Australian beef market update

Thursday, 8 September 2022

Production

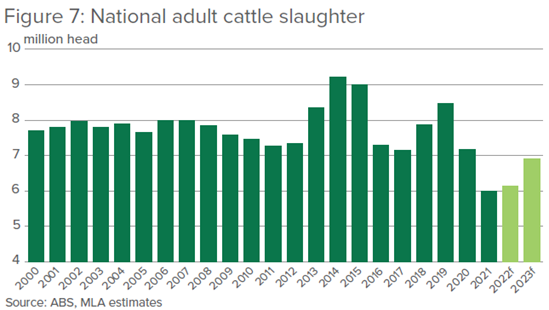

Meat and Livestock Australia (MLA) have revised down its predictions for 2022 cattle slaughter from 6.70 million to 6.15 million head for the year. This follows a lower-than-expected kill in the first quarter of 2022, 6.3% below 2021. Continued issues around COVID-19, labour availability and forced shutdowns due to public holidays and weather are the key drivers of reduced slaughter capacity. On top of this, producers are withholding more stock from slaughter and opting to retain it on farm to rebuild herd sizes.

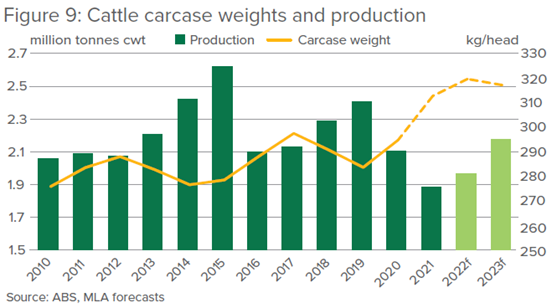

Despite the easing in slaughter numbers, production in the first quarter of 2022 only softened 2.5% year on year. Average carcase weights were 10.8kg heavier in Q1 2022 compared to 2021, due to record numbers of cattle in feedlot systems and higher prices incentivising higher weights. Total beef production for the year is forecast to reach 1.97 million tonnes, an increase of 4.5% compared to 2021.

Trade

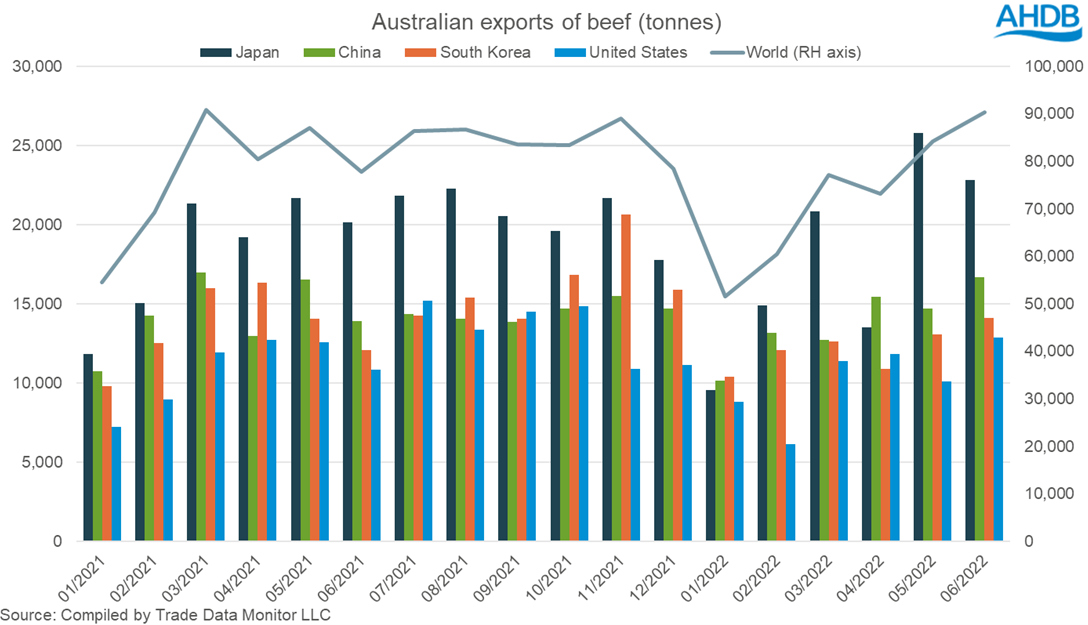

In the first six-months of 2022 Australia exported 437,000 tonnes of fresh and frozen beef, a 5.0% drop compared to the same period last year. The first quarter of the year was the worst affected with February and March behind 2021 volumes by 12.8% and 15.0% respectively. Volumes picked up in June, with exports up 16.3% year on year. The main constraints on export volumes have been lower supply and logistical challenges. Increased freight costs made long haul routes less attractive and the disturbance to shipping channels caused by lockdowns at Chinese ports and the war in Ukraine has been leaving goods stranded or requiring large detours.

For the first half of 2022, exports to all key nations were lower than in 2021, although some growth has been seen in the most recent months. Japan remains the top importer, receiving 107,500 tonnes of beef in the first half of the year, down only 1.6% on 2021 volumes. South Korea has seen the biggest decline year on year importing just 73,200 tonnes so far in 2022, down 9.4% compared to last year. China and the US are down 3.0% and 4.9% respectively.

The Australian live cattle export industry has been experiencing extremely challenging trading conditions for the past two years. MLA has revised its forecast of live export numbers for 2022 down 35.2% from 772,000 to 500,000 head. The two key factors weighing on live cattle exports are low availability of cattle and weakened demand.

Prices

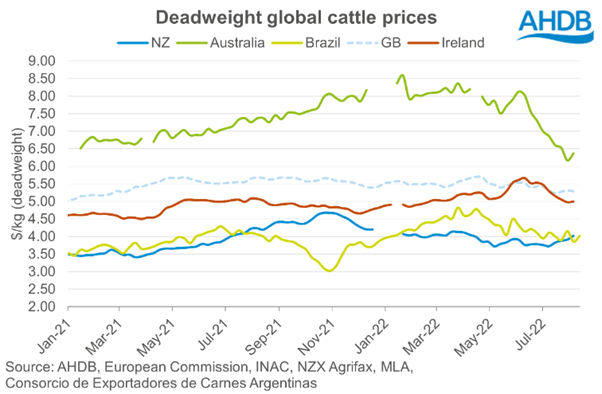

Amongst a background of tight supplies and recovering demand, Australian cattle prices have remained supported at historically high levels since late 2021. However, prices began to rapidly drop off in June due to a combination of factors. The pressure on cattle supplies is expected to ease in the second half of the year with the maturing of the 2020 calves. Adding to this, the weather so far this season has been favourable providing a positive outlook and the Australian dollar has depreciated in value making exports more competitive.

Impact on UK market

Despite lower prices, Australian beef is still at a premium to other key producing nations, including Great Britain. Although the UK- Australia free trade agreement is due to come into effect before the end of the year, it is unlikely we will see a flood of Australian beef on the market due to these higher prices, limited supply in Australia and global shipping issues. Shipping issues are weighing heavily on which markets traders prioritise, with nations closer to home being favoured over those further away. This is likely to keep Southeast Asia the most important market for Australian beef.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.