Beef market update: mixed fortunes for South American production

Thursday, 26 September 2024

Key points:

- Brazilian beef slaughter set to hit record levels for 2024 before falling into 2025

- Uruguay beef production hit by poor weather in 2024, as slaughter is set to increase into 2025

- Cow destocking in Paraguay will impact on slaughter and production into 2025

- Brazil is the second largest supplier of beef into the EU but questions remain on the impact of new EU regulations

Production

Brazil

The USDA note that Brazil is the second largest beef producer and the largest beef exporter on the globe. The increased supply of cattle available for slaughter has driven production up 8% compared to 2023, to 11.85m tonnes for the total of 2024. Prime slaughter is expected to hit record levels for the total of 2024, with an increase of 32% from Jan-July 2024 compared to last year. Cow slaughter has increased so far in 2024, which has been a main driver of overall increased slaughter. This trend of higher cow slaughter has been present in the market since 2021, which has impacted overall production predictions for 2024. With fewer cows in the herd, there have been fewer replacements bred, which has limited the total number of cattle available for slaughter. The USDA note that this trend of lower replacements will limit production for 2025, down by 1% from 2024, as the cattle cycle begins to revert into downturn.

Uruguay

Beef production in Uruguay has been marred by unstable weather in 2024, which impacted on the production of pasture to feed cattle. Total production for 2024 is set to reach 590,000 tonnes, a fall of 10,000 tonnes from 2023, according to the USDA. Slaughter of cattle is predicted to decline by 85,000 head from 2023 to 2.22m head for the total of 2024. Expected production for 2025 is set to sit at a similar level to 2024 at 595,000 tonnes, as slaughter is projected to increase by 2.5% but overall production is stifled by lower carcase weights.

Paraguay

Paraguayan beef production has been hit by three years of drought, as despite strong destocking in 2024, carcase weights have been pressured by a lack of forage. Slaughter for 2024 will sit at around 2.45m head, with production totalling 590,000 tonnes, report the USDA. Looking into 2025, production in expected to drop to 560,000 tonnes, with a fall in slaughter to around 2.3m head. This is due to destocking of cows in particular, and a lower-than-normal calf crop as conditions were not favourable at times of breeding for cows. This trend of a lower production and smaller herd size may continue over the coming years if weather conditions such as drought persist.

Trade

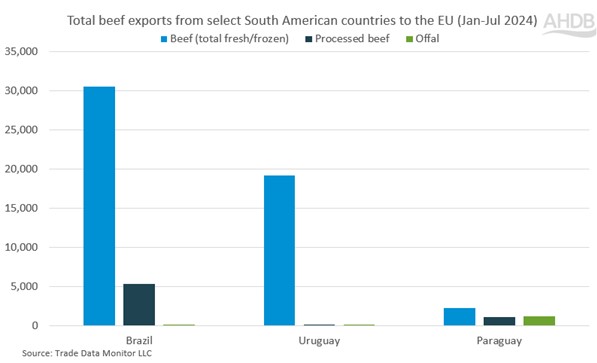

Brazil dominates beef exports to the EU from the South America region. Total fresh/frozen beef imports (including offal and processed) totalled 36,000 tonnes so far this year to July. This sits around 20,000 tonnes lower than beef exports from the UK into the EU, as Brazil is the second largest supplier of beef into the continent. However, volumes from Brazil into the EU have fallen by just over 3,700 tonnes from the same period in 2023, with the majority of this fall coming from a decline in frozen beef volumes. Processed beef made up around 15% of total beef volumes to July, sitting at 5,400 tonnes.

The quantity of beef exports moving forward into 2025 and beyond will be impacted by the EU’s deforestation-free regulation (EU-DR), that bans imports of products into the EU that are linked to deforestation. Brazilian officials have questioned this, and feel the regulation will harm Brazilian trade with the bloc.

Volumes out of Uruguay into the EU are lower than that of Brazil, sitting at 19,400 tonnes so far this year to July. These volumes have grown, unlike Brazil, by 2,200 tonnes from last year with the majority of this coming from frozen beef exports. Processed and offal exports into the EU are markedly lower than Brazil, sitting at 185 tonnes combined. Beef exports from Paraguay to the EU are fairly negligible compared to those of Brazil and Uruguay, totalling 2,300 tonnes.

UK imports of beef from Brazil have totalled 12,800 tonnes up to July this year. The majority of this volume comes from processed beef sitting at 78% of these imports, close to 10,000 tonnes. The remaining volumes are split fairly evenly between fresh and frozen beef. The estimated contraction in Brazilian production plus potential implications from the EU-DR, may provide further impetus for UK exports to the EU to fill the gap left temporarily.

However, the UK is also subject to EU-DR limitations on exports into the EU, which may prove an additional barrier to trade which we will need to overcome once we prove we are compliant. UK compliance with EU-DR is an issue that AHDB are working with industry partners on to ensure any disruption and costs to industry are minimised.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.