Bullish news limiting harvest pressure? Grain market daily

Tuesday, 20 July 2021

Market commentary

- UK wheat futures (Nov-21) closed yesterday at £178.40/t gaining £1.55/t on Friday’s close. The May-21 contracted closed at £183.45/t gaining £1.20/t on Friday’s close.

- The latest USDA crop conditions report released yesterday rated 65% of US maize good-to-excellent (as of Sunday). Unchanged from last week despite rains across parts of the US Midwest last week.

- Good-to-excellent spring wheat conditions fell 5% week-on-week to be estimated at 11%, as dry weather in northern states continues to impact the crop. Only minimal scattered rains are forecast over the next week in key northern US states.

Bullish news limiting harvest pressure?

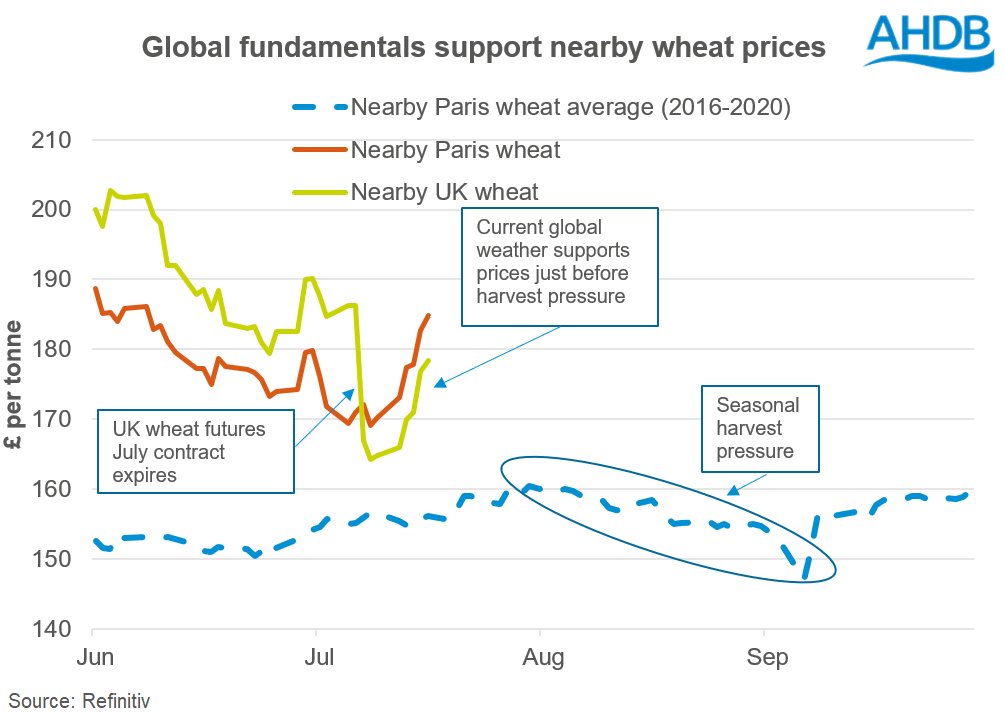

Seasonally, we’d expect to see an element of price pressure as Northern Hemisphere wheat harvests start, but currently we are experiencing quite the opposite.

Over the last fortnight, nearby Paris wheat futures and Chicago wheat futures have gained 6.9% and 12.5%, respectively.

This rallying support has been off the back of dry conditions for North American spring wheat, an estimated reduction in the Russian wheat crop and delayed harvests in Europe. The latest FrenchAgriMer report estimates that only 4% of French soft wheat is harvest up until 12th July, significantly behind last year which was at 42% at the same point.

All this bullish news has supported the domestic November 2021 wheat futures contract, it gaining over £11.00/t in the last two weeks, to close yesterday at £178.40/t.

Harvest pressure for 2021?

For Paris wheat futures, the seasonal pressure usually starts in the first week of August and continues until the middle of September, as harvests increase available supply.

As you can see the in graph above, the 5-year-average demonstrates the pressure on nearby prices as we get into the depths of harvest, averaging £4.50/t throughout the month of August.

The only time the nearby contract gained in the last 5 years was in August 2020 (+£5.98/t), due to the bullish rally in the market from global demand and introduction of export taxes and tariffs from some countries.

Will sellers take the bull by the horns?

All this bullish news is supporting prices for harvest. Delivered feed wheat into East Anglia for harvest was quoted at £169.00/t, gaining £6.00/t as published in the AHDB delivered survey, last Thursday.

This may attract more sellers to the market, allowing them to free up room and mitigate risk if storage space at harvest is sparse. However, with Nov-21 and May-22 contracts at supported levels, the cost of storage needs to be balanced against future sale opportunities.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.