Arable Market Report - 20 September 2022

Tuesday, 20 September 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Grain Market Outlook Conference: Managing risk and looking ahead to new demand

Please join us for this year’s conference on 22 November 2022, at the Belton Woods Hotel in Lincolnshire.

The AHDB will be delivering a grain and oilseed market outlook, as well as facilitating sessions looking at UK cereals demand direction and managing risk in price volatility.

For more information and to sign up to the day, please follow this link.

With this event being in-person, we look forward to seeing you there on the day.

Wheat

In the short-term, prices continue to respond to maize market movement and Ukrainian export news. Tight global grain supplies continue to support markets in the longer-term.

Maize

Lower global supplies are supporting markets in the short-term and long-term. Demand remains a watchpoint now for price direction.

Barley

Barley markets continue following the wider grains complex, with supply outlooks remaining tight.

Global grain markets

Global grain futures

Global grains saw overall pressure last week. Despite gaining support through the week, global contracts lost ground on Friday and yesterday.

Some support last week came from the USDA trimming global maize production for 2022/23 by 7Mt to 1,172.6Mt in their recent World Agricultural Supply and Demand Estimates (WASDE) report. This was due to reductions in US and EU production.

The European Commission have reduced their maize yield forecasts again, due to recent drought conditions, with recent rains too late to make a significant difference. As such, in the September report, EU maize yield estimates were reduced 4% on August’s estimate to 6.39t/ha, which is now 19% under the five-year average. Downward revisions to EU maize have also been seen in the recent Stratégie Grains report, with production now at 52.9Mt. This is down 2.5Mt from August's estimate.

However, overall global grain markets felt pressure last week on demand concerns. Increased interest rates to tackle inflation created some broad-based selling, as concerns grow for slow global economic growth.

Yesterday, global wheat markets felt further pressure too as IKAR revised Russian wheat production forecasts up 2Mt, to 99Mt.

According to FranceAgriMer and Arvalis, French milling wheat average protein content is down 0.5 percentage points on last year, at just 11.4%. This is a similar story to our domestic quality, as seen in the Cereal Quality Survey provisional results.

UK focus

Delivered cereals

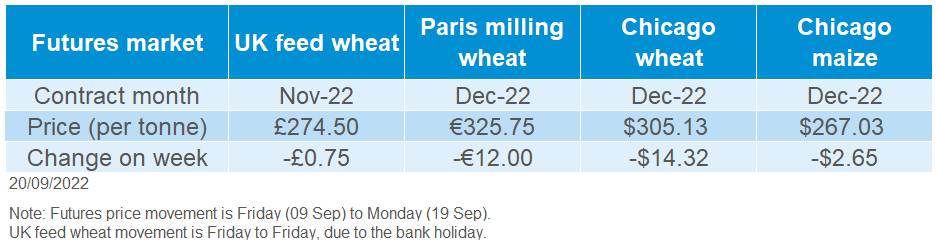

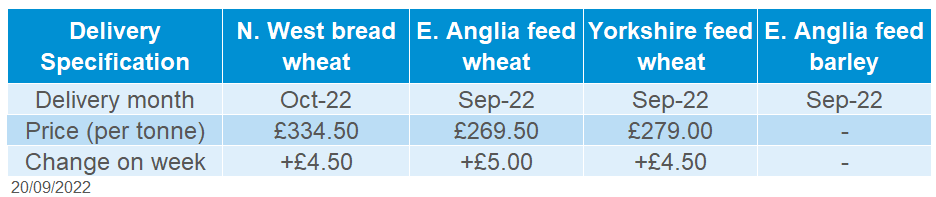

Due to the bank holiday for Queen Elizabeth II funeral, UK feed wheat futures did not trade yesterday. The Nov-22 contract was down £0.75/t across last week, closing at £274.50/t on Friday. The Nov-23 contract closed at £263.20/t, losing £1.70/t Friday-Friday.

East Anglia delivered feed wheat prices for September delivery were quoted at £269.50/t on Thursday, up £5.00/t on the week. This price increase mirrors UK feed wheat futures movements (Thursday-Thursday).

Bread wheat delivered into the North West for October was quoted at £334.50/t, up £4.50/t Thursday to Thursday.

According to HMRC’s most recent trade data (12 Sep), in July the UK exported 51.5Kt of wheat and 100.3Kt barley to the EU. Compared to the same point last year, this is up 35.2Kt and 86.6Kt respectively.

Our sixth and final harvest report came out on Friday. Harvest is all but complete, with some crops still to harvest in Scotland. Following the extended period of dry weather, recent rainfall across most of GB has had little impact on progress or quality. Although this has been variable. To note, there are increasing reports of Ergot in East Midlands in winter and spring wheat samples, and small amounts in winter and spring barley samples. However, overall, there have been limited amounts found in central stores.

Oilseeds

Rapeseed

Short-term harvest pressure from Canada’s canola crop and US soyabean will be expected. Longer-term rapeseed market for 2022/23 will be much more influenced by the greater oilseed complex with a larger Canadian canola crop.

Soyabeans

Despite lower US production, harvest pressure is expected over the coming weeks. Recessional fears still play into demand fears. Furthermore, record South American crops expected start of 2023.

Global oilseed markets

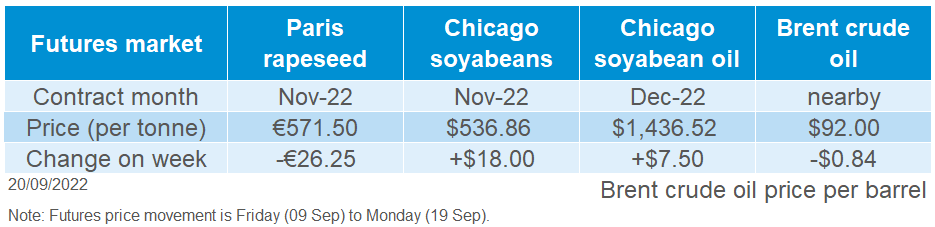

Global oilseed futures

Chicago soyabean futures (Nov-22) were supported (+2.6%) across last week, Friday to Friday. With the US market open yesterday, Chicago soyabean futures (Nov-22) started the week supported (+ 0.9%) further to Friday’s close from renewed export sales of 136Kt of soyabeans reported to China through its daily reporting system. Something to watch considering ongoing demand worries from global recessionary fears.

The soyabean market weekly gain last week, was on the back of the latest USDA World Agricultural Supply and Demand Estimate (WASDE) report. In the report, US soyabean production was reduced 4.1Mt to 119.2Mt on lower area and yield. This led to a fall in forecasted global ending stocks, read more on this report here.

Following Monday’s (12 Sep) support, the market dropped for the next 4 trading sessions. Driving this marginal pressure was the favourable weather conditions in the US, which has helped to mature the soyabean crop and for harvest to start. The latest USDA crop progress report (up until 18 Sep) estimates US soyabean harvest at 3%, below last year and the five-year-average of 5%. The slower harvest is reflecting the delayed sowing in May/June time.

In other news, Argentine growers have increased sales of their 2021/22 crop which they have been holding on to. This is after the government implemented a favourable exchange rate for them to market their soyabeans, increasing the amount of soyabeans on the market. Plantings of soyabeans is starting in the Mato Grosso region of Brazil on irrigated soils, with Ag Rural estimate 42.7Mha to produce a record crop of 148.5Mt for the 2022/23 season.

Rapeseed focus

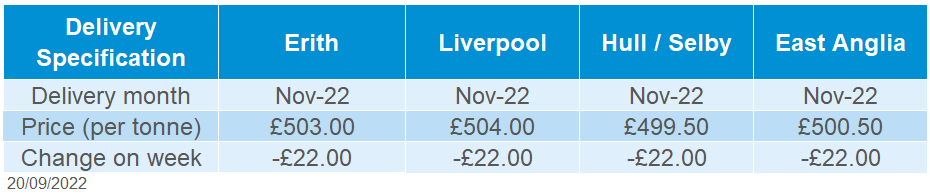

UK delivered oilseed prices

Quite the opposite happened in rapeseed markets with Paris rapeseed futures (Nov-22) closing Friday at €577.25/t, down €20.50/t across the week. Domestic prices shadowed this loss with delivered rapeseed (into Erith, Nov-22) being quoted at £503.00/t, down £22.00/t week-on-week.

With the market open yesterday, prices were further pressured with Paris rapeseed futures (Nov-22) closing at €571.50/t down €5.75/t on Friday’s close.

Limited rain across the Canadian Prairies over the last 7-days has allowed harvest to progress which pressured the market.

Latest statistics (released 14 Sep) from Statistics Canada estimate the 2022 canola (rapeseed) crop at 19.1Mt. This is up 38.8% from 2021. This prediction is based on satellite and agroclimatic data with consistent rains and warm temperatures this year, allowing the annual increases in crop production.

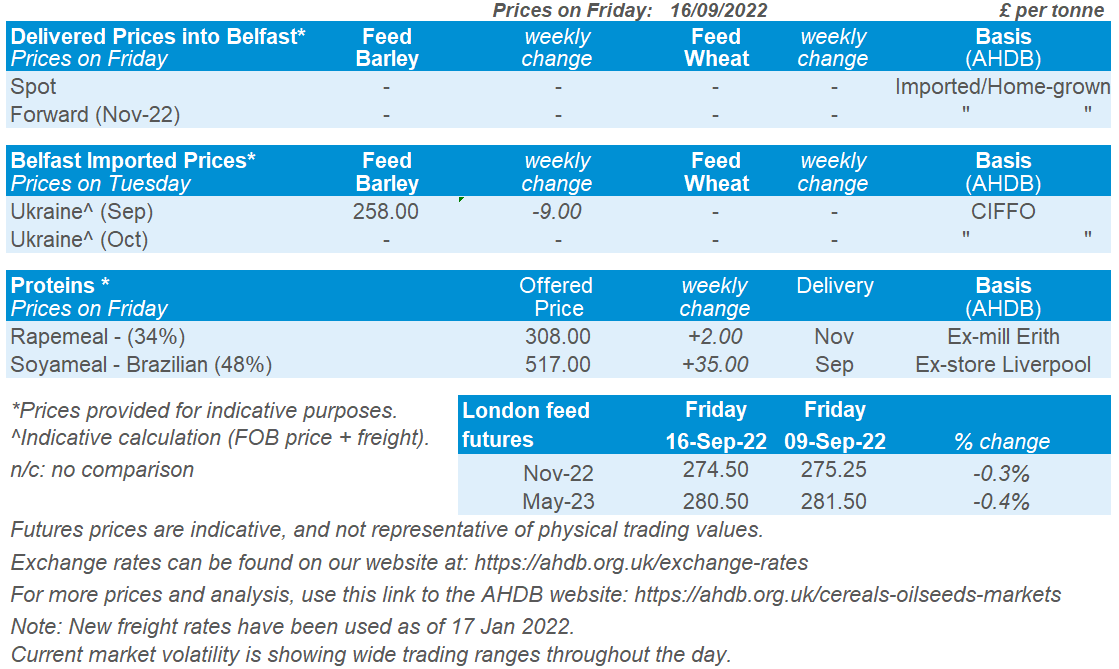

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.