Arable Market Report - 23 January 2023

Monday, 23 January 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

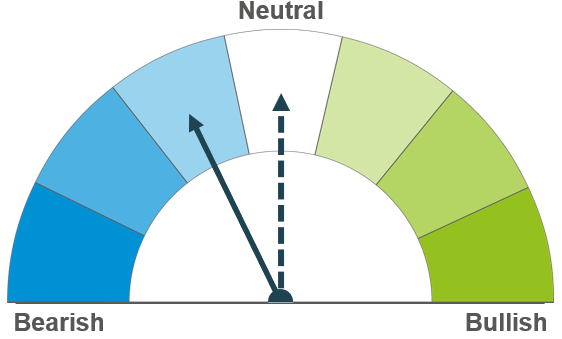

Competitive Black Sea supplies and movements in maize markets pressure prices short-term. Longer-term the renewal of the grain corridor and Chinese demand remain watchpoints.

Argentinian weather continues to influence prices both short and long-term, whilst a large Brazilian crop and uncertainty in Chinese demand could limit gains.

Barley markets continue to track the wider grain complex.

Global grain markets

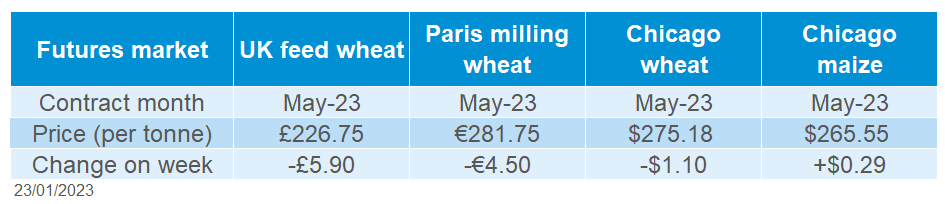

Global grain futures

Global wheat markets were pressured last week by competitive Black Sea exports, which continue to weigh on prices. Rain forecasted over the next week in Argentina also weighed on markets, with US wheat tracking US maize lower for much of the week. Though Chicago maize closed higher on the week, as pressure across the week was unable to outweigh gains in Tuesday’s rally, on the back of strong US export demand and US quarterly maize stocks declining more than expected the week before.

Nearby Paris milling wheat is at a near 11-month low as competitive Black Sea supplies pressure markets, although underlying support remains from potential North African demand for European wheat.

Despite concerns over Russian grain exports following Putin’s comments on Tuesday that Russia should maintain some stocks, concerns were eased on Thursday as Russia’s Agricultural Ministry indicated it does not plan to reduce exports. Meanwhile Russian consultancy IKAR raised the Russian wheat export forecast to 45.5Mt from 44Mt. With exports from July to January totalling 26.2Mt according to Sovecon, it remains to be seen whether Russia can meet these large export forecasts. With the Black Sea grain corridor up for renewal in March, this adds further uncertainty to grain supplies.

Chicago maize futures rallied at the start of the week after US quarterly maize stocks (as at 01 December) were lower than expected at just 274.6Mt (down 7% year-on-year), and strong US maize export sales supported prices. US grain sales for the week ending 12 January exceeded trade estimates, as wheat net sales totalled 508.1Kt for both old and new crop, and maize exports totalled 1.22Mt over the same period, exceeding trade estimates.

UK focus

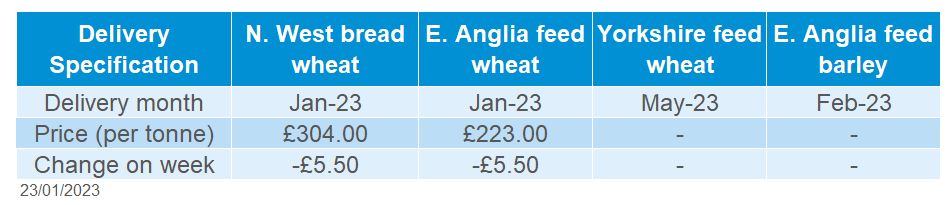

Delivered cereals

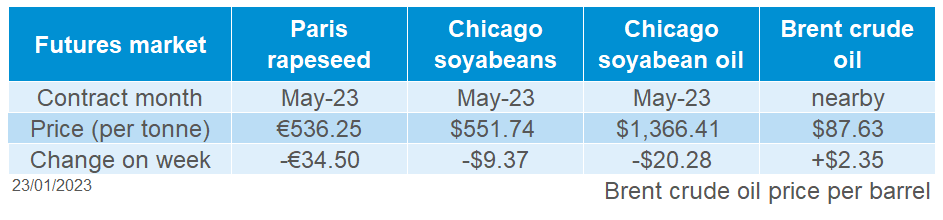

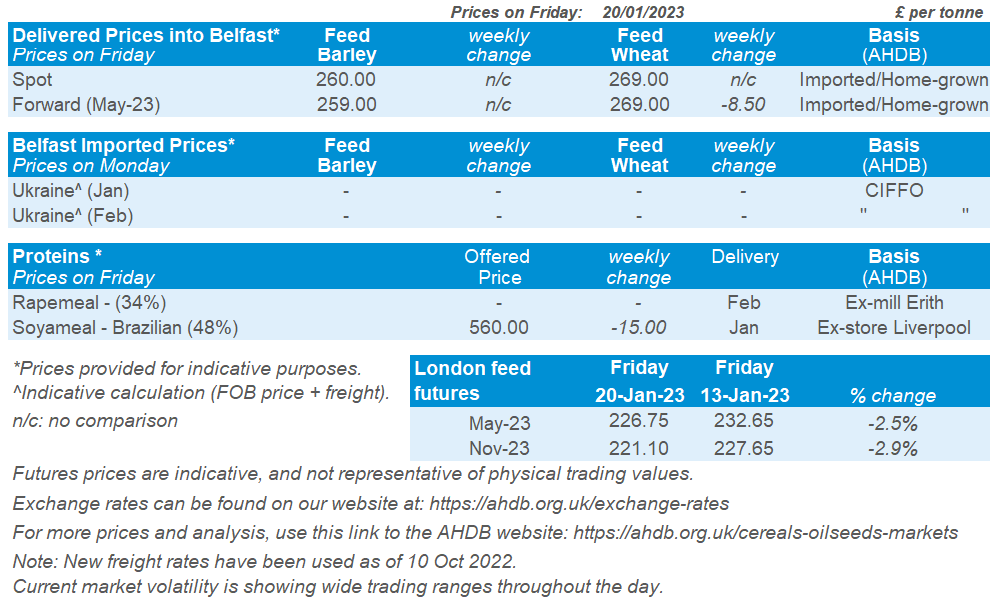

UK feed wheat futures (May-23) fell £5.90/t last week (Friday-Friday), closing at £226.75/t. New crop futures (Nov-23) closed at £221.10/t on Friday, down £6.55/t over the same period.

Feed wheat delivered into East Anglia (Jan delivery) was quoted at £223.00/t, down £5.50/t Thursday-Thursday. Bread wheat delivered into the North West (Jan delivery) was quoted at £304.00/t, down £5.50/t over the same period.

On Wednesday the Office for National Statistics (ONS) released updated consumer inflation data showing the Consumer Prices Index including owner occupiers’ housing costs (CPIH) fell from 9.3% in November to 9.2% in December (from year earlier levels).

The January release of the UK cereal supply and demand estimates is set to be published by the AHDB on Thursday 26 January, including the first estimates for exports and end-season stocks of wheat and barley for this season.

Oilseeds

Rapeseed

Soyabeans

Short-term rapeseed markets follow the pressure in soyabeans. There could be longer-term pressure from Germany’s announcement to phase out crop-based biofuels, reducing demand for rapeseed.

Short-term the much-improved outlook in Argentina will pressure the soyabean market. Long-term large Brazilian crops expected and questions over Chinese demand has the potential to weigh on soyabean prices.

Global oilseed markets

Global oilseed futures

Chicago soyabean futures (May-23) last Tuesday closed at the highest prices since June 2022. However, the oilseed market has since felt pressure from a much-improved weather outlook for Argentina and Chicago soyabean futures (May-23) ended down 1.7% across the week to close at $551.74/t.

Despite recent sizable cuts to Argentina’s soyabean crop, weather prospects have improved significantly with a storm front over Argentina that is expected to bring rainfall across much of Argentina’s key agricultural regions. Rainfall over the last seven days has alleviated some drought concern, and forecasts show that this will continue, with some parts of Northern Argentina receiving up to 6 inches. Welcomed rain continuing to fall on drought plagued Argentina has the potential to continue pressuring the market in the short term and help stall any further cuts to this soyabean crop.

Brazil is still on track to produce a record soyabean crop and focus now turns towards harvest progression. That harvest has started with 0.6% harvested according to Ag Rural behind last year of 1.2%. Export demand is expected to shift away from US supplies as this Brazilian crop comes to market.

Chinese demand is a key watchpoint especially as China’s growth in 2022 slumped to one of the lowest levels in near half a century, as Q4 was impacted by the strict COVID-19 measures, which have now been lifted. But will this spur additional demand beyond what has been forecast?

The USDA reported soyabean exports sales (for week ending 12 Jan) at 986.2Kt, up 38% from the previous week but in line with trade expectations of 600Kt – 1.3Mt. China had booked 507kt of the total amount.

Rapeseed focus

UK delivered oilseed prices

Broadly pressuring rapeseed this week has been the weakening of Chicago soyabeans and soyoil, from the improved weather outlook in Argentina. Further to that, proposals from the German Environment Minister to retract the usage of crop-based biofuel in the country, pressured the rapeseed market, as demand for vegetable oils such as rape and palm will be reduced.

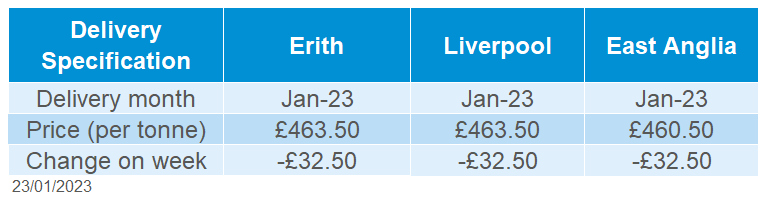

Paris rapeseed futures (May-23) closed Friday at €536.25/t, down €34.50/t Friday to Friday. Delivered rapeseed (Into Erith, Jan-23) was quoted at £463.50/t on Friday, broadly following Paris rapeseed futures movements, down £32.50/t across the week (Friday to Friday).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.