- Home

- News

- Australian wheat near record, but grain supply and demand stay tight for now: Grain market daily

Australian wheat near record, but grain supply and demand stay tight for now: Grain market daily

Wednesday, 8 September 2021

Market commentary

- UK feed wheat futures (Nov-21) fell £0.60/t yesterday, to close at £187.65/t.

- The US Gulf Coast grain export facilities are still dealing with the aftermath of Hurricane Ida, with reportedly around a dozen terminals still closed yesterday due to power outages.

- The USDA’s latest crop progress report was released yesterday as at 5 September, one day later due to a US holiday. Maize crops rated ‘good’ to ‘excellent’ fell 1 percentage point (pp) to 59%, whereas Soyabean ratings gained 1pp to 57%. US spring wheat harvest was at 95%, up from the 5-year average of 83%. Winter wheat planted totalled 5%, on pace exactly with last year.

- Despite declining US maize crop conditions, reports from Crop Watch producers in western Iowa are that late season rains may have boosted yield outlooks. USDA’s updated view on yields is due on Friday.

Australian wheat near record, but grain supply and demand stay tight for now

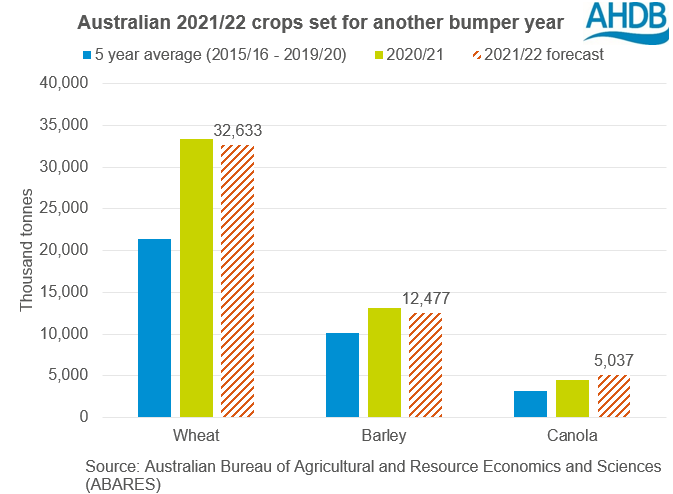

ABARES released their latest crop report this week, boasting well above average production forecasts for a second year in a row.

The release eased some global supply concerns, with wheat production forecasts increased by 17% to 32.63Mt. This was down to ‘exceptionally favourable’ growing conditions in June and July. AMIS too stated in their last report, that growing conditions had been exceptional with ample rainfall and soil moisture.

For rapeseed, the report increased forecasted production to a record high of 5.04Mt. A large Australian crop boosts global supply, considering heat damage to the Canadian canola crop this season. With a tight EU supply and demand balance, especially with some major exporters choosing non-EU destinations, this may ease some global availability concerns. The Australian rapeseed harvest is due to begin in October.

However, something to watch over the next 3 months is rainfall. The outlook for spring rainfall September to November, issued by the Bureau of Meteorology last week, is very likely to exceed median in both eastern and south Australia. This is something to watch, as could delay harvest and/or impact on quality.

What does this mean for global availability and UK grain prices?

Global wheat supply looks tighter than expected this season. The news of a large Australian wheat crop pressured UK prices somewhat. Though, Tuesday’s UK feed wheat (Nov-21) contract only fell £0.60/t to close at £187.65/t. The Paris milling wheat contract remained unchanged at €242.25/t.

Why? Well, there are still many factors playing into a tight market before the Australian wheat harvest in November.

Global buyers are still concerned about Black Sea supplies, according to Refinitiv. Russian export prices (as the biggest global exporter) rose again last week for the eighth week in a row. Sovecon pegged wheat prices as $301.00/t, the highest in 7 years.

Steady wheat demand is also helping to keep prices elevated. Tenders from countries in north/west Africa and Asia are helping to support prices. The latest tender from Egypt’s GASC for an unspecified amount of wheat has a deadline of today.

Now the market looks to the updated USDA’s world supply and demand estimates due on Friday. Points to watch for include the USDA’s yield and area figures for maize and soyabeans, wheat production figures of major wheat exporters, and Chinese domestic supply and demand figures across the board.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.