Arable Market Report – 22 July 2024

Monday, 22 July 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

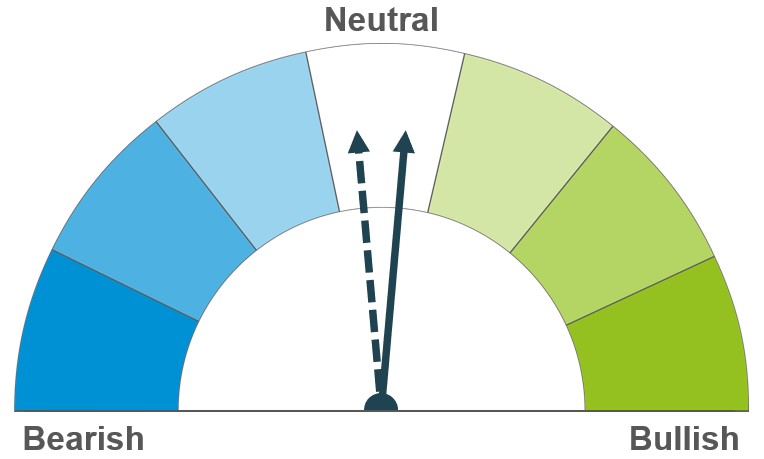

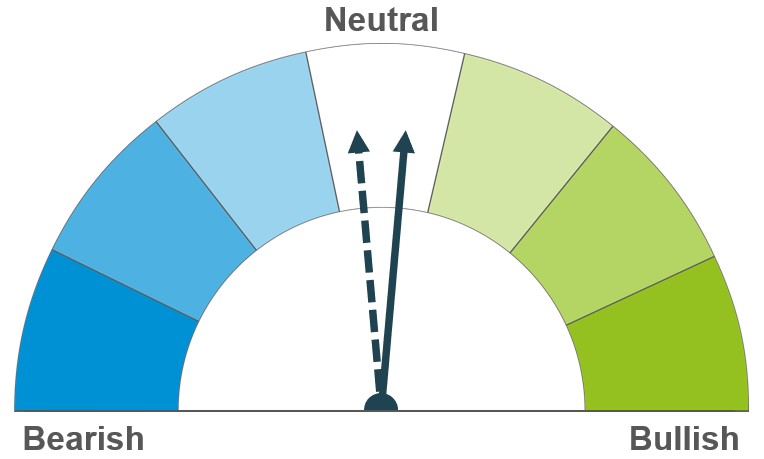

Harvest pressure is balanced with weather concerns short-term. Longer-term, global stocks are now estimated higher than previously expected, though demand also remains high.

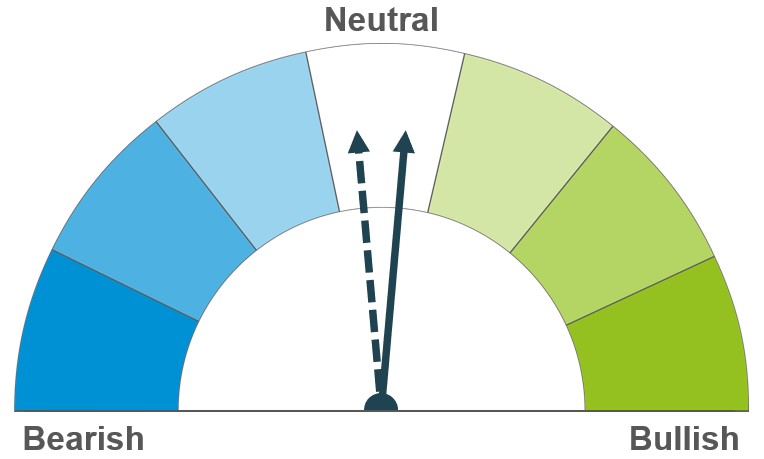

Crop conditions in the US and Black Sea region are a key watchpoint. Longer-term, greater US area suggests plentiful global supplies.

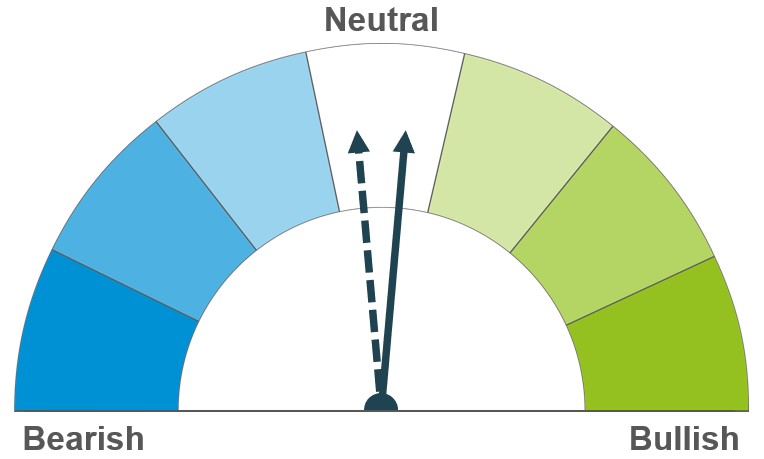

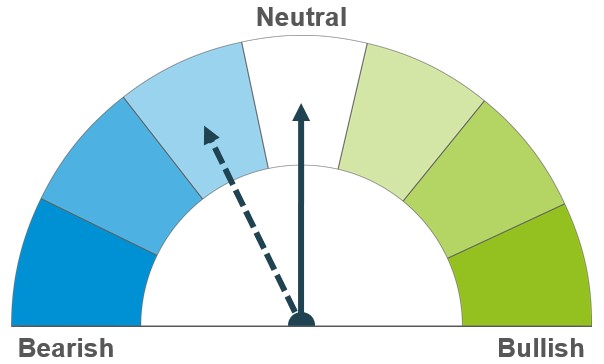

Global barley supplies are still expected to increase in 2024/25. Feed barley prices will likely track the wider grains complex, though harvest results in key producing countries are something to watch.

Global grain markets

Global grain futures

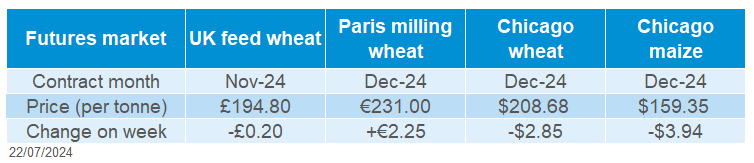

Global wheat markets moved sideways last week. Chicago wheat futures (Dec-24) were pressured 1.4% Friday to Friday. Meanwhile, Paris milling wheat futures (Dec-24) gained 1.0% over the same period. Harvest pressure in the northern hemisphere, as well as an increased global wheat supply estimate by the USDA on the previous Friday, pressured prices at the beginning of the week. However, towards the end of the week support came from bargain buying and global weather concerns.

Harvest pressure in the US and Russia weighed on prices at the start of the week. On Monday, the USDA reported that US winter wheat harvest was 71% complete as at week ending 14 July. This is well ahead of the five-year average of 62%, and up from 53% last year. Russian agricultural consultancy firm IKAR increased its estimate for the country’s wheat crop last Monday, now at 83.2Mt from 82.0 Mt previously. However, recent hot weather in eastern Ukraine and southwest Russia is a watchpoint for the country’s maize crop development.

Some support however towards the end of the week came from disappointing harvest results in western Europe. Excessive rainfall in parts of France and Germany has led to lower yields and specific weights for winter barley. Two German associations representing farmers, DBV and DRV, have pegged production down 3% and 6% respectively on the year. The wet weather is also impacting harvest progression. In France, just 14% of the wheat crop (excl. durum) had been harvested by 15 July (FranceAgriMer). This is well behind the five-year average of 43% for this point in the season.

Another factor limiting losses last week was a flurry of international tenders on the back of lowering prices. Algeria, Egypt and Jordan all called wheat import tenders at the beginning of last week. Due to its competitive price, much of the wheat purchased was of Russian origin.

UK focus

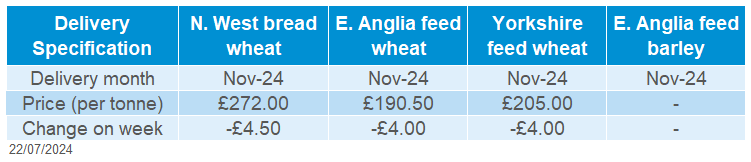

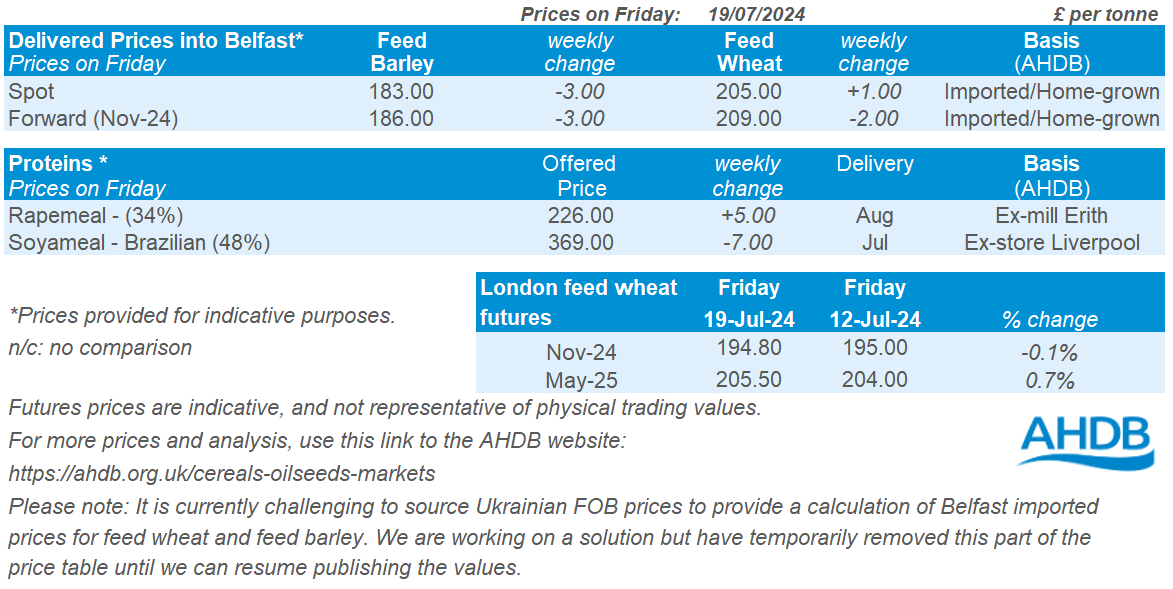

Delivered cereals

Domestic feed wheat markets were largely unchanged on the week, with earlier declines generally offset by a rebound on Friday. Nov-24 UK feed wheat futures edged down 0.1%, to close on Friday at £194.80/t. While, the May-25 contract closed at £205.50/t, up 0.7% over the same period.

UK delivered prices followed futures price direction down Thursday to Thursday (before futures climbed again on Friday). Feed wheat delivered into East Anglia for November delivery was quoted at £190.50/t on Thursday, down £4.00/t on the week. Over the same period, bread wheat delivered into the North West for November fell £4.50/t, quoted at £272.00/t.

AHDB published analysis this week regarding gross margins for 2025. Perhaps unsurprisingly, milling wheat, followed by feed wheat, remain the most favourable options for autumn drilling when considering high yield potentials and current UK feed wheat prices for Nov-25. Find the full results and analysis here.

Oilseeds

Rapeseed

Soyabeans

Unfavourable weather in key producing countries is currently keeping prices supported. A tight global supply of oilseeds will likely also help to keep prices stable longer-term.

Better weather in the US could improve crop yield and keep prices neutral. Ample global supply from major producers like Brazil and the US could keep prices down in the long run.

Global oilseed markets

Global oilseed futures

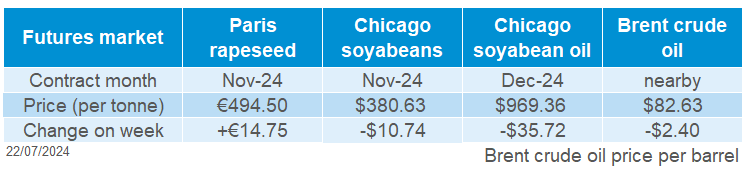

Last week (Friday to Friday), Chicago soyabean futures (Nov-24) closed at over a three-year low, continuing the previous week’s decline. Fund managers anticipated a larger crop by increasing their bearish positions ahead of the USDA WASDE report. However, the report showed a slight decline in global production from June to July.

Prices briefly rebounded during the week due to bargain buying but eased back on favourable weather in the US Midwest. The Nov-24 contract dropped by 2.74% on the week to end at $380.63/t on Friday.

The National Oilseed Processors Association (NOPA) said its members, who process 95% of US soyabeans, crushed fewer soyabeans in June. This is a 4.4% drop from May and below analysts’ expectations.

The Brazilian association of vegetable oil industries (Abiove), raised the country’s 2024 soyabean production estimate by 700 Kt, bringing the total to 153.2 Mt on adjusted yield expectation. Also, the association kept its export forecast for the 2024 crop unchanged at 97.8 Mt.

Soyabean prices are now more influenced by US crop conditions since the harvest in South America is complete. Last week, the USDA reported that 68% of US soyabeans are in good to excellent condition, the same as the previous week, but slightly below the expected 69%. The USDA’s crop report today will be key for soyabean prices this week.

Rapeseed focus

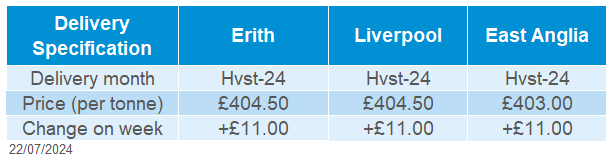

UK delivered oilseed prices

Paris rapeseed futures rose last week (Friday to Friday), unaffected by the drop in soyabean prices. The Nov-24 and May-25 contracts gained €14.75/t and €13.50/t to close at €494.50/t and €496.75/t respectively.

Delivered rapeseed prices followed the trend of global prices. Rapeseed delivered into Erith for August delivery was quoted at £404.50/t on Friday, rising £11.00/t on the week. Also, delivery into East Anglia for November was quoted at £414.00/t, up £11.50/t on the week.

Adverse weather conditions in key producing countries supported prices globally as highlighted below.

- LSEG reduced its 2024/25 rapeseed harvest estimate from 3.9 Mt to 3.6 Mt on warm and dry weather. This new estimate is slightly below the USDA’s forecast of 3.7 Mt for the country.

- Germany’s association of farm cooperatives expects the country’s winter rapeseed crop to be 10% smaller than last year due to reduced planted areas and poor weather, including repeated rain this summer.

- LSEG kept its production forecast for Australian rapeseed at 5.35 Mt due to warm/dry weather condition over the main cropland regions. This is slightly below USDA’s 5.5 Mt.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.