Bioethanol output declines further: Grain market daily

Friday, 4 April 2025

Market commentary

- UK feed wheat futures (May-25) closed yesterday at £167.65/t, down £0.30/t on Wednesday’s close. New crop futures (Nov-25) closed at £184.15/t, also down £0.30/t over the same period.

- The domestic market followed Chicago and Paris futures lower yesterday. Chicago wheat (May-25) dropped 0.6%, and Paris milling wheat futures (May-25) fell 0.45%. US tariffs concerns pressured the US market, while a weaker US dollar limited the decline. In Europe, a stronger euro and concerns over potential trade disruption due to the US tariffs added downward pressure.

- Paris rapeseed futures (May-25) closed at €517.25/t, down €7.50/t on Wednesday’s close. Nov-25 futures closed at €482.75/t, down €11.25/t over the same period.

- Rapeseed market declines followed the weaker Chicago soyabean futures, which fell due to the US reciprocal tariffs. China is a major importer of US soybeans, and although their purchases usually shift to Brazil at this time of year, future demand could be significantly affected.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Bioethanol output declines further

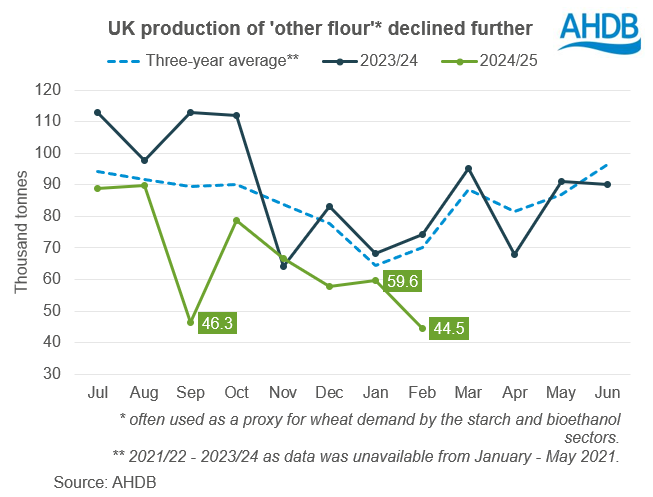

The UK produced the lowest amount of ‘other flour’, generally used as a proxy for output from the starch and bioethanol sectors, in over three years in February.

Data from AHDB out yesterday shows that just 44.5 Kt of ‘other flour’ was produced in February. This is lowest amount since ethanol production rose and Vivergo Fuels re-opened ahead of the introduction of E10 in Great Britain in September 2021.

This is the lowest figure reported since December 2020. However, it’s important to note that data on ‘other flour’ production was unavailable from January to May 2021 to protect the confidentiality of respondents.

The most recent fall in ‘other flour’ production continues a trend seen through this season. Last week, AHDB reduced its estimate for total wheat used by the human and industrial (H&I) sectors in 2024/25 by 108 Kt to 7.135 Mt. The new estimate is also 386 Kt below 2023/24 levels. The declines are largely down to reductions in demand from the bioethanol sector.

AHDB also cut its estimate for maize used by the H&I sectors due to a fall in demand by the bioethanol sector. At 1.007 Mt the latest estimate is 102 Kt lower than the previous one, though it remains 86 Kt higher than 2023/24’s usage. With a competitive price at the start of the season, combined with concerns over RED II, maize usage in bioethanol production is estimated to be higher, compared with last season too.

Neither UK bioethanol plant is expected to be running at full capacity, largely due to competitively priced ethanol imports (particularly from the US) and squeezed margins.

The US is a key origin for ethanol imports into the UK. So, any retaliatory tariffs by the EU or UK following Wednesday night’s announcements will need to be watched.

However, without this or unless exports can help offset, any further decreases in the amount of wheat used for bioethanol and starch production could further add to stocks at the end of this season. This would likely pressure old crop prices and add to new season supplies, with potential to impact new crop prices too.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.