Arable market report - 31 October 2022

Monday, 31 October 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

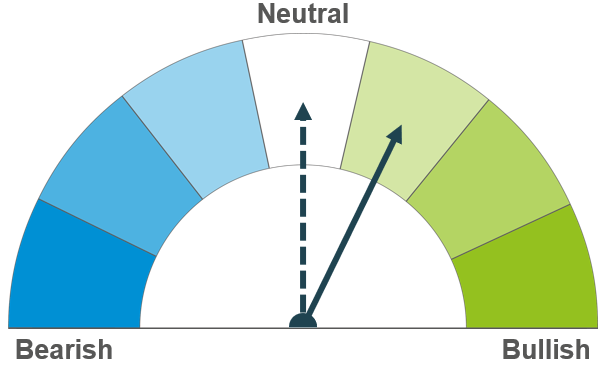

Wheat

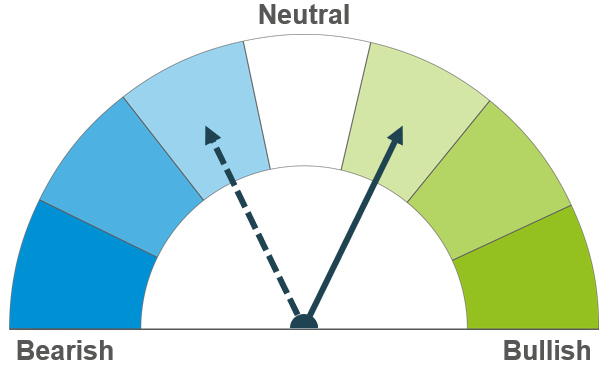

Maize

Barley

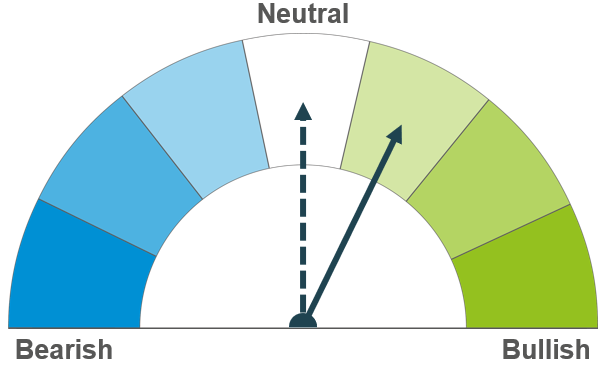

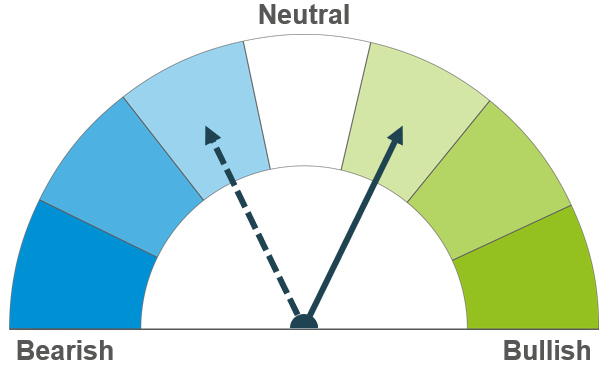

Markets await news on the future of the Ukrainian export corridor, keeping prices volatile but supported in the short term. Longer term, Southern Hemisphere production as well as recessionary concerns remain something to monitor going forward.

A tight global picture as well as news on the Black Sea export corridor deal keeps prices supported in the short term. Longer term improved South American conditions and recessionary concerns could pressure maize markets.

Barley markets continue to follow the wider grain complex, supported by tight outlooks.

Global grain markets

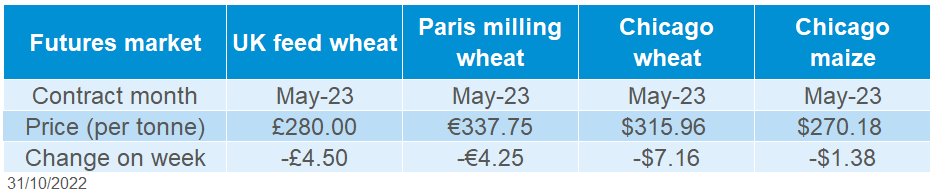

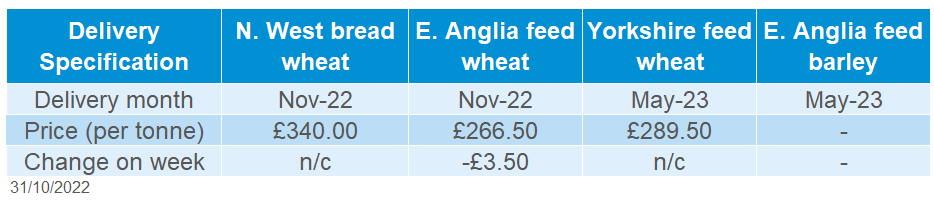

Global grain futures

Global grain markets felt some pressure last week. Chicago wheat (Dec-22) and Paris milling wheat (Dec-22) were down 2.5% and 1.3% respectively Friday to Friday. Improved US weather in drought concerned areas for wheat, recessionary fears and optimism surrounding the Ukrainian grain corridor all weighed on prices.

While last week it was believed there was a good chance of an extension, over the weekend Russia withdrew themselves from the UN-brokered Black Sea deal indefinitely. Russia had claimed that throughout the deal, its own exports were still hindered and had suggested that they may not agree with an extension to the agreement. After accusing Ukraine of a drone attack on Saturday, Russia announced it would no longer guarantee the safety of cargo ships in the region (Refinitiv, BBC news).

This news is already impacting prices, with UK feed wheat (May-23) as at 12.30pm climbing £9.00/t since Friday’s close. Paris milling wheat (Dec-22) has also climbed €12.50/t over the same period. This morning, ships have continued to move in and out of the region, though prices over the next few weeks will likely remain volatile as the future of the grain corridor is decided.

As mentioned in Millie’s analysis last week, with Northern Hemisphere wheat harvest all but complete, attention is turning to Southern Hemisphere output. While Australia is expecting their second largest wheat crop on record at 32Mt for the 2022/23 season, heavy rains continue to cause concerns over quality. Heavy rainfall is forecast to continue over the next week in Southern and Eastern parts of the country.

South American wheat is also feeling the impacts of adverse weather conditions in the South Pacific, with drought and late frosts hitting Argentina. The Rosario Grain Exchange cut the country’s wheat output estimate from 15Mt to 13.7Mt on Wednesday. If realised this would be the smallest crop in seven years, further tightening the global wheat outlook.

Also in Argentina, while maize plantings have been delayed and there is an expected fall in area on the year due to the dry weather, recent rain could improve conditions of the recently planted crop. The main agrarian regions received 30-100mm of rain last week, aiding the development of maize plantings. In Brazil, rains continue to support first crop maize planting progression. More rain is forecast across Brazil next week, though precipitation in Argentina looks minimal. Weather will be an important watchpoint as plantings continue into November.

UK focus

Delivered cereals

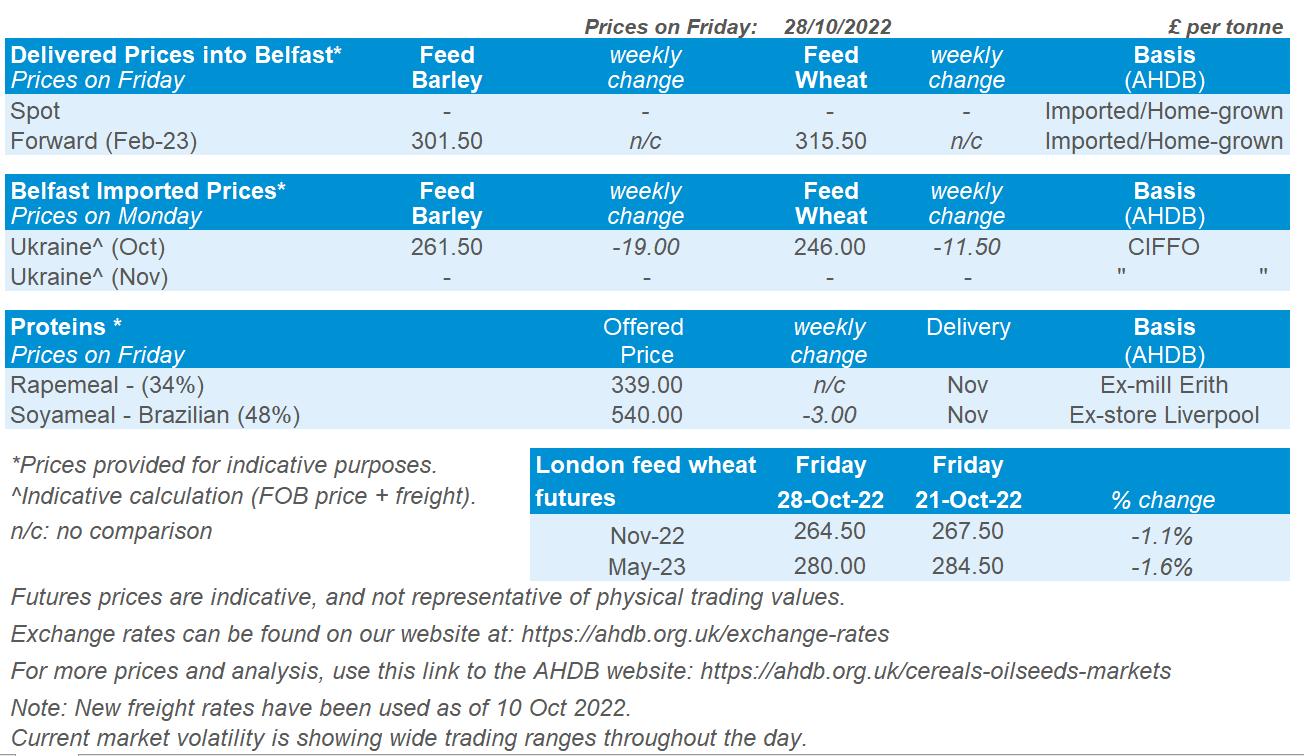

UK feed wheat futures continue to track global movements down. The May-23 contract lost 1.6% over the week (Friday to Friday), while new crop prices (Nov-23) were down 1.5% over the same period. With both contracts closing at £280.00/t and £263.10/t, respectively.

Domestic delivered prices for feed wheat into East Anglia for November delivery was quoted at £266.50/t on Thursday, down £3.50/t on the week. Bread wheat prices for December delivery into the North West were quoted at £341.00/t, down £1.00/t on the week.

Last week the UK tax and spending plan was pushed back by two weeks, moving it to 17 November. The move is said to have settled investors and led to calmer market conditions. The current Bank of England base interest rate sits at 2.25% though is expected to be reviewed in a meeting on Thursday.

As mentioned in Megan’s GMD last week, UK natural gas prices have been falling over the past two months, back to levels in line with last year. Milder weather across Europe has meant that demand has dampened slightly for winter gas supplies. However, the heightening of the war in Ukraine over the weekend has seen prices climb, with nearby futures at 12.30pm today, up 32.3% from Friday’s close. Weather and its impact on demand will remain a watchpoint over the next few weeks, as well as the situation in Ukraine.

Oilseeds

Rapeseed

Soyabeans

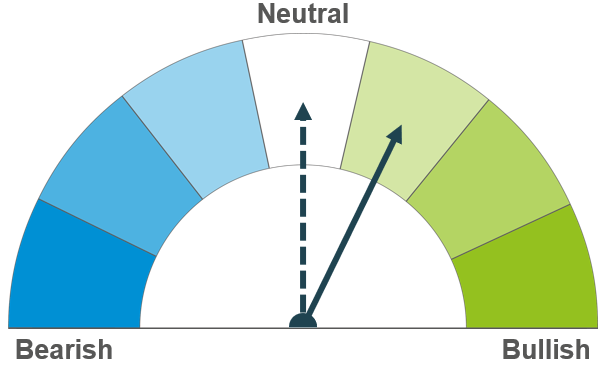

In the short-term, rapeseed markets remain supported by uncertainty of the Ukrainian export corridor continuation. As such, volatility will remain. Longer term, recessionary concerns and the bearish outlook for soyabean could weigh on prices.

Like rapeseed, short term volatility from the Ukrainian export corridor will filter into prices. Longer term large South American soyabean crops, combined with potential recessional fears, could pressure the market.

Global oilseed markets

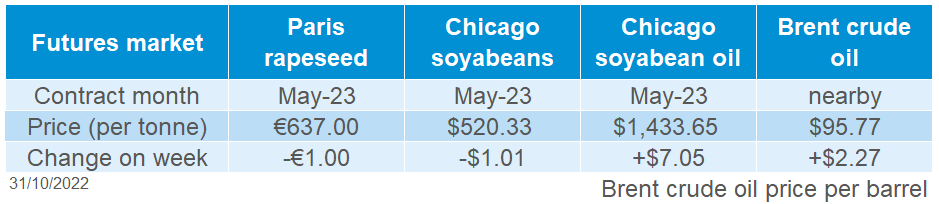

Global oilseed futures

Chicago soyabeans futures (May-23) closed Friday at $520.33/t, down 0.2% across the week. At the start of the week the market was pressured due to largely favourable conditions across the US Midwest allowing soyabean harvest to progress. This crop will bring large supplies to the market, however currently Mississippi levels are low which is impacting commodity movement.

However, a weakening US dollar, after poor US economic data reinforced speculation that the federal reserve will slow its interest rate increases. This added support to Chicago soyabeans as there were hopes for improved export demand going forward if the US dollar weakened further. In the latest weekly export data, net sales of US soyabeans were estimated at 1.03Mt to the week ending 20 October, with the majority to China. This is in line with trade expectations of 800Kt – 1.6Mt (Refinitiv).

Nearby brent crude oil closed Friday at $95.77/barrel, up 2.4% across the week. Despite China continuing to increase Covid-19 restrictions causing some price pressure on Friday, the market last week was overall supported on continental supply concerns as Europe reduces reliance on Russian imports.

Over the last week there was much needed rains in Argentina bringing timely relief to soil moisture deficits. This will boost planting prospects as the country begins their sowing campaign for soyabeans. However, rains are not forecast of the next week, this is a key watchpoint going forward. In Brazil there will be continued rains over this week too.

Going forward, another critical watchpoint is the continuation of the Black Sea grain corridor. Currently, Russia is not committing to the extension of the UN deal that is due to expire late November. If this corridor is not extended, it will lend support for world vegetable oil prices as it will impact Ukrainian sunflower exports.

Rapeseed focus

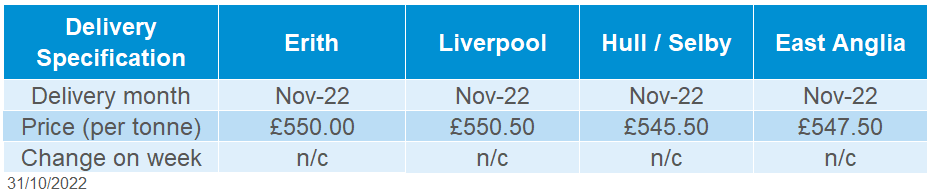

UK delivered oilseed prices

Rapeseed prices were down across last week, alongside soyabeans. Paris rapeseed futures (May-23) closed at €637.00/t on Friday, down €1.00/t across the week.

Delivered rapeseed (into Erith, May-23) was quoted at £556.50/t on Friday with no comparison on the week. However, harvest-23 was quoted at £546.50/t, down £3.50/t across the week.

Sterling strengthened (+1.7%) against the euro across the week to close Friday at £1 = €1.1654. This would have added further losses to domestic rapeseed prices across the week.

This Wednesday (02 November), StatCan will be releasing the Canadian estimates of production and yields of principal field (as at November 2022). This will provide further insight into Canada’s improved production for this marketing year.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.