Arable Market Report - 4 August 2025

Monday, 4 August 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

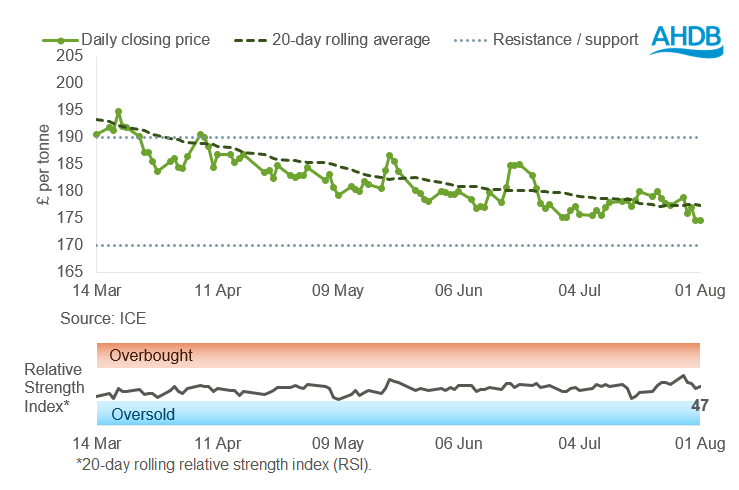

UK feed wheat futures (Nov-25)

UK feed wheat futures edged lower last week (Friday to Friday), closing below a key support level of £175/t.

The RSI eased from 49 to 47, reflecting limited market momentum. As a result, key technical levels are now seen at £190/t (resistance) and £170/t (support).

Find out more about the graphs in this report and how to use them

Find out more about the graphs in this report and how to use them

Market drivers

Global wheat prices eased last week (25 Jul–1 Aug), pressured by strong supply prospects, harvest progress, currency movements and lacklustre export demand.

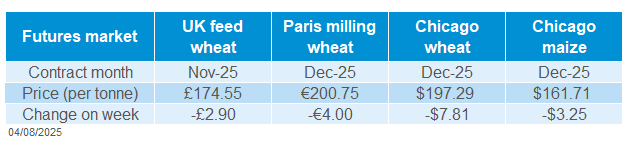

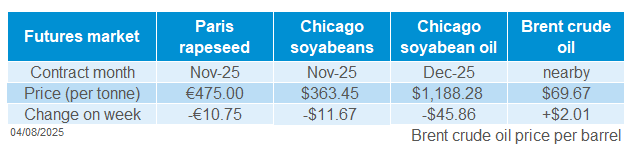

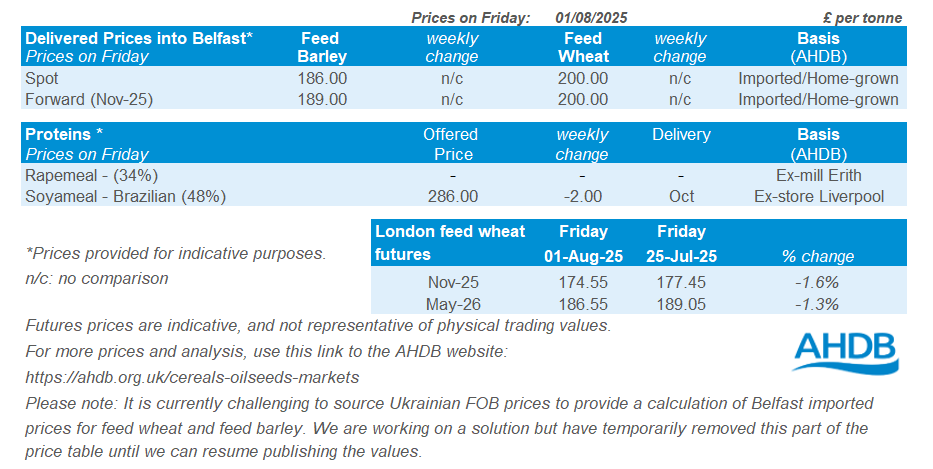

Nov-25 UK feed wheat futures fell by £2.90/t (–1.6%) to close at £174.55/t, tracking declines on global markets.

Paris milling wheat and Chicago wheat futures (Dec-25) dropped 2.0% and 3.8%, respectively.

The larger fall in Chicago was driven by a stronger US dollar after the Federal Reserve held interest rates steady.

Harvest progress is weighing on markets amid expectations of ample global supply. In the USA, 80% of the winter wheat crop had been harvested by 27 July, with spring wheat harvesting underway in some regions.

However, forecasted rainfall across the Midwest may cause delays. In France, 89% of the soft wheat crop had been harvested by 28 July, up from 86% the previous week and well ahead of 63% at the same time last year.

Meanwhile, persistent rainfall in Germany and Poland is disrupting harvest and raising concern over crop quality.

Recent rainfall has enhanced soil moisture levels across Argentina, supporting the 2025/26 wheat crop as planting nears completion.

According to the Buenos Aires Grain Exchange, nearly all sown areas are now in normal to optimal condition.

In the Black Sea region, SovEcon has trimmed Russia’s 2025 wheat crop forecast to 83.3 Mt (USDA: 83.5 Mt) from 83.6 Mt, due to weaker yields in the south.

Despite this, the export projection remains steady at 43.3 Mt. Meanwhile Ukraine’s wheat exports are off to a slow start, with only 487 Kt shipped so far this season, compared to 1.4 Mt at the same point last year.

Export demand remains subdued. Weekly US wheat export sales totalled 592.1 Kt for the week ending 24 July, down 17% on the previous week, though still broadly in line with recent averages.

EU soft wheat exports also continue to lag behind last year’s pace. However, renewed interest from Jordan, Bangladesh and Egypt offered a modest lift to market sentiment.

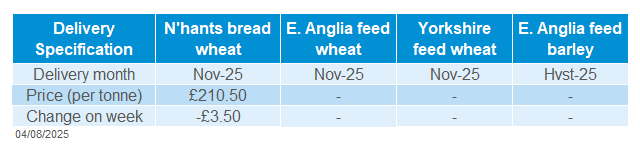

UK delivered cereal prices

Feed wheat delivered into Avonmouth for Harvest delivery was quoted at £176.50/t on Thursday.

November delivery of bread wheat into the North West was quoted at £222.00/t, down £4.00/t on the week.

Rapeseed

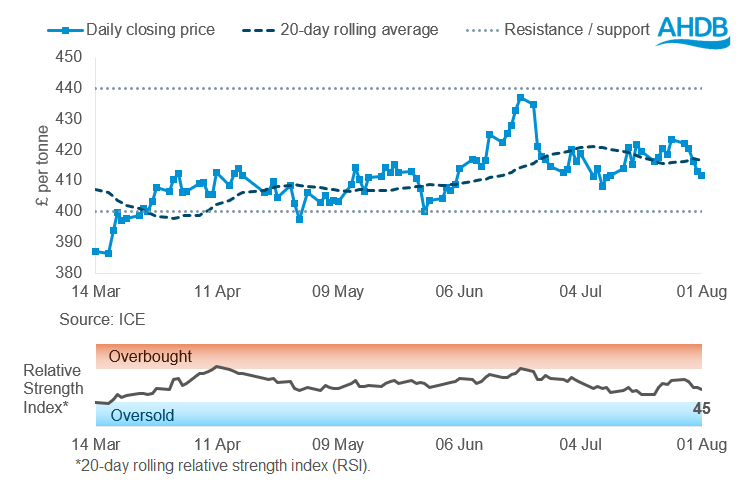

Paris rapeseed futures in £/t (Nov-25)

Last week (Friday–Friday), Paris rapeseed futures (in £/t) finished below the 20-day moving average, closing at over £411.59/t.

The relative strength index (RSI) decreased this week from 56 to 45 showing a decline in momentum in the market.

Find out more about the graphs in this report and how to use them

Market drivers

Paris rapeseed futures (Nov-25) fell last week to finish at €475.00/t down €10.75/t on the week.

The global oilseed complex moved downwards on ample global supply and sluggish export demand, favourable weather in the US and Canada, and weaker Chinese demand.

A soya meal glut in China has weakened demand ahead of the key US soyabean export season. Strong imports earlier in 2025 and lower demand from animal feed producers have pushed up soya meal inventories in China.

This is pressuring Chicago soyabean futures (Nov-25) which fell to their lowest level since April, with a predicted bumper U.S harvest adding further weight to prices. Chicago soyabean futures (Nov-25) declined by -3.1% last week, for a second weekly fall.

To offload excess stocks, China has been selling soya oil and meal to India at a $15–$20/t discount compared to South American suppliers.

India, which is typically reliant on Argentina and Brazil, secured 150 Kt of soya oil for delivery between September and December, attracted by both price and faster shipping times.

Last week, Argentina announced it would permanently reduce export taxes on soyabeans from 33% to 26%, and on soyabean by-products from 31% to 24.5%, as part of President Javier Milei’s broader push to support the agricultural sector.

Ukraine has been the world’s leading producer of sunflower seeds, having harvested 13 Mt (USDA) last year.

This season’s crop faces threats, severe drought in the southeast is already impacting yields, while locust infestations have spread across six regions.

Conventional pest control efforts have been hampered by the ongoing war.

UK delivered rapeseed prices

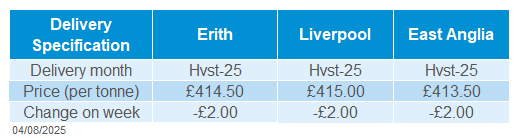

Rapeseed to be delivered in August into Erith on the harvest contract was quoted at £414.50/t on Friday, down £2.00/t on the week.

Liverpool and East Anglia delivery in August were quoted at £415.00/t and £413.50/t respectively, also both down £2.00/t on the week.

Extra information

Our third harvest report is due to be released this Friday (8 August), with the latest update on harvest progression by region, including data on yields and quality.

For top tips on straw, sampling and more this harvest, visit our Harvest Toolkit.

Cereal usage data is to be released this week (7 August) covering UK human and industrial usage as well as GB animal feed production.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.