Australian sheep meat production forecast to rise in 2021

Wednesday, 17 February 2021

By Bethan Wilkins

A larger lamb crop and higher carcase weights are expected to lead to increased supplies of Australian sheep meat in 2021, according to the latest MLA projections.

Higher lambing percentages are expected this year due to improved nutrition in pregnant ewes, as good quality pasture has been plentiful. Better seasonal conditions, alongside genetic improvements and an increase in the number of lambs on feed, are also expected to support the number of lambs coming forward and the weight of the carcases produced.

However, sheep flock rebuilding due to the improved seasonal conditions will mean a larger percentage of ewe lambs are retained rather than slaughtered. This will constrain the overall increase in slaughter levels recorded. Lamb slaughter in 2021 is expected to increase by 4%, compared to the previous year, to 20.8 million head.

Despite the expected flock rebuilding activity, an increase in adult sheep slaughter is still expected. This is because of the anticipated gains in productivity. Sheep slaughter is forecast to rise by 2% to 6.6 million head.

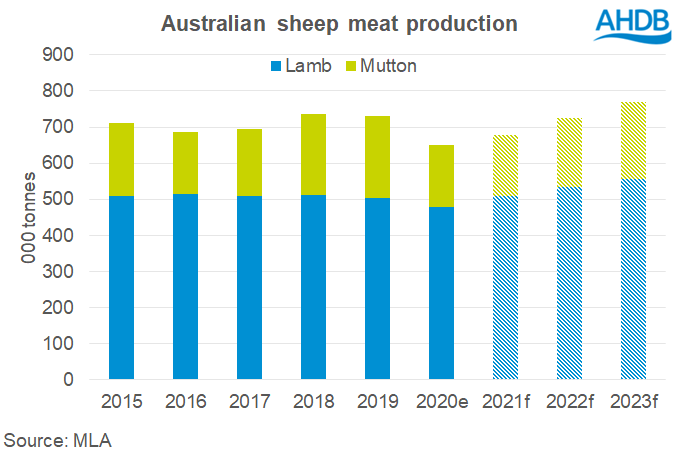

With a rise in both sheep and lamb slaughter anticipated, alongside growth in lamb carcase weights, overall Australian sheep meat production is forecast 4% higher than 2020 levels this year. Within this, 2021 lamb production is forecast at 508,000 tonnes, 6% above last year. Mutton production is forecast at 170,000 tonnes, similar to year earlier levels.

International demand for Australian sheep meat is expected to continue facing some challenges in the short-term, due to COVID-19 related demand disruption. With this in mind, MLA describe it as “fortunate” that, despite a little recovery, supply levels are still relatively low in historic terms. Nonetheless, lamb exports are expected to rise by 10% this year to 290,000 tonnes shipped weight, on the back of higher production. These forecasts are also based on global markets beginning to recover from COVID-19 impacts this year, due to the various vaccine programmes being employed.

Virtually all Australian mutton production is now exported. As production is expected to remain stable this year, these shipments are also expected to hold steady. In shipped weight, this volume totals 140,000 tonnes.

Turning to the Australian domestic market, in recent years lamb demand has suffered somewhat, with an increasing portion of production now exported. High price levels have influenced this. Going forward, volumes consumed on the domestic market are expected to stabilise at this lower level, with affordability relative to other proteins an ongoing challenge.

Rising exports from Australia do not necessarily mean an increase in sheep meat coming to the UK. Volumes that Australia can send to the UK and EU are constrained by quota availability. Also, despite the increase in Australian export volume, the amount available to trade internationally will still be constrained by falling volumes from New Zealand. This points towards higher prices persisting on the global market, especially if demand is boosted by COVID-19 recovery. Prices here could well reflect this, despite current export challenges associated with leaving the EU, as UK sheep meat production is also set to fall this year.

Looking further ahead, to 2022, early forecasts suggest Australian lamb production could reach a record high. Higher carcase weights as well as some further recovery in slaughter numbers support this growth. In contrast, mutton production is not expected to reach 2018/19 levels until after 2023. With no increase in Australian consumption expected, this growth will be carried through into higher export volumes. MLA note that in the coming years, particularly as China’s protein shortage due to African Swine Fever starts to ease, new export opportunities may need to be considered. Increasing access to the UK and EU markets is specifically mentioned as an avenue to consider. The UK industry needs to be mindful that while competition from Australian lamb may currently be limited, there is the potential for this to increase in the coming years.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.