Black Sea wheat competitive on the global wheat market: Grain market daily

Thursday, 9 November 2023

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £202.70/t, up £2.50/t from Tuesday’s close. Nov-24 futures gained just £0.80/t over the same time frame, to close at £209.00/t.

- UK feed wheat futures followed Paris and US wheat markets up yesterday, as well as US maize markets. French prices were boosted by Algeria’s purchase of wheat in its latest tender and renewed concerns for the Argentinian harvest.

- The Rosario Grains Exchange cut its Argentinian 2023/24 wheat forecast by 0.8 Mt to 13.5 Mt.

- Paris rapeseed futures (May-24) closed yesterday at €448.50/t, up €1.75/t from the previous session, finding some support with Chicago soyabean futures.

- Nearby brent crude oil futures fell yesterday by $2.07/ barrel, to close at $79.54/ barrel. Pressure came from mixed Chinese economic data which could dent demand, rising OPEC exports, and the US dollar strengthening.

Black Sea wheat competitive on the global wheat market

The competitiveness of Black Sea wheat has been in focus for markets throughout this season, keeping a cap on price gains. Despite the ongoing war in Ukraine, grain continues to leave the country, albeit more slowly than this time last year. Exports have benefitted from the new Ukrainian temporary grain corridor, and freight costs for the Danube region have seen some falls in October and November. The Danube region retained the largest share of exports in October, followed by the new corridor (UkrAgroConsult).

Russian wheat too has been in focus, after a few big crop years and aggressive export pricing. The Russian grain harvest this season (2023/24) has reportedly reached 147 Mt according to the First Deputy Agriculture Minister, reported yesterday. This is higher than earlier forecasts of 140 Mt but below last year’s 158 Mt.

For this season, Russia and the EU-27 are forecast as the largest global exporters of wheat by the USDA, with forecasts currently totalling 50 Mt and 37.5 Mt respectively. From July to September, SovEcon peg total Russian grain exports at 17.3 Mt – a strong start to the season, including 14.8 Mt of wheat (86% of the total). Total wheat exports from the EU have started more slowly than last season, with soft wheat exports to 02 Nov behind the previous 5-year average by 1.6% (EU Commission customs surveillance data).

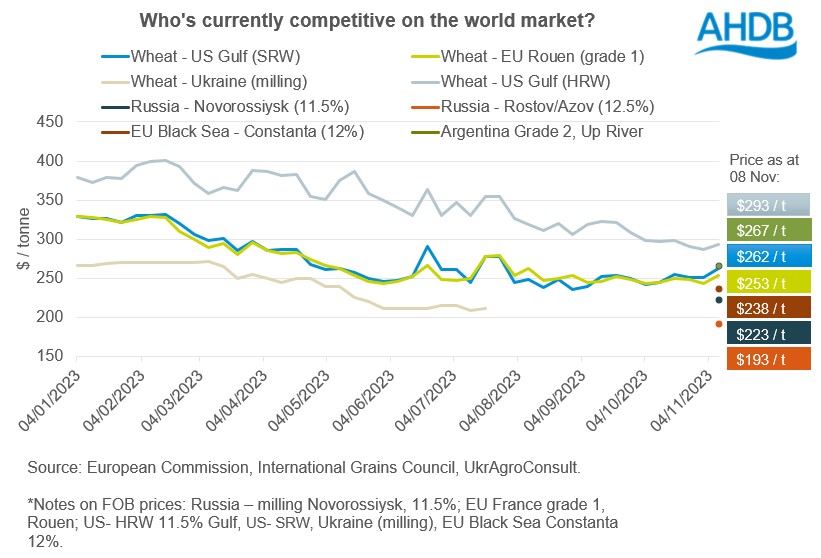

In terms of the competitiveness on the global market, Black Sea and EU origin wheat look well positioned. In a recent tender, Algeria’s state grains agency is believed to have bought 600 Kt - 690 Kt of milling wheat. This is expected to be a mix of Black Sea and French wheat, which pushed Paris milling wheat futures higher yesterday. Refinitiv reports that Russian wheat looks the cheapest, but there was doubt amongst some traders as to whether Russia can provide the volumes needed.

Where next for competition?

The Russian Agriculture Ministry has set a grain export quota for next year at 24 Mt from 15 February to the end of June. Could this impact exports? Well, there’s been a strong start to Russian wheat exports (Jul to Sep) with an average of 4.9 Mt estimated per month. Wheat has accounted for 86% of total grain exports so far. If we assume 86% of the 24 Mt grain quota (15 Feb to 30 Jun 2024) will continue to be wheat, this could cap exports in that period at 20.6 Mt. To meet the total USDA season forecast of 50 Mt, between 01 Oct to 15 Feb, only 14.6 Mt would need to be exported over 4.5 months. Should Russian supplies remain export competitive, arguably the USDA forecast is still within reach. Could we see Russian traders ship more wheat earlier, before the quota comes into play?

Argentinian wheat prices have come down recently as the harvest started (IGC), but they remain more expensive than most other origins, as seen in the graph. This position in world competitiveness looks to continue going forward considering further trims to the Argentinian wheat crop from dry conditions (see market commentary).

What does this mean for prices?

The continued flow of competitive Black Sea wheat will be important for price direction through this season. If we continue to see Russian and Ukrainian wheat flow and there is not a ‘market shock', this will likely keep a cap on market gains.

Ultimately, South American and US maize supplies will be critical for total feed grain supplies in the short to mid term. If large supplies arrive as expected, this could pressure the full grain complex. Though considering mixed weather in Brazil, the market will be following Southern Hemisphere weather closely in the coming weeks.

As we progress into 2024, wheat markets will look more towards harvest 2024, which will be key for price direction looking ahead six months.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.