the moment countries towards the front of the queue appear to be the US, Australia and New Zealand, all important players on the global beef market.

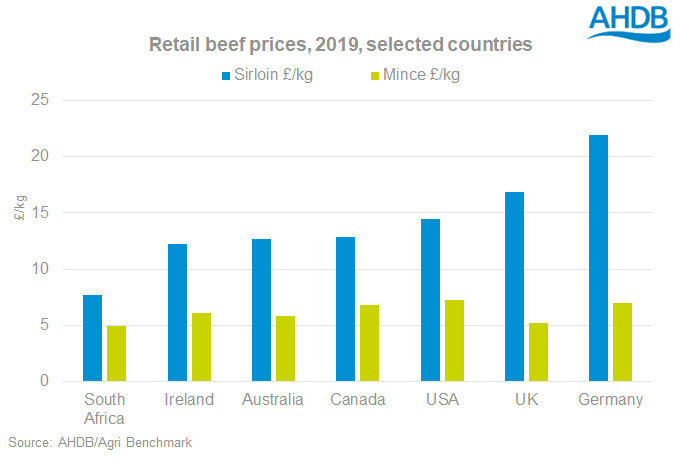

The UK retail market currently prices mince and top cuts slightly differently than other countries, including those operating in the global beef market. Among the countries surveyed, from AHDB’s Agri Benchmark network, only Switzerland had a higher sirloin to mince price ratio.

This begs the question, what will this difference mean if the UK becomes more exposed to the world market? Perhaps the UK will be able to compete with the likes of Australia, Ireland and the US on mince prices, but may find itself priced out of the steak market. An increase in mince exports, without a corresponding rise in steak sales could bring a return to the coronavirus carcase challenges. It may well be that the difference between the mince price and the prices of those top cuts, will narrow in the future. That could return value to the producer by way of the carcase price, while at the same time allowing UK steak prices to be competitive.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.