Arable Market Report – 29 July 2024

Monday, 29 July 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

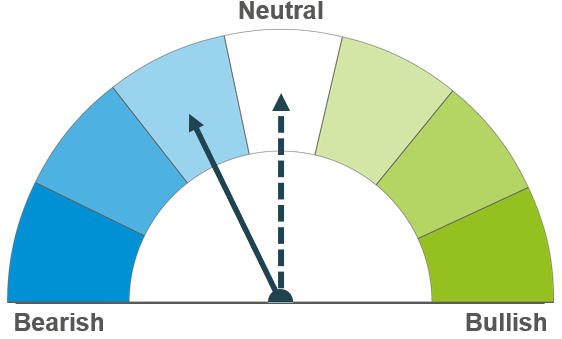

Grains

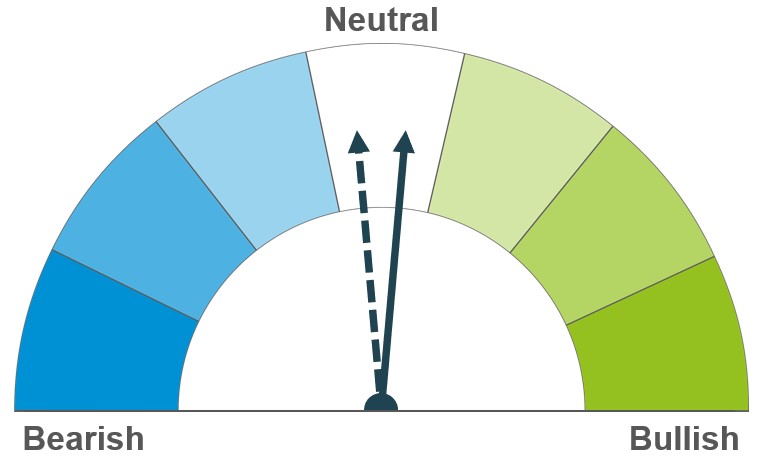

Wheat

Poor harvest results so far in Europe are balanced out with rapid harvest progress in the US and competitive Black Sea exports. Expectation of improved production in the Northern hemisphere could help steady prices long-term, despite the high consumption levels.

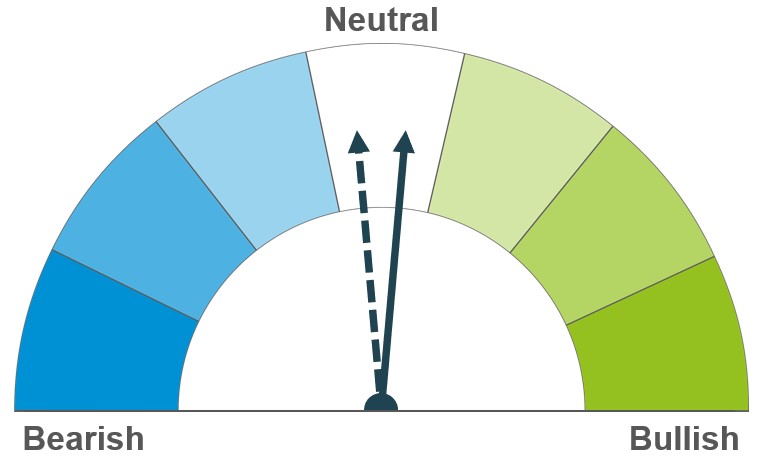

Maize

In the short-term, focus is on crop conditions in the US maize belt and the Black Sea region. The long-term expectation of ample global production is balanced by ongoing weather concerns.

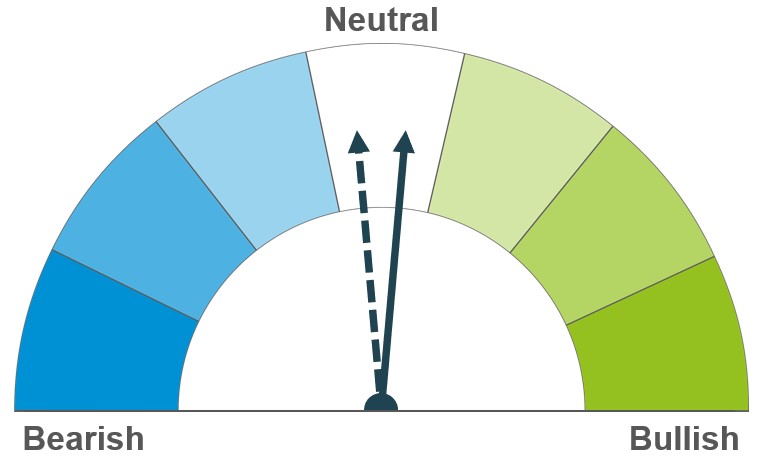

Barley

Higher yield results in the EU is adding to expectations of increased global supply. Though higher demand for feed barley coupled with weather concerns in the Black Sea and parts of Europe could keep prices steady in the long-term.

Global grain markets

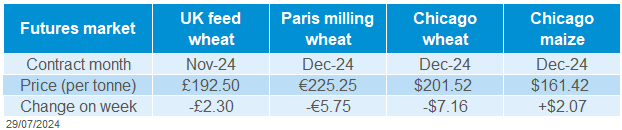

Global grain futures

Global wheat futures were generally pressured last week (Friday-Friday). Monday’s early rally driven by concerns over EU and Russian harvests, quickly faded. Prices were weighed on by improved crop prospects in the US, and competitive Black Sea exports. Chicago wheat (Dec-24) and Paris milling wheat (Dec-24) futures dropped 3.4% and 2.5% respectively.

On Friday, agricultural consultancy firm Sovecon, slightly increased its forecast for the Russian wheat crop from 84.2 Mt to 84.7 Mt. Also last week, we reported that IKAR raised its estimate for the Russian wheat harvest from 82.0 Mt to 83.2 Mt. These updates suggest that the incidents of frost and drought that occurred in the spring may not have been as damaging as initially thought.

Last week's USDA crop progress report showed that the US winter wheat harvest had reached 76% completion as at week ending 21 July, up from 71% the previous week. This was ahead of the five-year average of 72%, though fell short of analysts’ expectations of 81%. The crop progress report to be released later today will be a key watch point given the recent reports of dry weather in parts of the country. However, rain is forecast for much of the key growing area over the coming days.

Last Monday, the EU crop monitoring service, MARS, published its July crop yield forecast for the EU-27. The forecast shows a reduction in yield expectations for most crops, mainly due to persistent extreme weather conditions. Maize saw a significant decline of 4%, partly due to insufficient rainfall and elevated temperatures in Hungary, a major producer. However, spring barley saw an improved outlook, with yields estimated at 4.44 t/ha, up from the five-year average of 4.08 t/ha. This is due to favourable weather in Spain and northern Europe.

UK focus

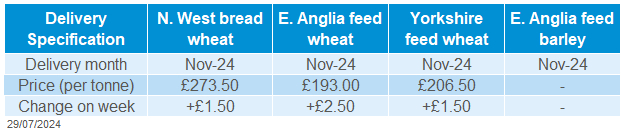

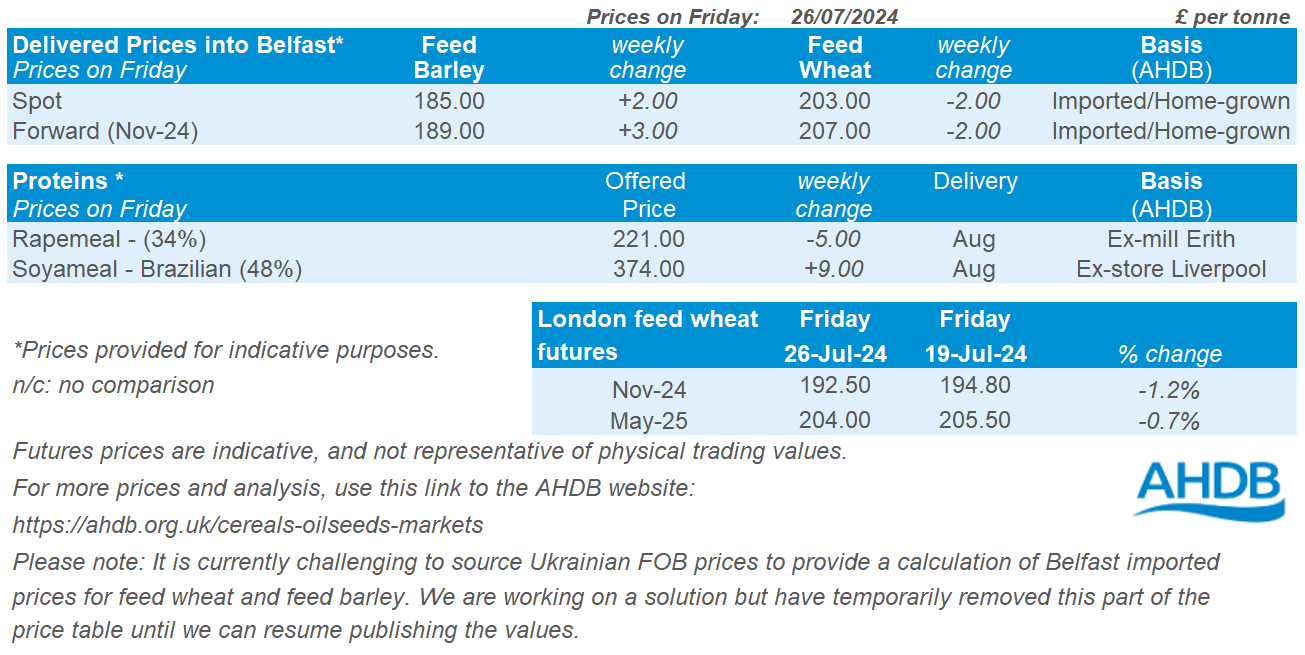

Delivered cereals

The domestic feed wheat market followed global wheat futures down, last week (Friday-Friday). Earlier gains were mostly offset by a decline on Friday. Nov-24 UK feed wheat futures dropped £2.30/t, to close at £192.50/t on Friday. Also, the May-25 contract closed at £204.00/t, down £1.50/t over the same period.

UK delivered prices followed futures price direction down Thursday to Thursday. Feed wheat delivered into East Anglia for November delivery was quoted at £193.00/t on Thursday, up £2.50/t on the week. Over the same period, bread wheat delivered into the North West for November rose £1.50/t, quoted at £273.50/t.

Last week, AHDB published analysis on the SFI uptake as part of the data collected during the planting and variety survey. Results show that 65% of arable farm businesses in England surveyed did not reduce their cropped arable area for harvest 2024 with SFI options. While this percentage does vary regionally, considering sample size for each region too, most arable farm businesses surveyed in England opted not to take cropped land out for SFI options. Find more details here.

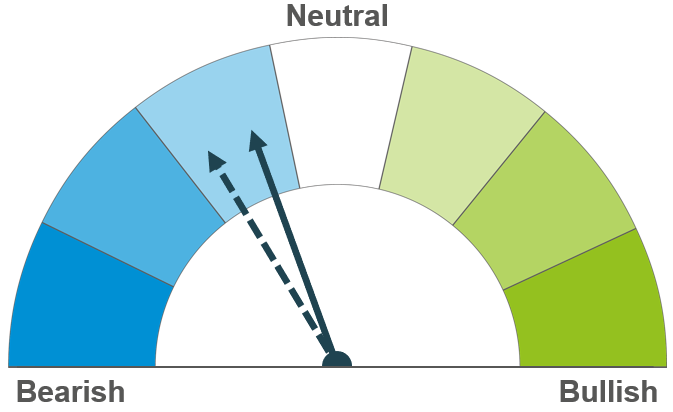

Oilseeds

Rapeseed

Rival vegetable oils weighed on rapeseed markets, in addition to the forecasted rains over the US Midwest improving the outlook for US soyabeans. However, lower harvested yields in parts of Europe could offer support longer-term.

Soyabeans

Favourable weather forecasted in the US Midwest and uncertain Chinese demand weighs on the oilseed short-term. Longer-term, expectations of ample global supplies will likely keep prices under pressure.

Global oilseed markets

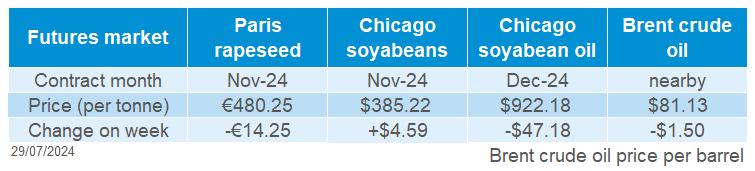

Global oilseed futures

Global oilseed markets were mixed last week as Chicago soyabeans futures (Nov-24) gained 1.2% to close at $385.22/t (Friday to Friday), while Paris rapeseed futures (Nov-24) fell 2.9% to close at €480.25/t. US politics and forecasted warmer weather in the US Midwest helped to support soyabean markets earlier in the week. However, on Friday (26 July), the weather forecast for the coming days became more favourable over the US Midwest, which partially offset the gains made throughout the week.

In response to Kamala Harris becoming the Democratic candidate, on Monday, Chicago soyabean futures appreciated considerably as the improved outlook of the Democrats retaining presidency lessened the potential for changes to US trade policy. In the past, during Republican nominee Donald Trump’s presidency, he had instigated a trade war with China which had impacted the export potential of soyabeans.

Last Monday, the USDA reported no change on the week for soyabeans conditions, remaining at 68% good or excellent, up from 54% last year. As the crop progresses through the sensitive pod setting stage, elevated temperatures that had been forecasted over the US Midwest in August led to some concerns regarding yield prospects. However, weather forecasts on Friday showed plentiful rainfall and lower temperatures over the US Midwest, calming concerns of continued dryness. On Wednesday (23 July), only 4% of the US soyabean crop was in drought, one percentage point less than last week.

While Chinese demand of South American soyabeans has been strong throughout July, the country is now experiencing an oversupply of the oilseed, pressuring the already negative crush margins seen in regions of the country, as animal feed demand continues to be lacklustre. September to December is usually the peak marketing season for US soyabeans however there are concerns that China’s oversupply could reduce their demand.

Malaysian palm oil futures depreciated in response to the Malaysian Palm Oil Association estimating greater production in July, up 15% from a month before. In addition, Brent crude oil dropped to $81.01/bbl last Tuesday, nearly a seven-week low in response to increased expectation of a ceasefire deal in the Middle East, and weakening Chinese demand and macroeconomic outlook.

Rapeseed focus

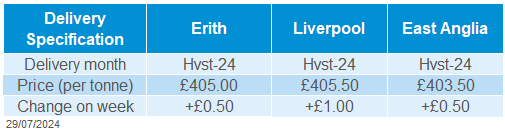

UK delivered oilseed prices

Paris rapeseed futures fell considerably on the week (Friday to Friday). Despite a modest appreciation on Monday, the Nov-24 contract fell €14.25/t to close at €480.25/t at the end of the week. Although rapeseed harvests in parts of Europe are reporting lower yields than forecasted and warmth and dryness continued in parts of the Canadian Prairies, rapeseed markets were pressured by more attractively priced palm oil. In addition, the notable depreciation in soyabeans markets on Friday spilled over to rapeseed markets.

Rapeseed delivered into Erith for August delivery was quoted at £405.00/t on Friday, rising £0.50/t on the week. Also, delivery into Erith for November was quoted at £415.50/t, unchanged on the week. Please note, the delivered prices survey was undertaken on Friday morning, and therefore will not take into account the price movement for Paris rapeseed futures across the whole day on Friday.

Weather forecasts for Canada had shown abnormally high temperatures across key rapeseed growing regions, during a time when the crop’s seeds are developing and is therefore sensitive to unfavourable growing conditions. However, over the weekend, the hot temperatures that had been forecast became less extreme, reducing some concern.

The European Commission published the July MARS report regarding European crops. Yields for rape and turnip rape were revised down 2% from June to 3.10t/ha largely due to the hot and dry conditions in south-eastern Europe and continued wet conditions in the west

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.