Southern Hemisphere wheat woes to support markets? Grain market daily

Thursday, 27 October 2022

Market commentary

- UK feed wheat futures (May-23) closed at £278.00/t yesterday, down £1.50/t from Tuesday’s close. The Nov-23 contract was down £1.75 over the same period, closing at £262.00/t.

- Argentina’s 2022/23 wheat production has been revised down a further 1.3Mt to 13.7Mt by the Rosario grain exchange. This comes just 7 days after the previous forecast of 16.5Mt as drought and frosts damage crops – read more about this below.

- Paris rapeseed futures (May-23) gained €2.00 yesterday, closing at €639.25/t. Rapeseed markets felt support from gains in soy oil and crude oil, with the latter impacted by a weaker US dollar and falling US crude oil stocks.

- Yesterday the pound sterling closed at its highest point since mid-September at £1=$1.1627, following the government delaying the tax and spending budget plan until 17 November. Also, the US dollar weakened from concerns over interest rate rises.

Southern Hemisphere wheat woes to support markets?

With Northern Hemisphere wheat harvest all but complete, attention has started to turn to Southern Hemisphere output. Excessive rains in Australia and drought in Argentina are leading to concerns over the quality/size of the respective crops. Between them, Australia and Argentina have accounted for around 6% of total global wheat production and 16% of total global exports over the past five-years. With the war continuing in Ukraine leading to uncertainty around supply from the Black Sea region, Southern Hemisphere output has been put even more in the spotlight this season.

Bumper Aussie wheat crop, but rains to hamper quality?

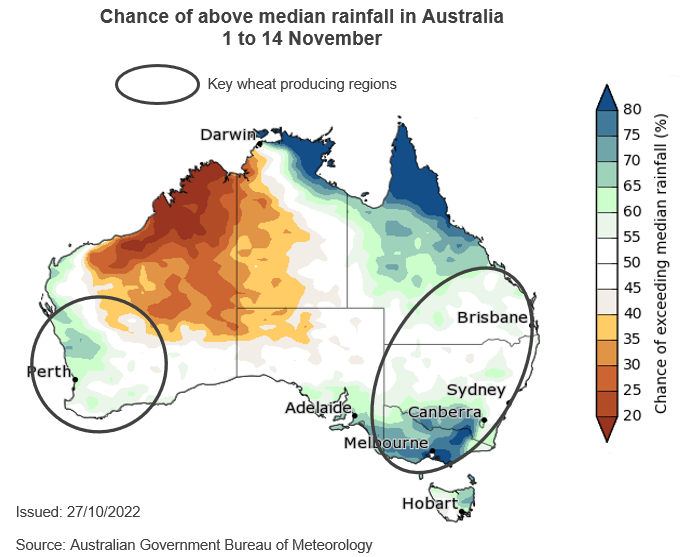

Australia is expected to have a bumper wheat crop again this season. ABARES currently have Australian wheat output pegged at just over 32Mt for 2022/23, 11% down from last year, but this is the second highest level on record. While wheat output is set to be high, the recent heavy rains are expected to have affected the quality of the crop in the southern and eastern regions. Below average temperatures and heavy rainfall are forecast to continue over the next couple of weeks across South Australia, impacting the development and harvest of crops. This is all due to the third successive La Niña weather event in the South Pacific.

Severe drought to lead to a small exportable surplus for Argentina?

South America is adversely being impacted by La Niña too, which has led to a lack of rainfall and late frosts in Argentina. This is expected to seriously hamper Argentinian wheat output this season. On Wednesday, the Rosario Grain Exchange cut the wheat output forecast from 15Mt, to 13.7Mt. If realised, this would be the smallest crop in seven years. It is thought that 9% of the area planted to wheat this season will not be harvested due to the crop condition (Rosario Grain Exchange).

So what does this mean?

Globally, the supply of quality wheat is relatively tight this season, so a downgrade to the Australian crop will impact this further. Likewise, if the Argentinian crop does come in as small as expected, then this will tighten global supply further.

The impact of the wet conditions in Australia and the drought in Argentina will have likely been factored into markets to an extent. However, if the damage of either is greater than expected, then this will likely add support.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.