Global grain production to rise in 2025/26: Grain market daily

Friday, 21 March 2025

Market commentary

- UK feed wheat futures (May-25) closed at £173.25/t yesterday, down £1.95/t from Wednesday’s close. New crop futures (Nov-25) closed at £192.05/t, down £2.80/t over the same period.

- Domestic wheat markets followed Chicago wheat prices down yesterday, which fell due to weak US export sales data and a stronger US dollar. Rain and snow in US winter wheat areas helped eased dryness, adding further pressure to prices.

- Paris rapeseed futures (May-25) closed yesterday at €492.00/t, up €5.75/t from Wednesday’s close. The Nov-25 contract ended the session at €474.50/t, down €1.00/t over the same period. The old crop contract took support from Chicago soybean oil futures.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Global grain production to rise in 2025/26

Yesterday, the International Grains Council (IGC) released new global supply and demand forecasts, showing higher grain production for both the current season and the 2025/26 season.

With the large projected increase in grain production for 2025/26, ending stocks are expected to increase by 1.4 Mt, despite the rise in consumption. However, any threats to production from adverse weather, may affect market dynamics and pricing heading into the next season. This is something to monitor closely.

Current season (2024/25)

Total grains production has been revised up by 4.4 Mt from last month, now forecast to reach 2,306 Mt. This increase is primarily driven by higher wheat production in Australia.

Ending stocks for 2024/25 are expected at 576.6 Mt, 1.1 Mt higher than in March, mainly due to wheat. This comes despite a 2.2 Mt increase in global consumption, as larger supplies more than offset the rise in demand. While this suggests that the global grain market will have more reserves at the end of this season than previously thought, the stocks are still expected to be lower than last season’s level.

2025/26 season

The first projections for 2025/26 show an increase in global grain production, driven by maize, wheat and barley. Total global grain production is expected to rise by 62.9 Mt, reaching 2,368 Mt. However, lower stocks carried over from 2024/25 and a rise in demand mean 2025/26 ending stocks are projected up only slightly, by 1.4 Mt.

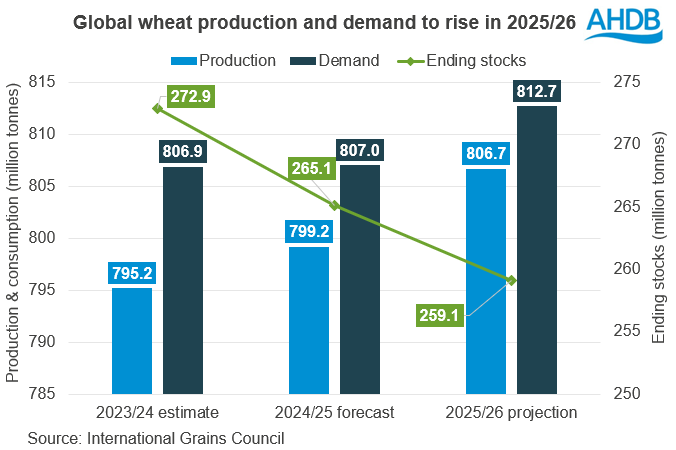

For wheat, the 2025/26 crop is projected to reach a record 806.7 Mt, up by 7.6 Mt from this season. This increase is driven by a 13.4 Mt recovery in the European Union crop and a 1.0 Mt rise in Canada, which more than offset declines from other major exporters.

Due to a 5.7 Mt increase in consumption, wheat ending stocks for the 2025/26 season are expected to fall by 6.0 Mt.

Maize production is also set to increase, with the 2025/26 crop forecast at 1,269 Mt, up by 52.2 Mt from this season. The biggest rises will be in the US, Brazil, and Argentina, with the US crop growing by 16.6 Mt to 394 Mt. Demand will increase, but not as quickly as supply. As a result, closing stocks for 2025/26 are expected to rise by 6.0 Mt.

Global soyabean production for 2025/26 is forecast at 427.5 Mt, up from 417.7 Mt this season. The increase is mainly driven by production rises in Brazil (up 6.0 Mt to 173.5 Mt) and Argentina (up 2.5 Mt to 50.5 Mt). The higher supply is just enough to offset the projected 16.9 Mt rise in consumption, resulting in a 1.4 Mt increase in ending stock to 83.2 Mt.

The global soyabean supply and demand looks more balanced in 2025/26, though several years of large surpluses mean there are large stocks to fall back on.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.