Seasonality in Paris rapeseed futures: Grain Market Daily

Thursday, 20 March 2025

Market commentary

- UK feed wheat futures (May-25) ended yesterday at £175.20/t, up £0.25/t from Tuesday’s close. The Nov-25 contract gained £3.65/t over the same period, to close at £194.85/t. The discount of old crop UK feed futures (May-25) under new crop (Nov-25) reached a record level of £19.65/t at yesterday’s close.

- Domestic wheat futures closed higher yesterday following European grain prices. However, Chicago wheat futures were down 0.3% yesterday. The US Federal Reserve kept interest rates unchanged, and a stronger US dollar added to the pressure on Chicago prices. Meanwhile, Turkey announced easing import rules for wheat and maize, supporting Paris futures yesterday.

- May-25 Paris rapeseed futures closed at €486.25/t yesterday, up €15.00/t (3.2%) from Tuesday’s close. Winnipeg canola futures (May-25) were up 1.7% yesterday.

Seasonality in Paris rapeseed futures

Recently, old crop Paris rapeseed futures have been volatile largely due to factors driving the wider global oilseeds complex, with Winnipeg canola being a key driver of prices. But what about the outlook for new crop rapeseed futures prices?

For new crop prices, the key watchpoints are ending stocks for the current 2024/25 season and what to expect from harvest 2025, taking into account the area planted, as well as weather conditions for the new crop.

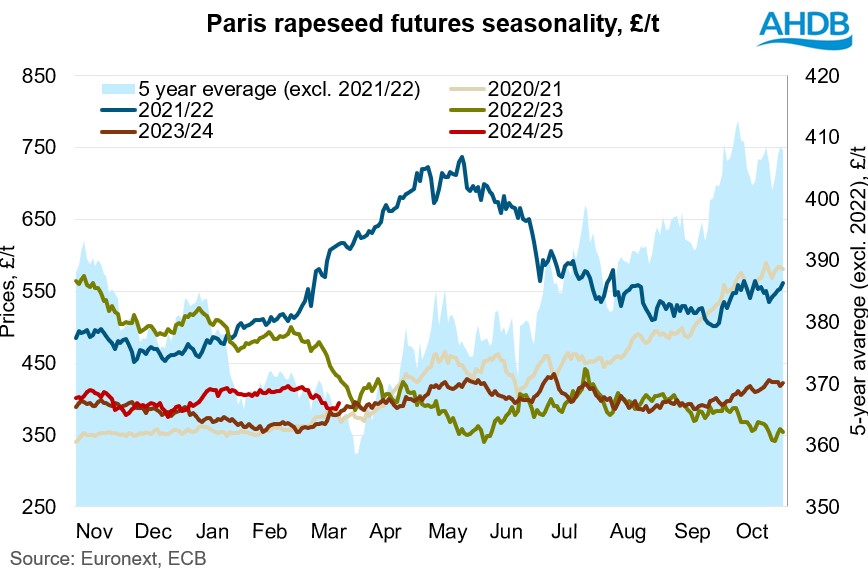

The chart below shows historical seasonality for Paris rapeseed futures by month. For the analysis, we have used the November Paris futures contract until expiry in October by year.

Paris rapeseed futures typically come under pressure in the first quarter of the calendar year, based on the five-year average. However, from April to June, rapeseed futures show some correction, after which prices have historically stabilised. From July to October, we have generally seen an upward trend with high volatility. Please note we have excluded the 2021/22 season from our five-year average due to the unusually significant geopolitical influence that year.

Looking ahead

While this chart of course only shows historical trends, the seasonality comparison could be used as an extra tool to help growers making selling decisions. Currently, Nov-25 Paris rapeseed futures are at a similar level in price to new crop contracts in 2021, 2023 and 2024. In April, prices have tended to move sideways, something to consider when marketing rapeseed at the moment.

Of course, conditions of the new season’s crop, and as such supplies moving forward, will remain a key driver. Over the next few weeks as the Northern Hemisphere crops approach their key development phase, we could see markets start to become more reactive.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.