Areas to watch for 2022 crops: Grain market daily

Wednesday, 27 October 2021

Market commentary

- UK feed wheat futures (May-22) gained again yesterday, increasing £0.65/t to a new contract high of £220.15/t. The Nov-22 contract rose £0.75/t to close at £192.25/t.

- Gains followed Paris milling wheat futures, where the Dec-21 contract rose €2.75/t to close yesterday at €284.75/t. Some gains on the UK contract may have been capped from a strengthening in pound sterling against the euro.

- The wheat market continues to be supported by strong demand and supply. With a further increase in Russian export prices, this tightens supply further.

- Argentine farmers soy sales for 2020/21 lag the previous year, with 32.7Mt sold of 43.1Mt harvested according to the Agriculture Ministry. This is down from 33.9Mt at the same point last year. For 2021/22, a production of 44Mt is expected, of which 2.4Mt has been forward sold.

Areas to watch for 2022 crops

A fine balance between global supply and demand has been lending support to UK prices in recent weeks, with tightening stocks in the major global wheat exporters.

Northern hemisphere supply (US, Canada, Russia) saw production cuts this season, from dry weather curbing yields. Southern hemisphere crops are expected to be large which may alleviate some supply concerns, and the Australian harvest now underway. However, we have not yet seen global prices easing, as demand and supply are set to remain tight this season.

News is now emerging on planting progress and conditions for 2022. What can the market expect for next season’s supply? Can a production rebound alleviate tight stocks?

Yesterday, Helen mentioned the latest EU MARS crop monitoring report showed good progress in planting of winter crops in Europe in the market commentary. Today, I cover the US and Black Sea region.

US crop conditions below market expectation

US winter wheat plantings were 80% complete to 24 October according to Monday’s USDA crop progress report, in line with the five-year average (2016 to 2020).

The first winter wheat crop condition report showed a good to excellent condition score of 46%, to 24 October. While this was up from the 41% reported at the same time last year, it fell below average trade expectations by 8 percentage points according to Refinitiv. This is also 6 percentage points below the previous 5-year average (2016 to 2020) for the first crop condition score of winter wheat plantings. Something to monitor going forward.

Black Sea dryness concerns

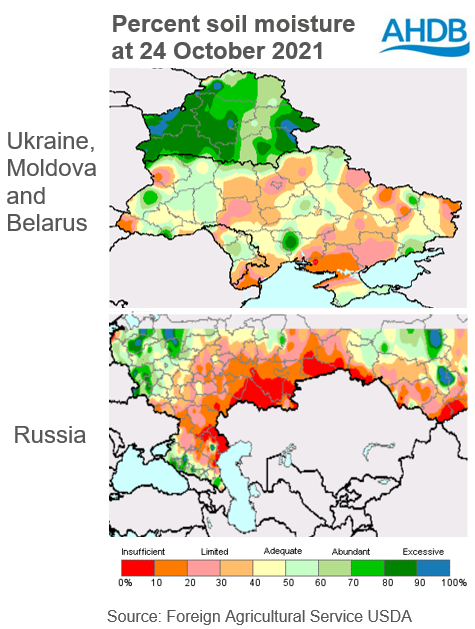

In central Russia and Ukraine, winter wheat crops are expected to suffer drought for 2 to 3 weeks according to UkrAgroConsult.

Russia was highlighted as a watch point in the latest AMIS crop monitoring report, due to persistent dryness in the Volga region. This area was badly affected this season for wheat yields, due to hot and dry weather. Winter wheat sowings in Russia have reportedly fallen further behind average pace and sowed area is expected to fall by 0.7Mha to 1.2Mha from one year ago (according to Sovecon).

The same AMIS report considered Ukraine conditions as favourable. However, UkrAgroConsult reported this week that Ukraine’s fields are ‘badly short of soil moisture’, which could adversely affect both crop survival in winter and productivity in 2022.

Some rain is due in the Black Sea regions for mid-November. Chances the Volga region will receive rain are improved. However, with Russian availability driving European wheat prices, especially this season, this rain and dryness concern in this region is something to watch going forward.

What does this mean for the UK?

This season’s global wheat supply and demand remains tight, supporting UK prices currently. As we progress through 2021/22, more information will become clear on 2022 crop conditions and develop market sentiment. In turn, this could influence global, and therefore UK, wheat price direction as we progress through the season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.