Arable Market Report – 24 March 2025

Monday, 24 March 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

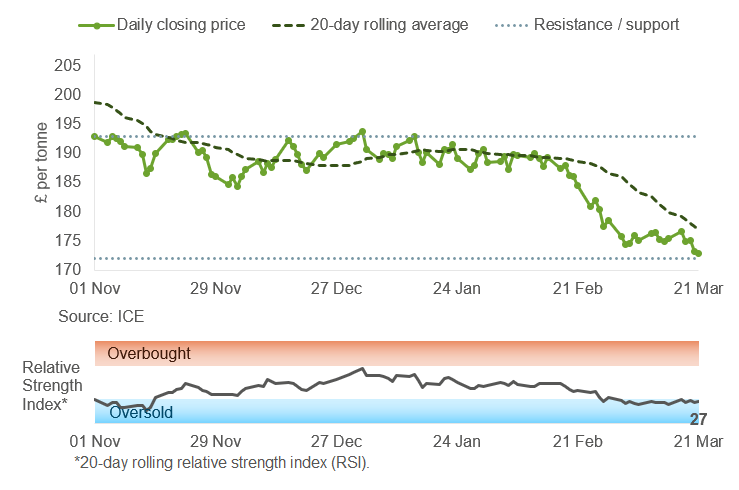

The May-25 UK feed wheat futures contract closed below previous support level last week. With the Relative Strength Index (RSI) in the oversold range, prices may find support around last week's low of £172/t.

Find out more about the graphs in this report and how to use them here.

Market drivers

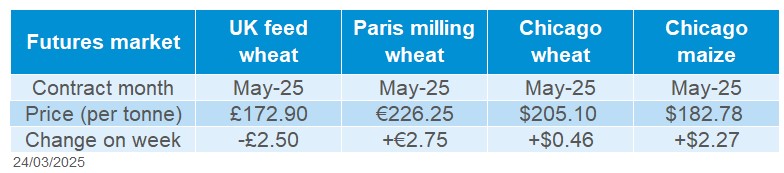

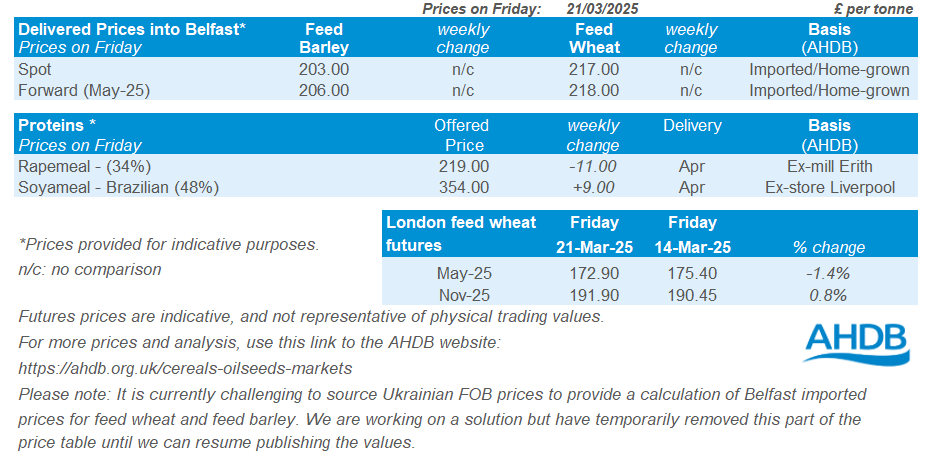

Last week saw mixed results for domestic feed wheat futures (Friday to Friday). The old crop contract (May-25) ended at £172.90/t, down £2.50/t, while the new crop contract (Nov-25) rose by £1.45/t, closing at £191.90/t. The difference in trends reflected domestic market sentiment towards the old crop as the discount to new crop extended to £19/t, plus sterling strengthening against the euro.

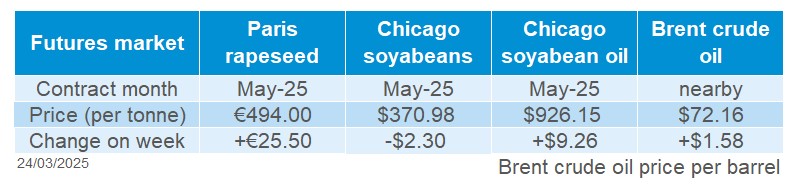

Chicago wheat and Paris milling wheat futures (May-25) saw gains of 0.2% and 1.2%, respectively. Global price support came from supply concerns in the US and Russia, along with new export opportunities in Turkey. Although weaker US export sales and the IGC's forecast of a larger global crop capped the gains.

Earlier last week, severe windstorms and dry conditions were reported in key wheat-growing areas of the US. This raised concerns about potential crop damage.

Meanwhile, Russia’s grain shipments are slowing, which could tighten global supply. SovEcon forecasts Russian wheat exports to be just 1.5 Mt in March, down from 4.8 Mt last year and below the five-year average of 3.3 Mt. Full season exports are projected to reach 42.2 Mt, lower than the USDA's estimate of 45.0 Mt.

Turkey has removed tariffs on wheat imports, which will be milled into flour for export, to increase its flour exports. This is expected to boost global wheat demand in the short term.

However, US wheat export sales for the week ending 13 March were reported at 248.8 Kt, a season low, and fell short of trade estimates, which ranged from 300 Kt to 700 Kt.

Also, the International Grains Council (IGC) raised global grain production for the current season by 4.4 Mt, mainly due to a larger wheat harvest in Australia. For 2025/26, early forecasts show an increase in global production, driven by maize, wheat, and barley.

UK delivered cereal prices

Domestic delivered wheat prices were overall down from Thursday to Thursday. Feed wheat delivered into East Anglia for March 2025 dropped £1.00/t on the week, quoted at £174.50/t on Thursday.

Bread wheat delivered to Northamptonshire for March 2025 was quoted at £199.50/t, down £1.00/t, while July delivery fell £0.50/t on the week to £208.50/t.

Rapeseed

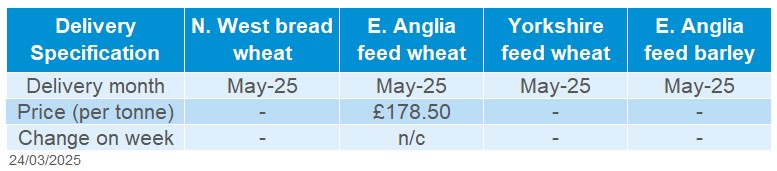

May-25 Paris rapeseed futures moved up to the 20-day moving average last week. After rallying from Friday to Friday, the price chart may find resistance at the 20-day moving average.

Find out more about the graphs in this report and how to use them here.

Market drivers

May-25 Paris rapeseed futures closed at £413.80/t on Friday, up £19.40/t on the week. New crop (Nov-25) futures finished on Friday at £397.88/t, up £10.64/t. The spread between old crop and new crop rapeseed prices increased. When developing a selling strategy for new crop rapeseed, it can be helpful to consider the seasonality of Paris rapeseed futures.

Old crop Paris rapeseed futures rose last week, mainly due to a supportive physical market in the EU and a correction after a fall in the week before. For the new crop futures, weather risks remain for both the winter and spring 2025 crops. EU rapeseed imports in 2024/25 season at 4.75 Mt by 16 March, up 4.14 Mt from a year earlier.

German agricultural co-operatives forecast 2025 winter rapeseed harvest at 4.01 Mt, down 5.2% year-on-year. Winter rapeseed crop conditions in the EU and Ukraine are a factor influencing 2025 crop prices.

Palm oil premium over other vegetable oils in the EU continues to support rapeseed prices.

Winnipeg canola futures (May-25) gained by 2.0% over the last week (Friday to Friday). After the previous fall, Winnipeg canola futures underwent some correction. The price difference between Paris rapeseed futures and Winipeg canola futures is in focus of market participants.

The USDA attaché forecasts Chinese rapeseed production for 2025/26 season at 15.9 Mt, up slightly from last year's 15.6 Mt due to increases in both area and yields. The weather in China has been favourable for winter rapeseed. Chinese rapeseed oil imports in February were significantly higher than last year. Chinese demand for Australian canola is also growing.

May-25 Chicago soyabeans futures decreased by 0.6%, while soyabean oil futures increased 1.0% (Friday-Friday). US net export sales of soyabeans were reported at 353 Kt by the USDA for the week ending 13 March, significantly lower than the previous week and below trade estimates. At the same time, US soybean NOPA crush data for February fell to its lowest level since September 2024.

US import tariffs are approaching. They are planned to be implemented from 2 April and will be the main driver in the near future, especially for the soyabean market. Additional US port charges for Chinese ships could also put pressure on Chicago futures.

The Brazilian soyabean harvest is ahead of last year and improving soyabean crop conditions in Argentina are putting pressure on the global oilseeds market.

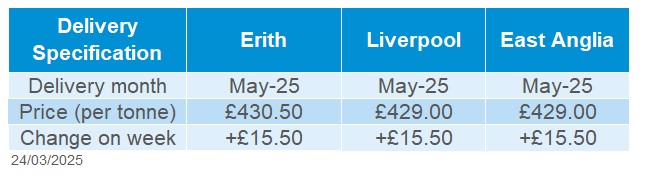

UK delivered rapeseed prices

Rapeseed to be delivered into Erith in May was quoted at £430.50/t on Thursday, up £15.50/t from the previous week. Delivery to East Anglia in May was quoted at £429.00/t, also gaining £15.50/t. In a volatile market, please note that the survey is usually conducted mid-late morning on Friday, so can show different trends from Paris futures closing prices.

Domestic rapeseed delivery prices have generally tracked Paris rapeseed futures, but with some lagged reactions due to recent low trading activity.

Extra information

AHDB's next UK cereals supply and demand estimates will be published on Thursday (27 March) and first crop development report of 2025 will be published on Friday (28 March).

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.