Global maize and soyabean production trimmed: Grain market daily

Tuesday, 13 September 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £275.85/t, up £0.60/t from Friday’s close. Nov-23 futures closed yesterday at £264.25/t, down £0.50/t on Friday’s close.

- Chicago maize futures (Nov-22) found support yesterday, though Chicago wheat (Nov-22) saw falls on futures contracts following news on the USDA WASDE report. More on this below.

- Paris rapeseed (Nov-22) gained €7.00/t yesterday, to close at €604.75/t. This followed gains on the Chicago soyabean (Nov-22) contract.

Global maize and soyabean production trimmed

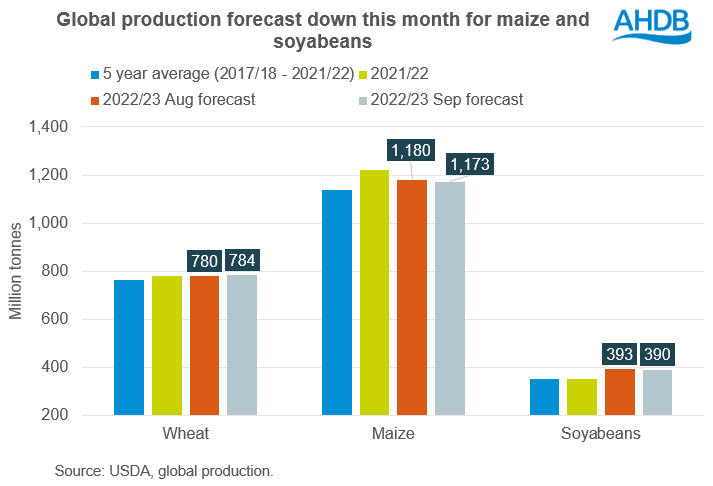

Yesterday, the USDA released their latest World Agricultural Supply and Demand Estimates (WASDE). The September report trimmed the global 2022/23 production outlook for maize (down 7Mt to 1,172.6Mt) and soyabeans (down 3.0Mt to 389.8Mt). This pushed global ending stock forecasts lower too for maize and soyabeans.

In response yesterday, Chicago maize (Dec-22) and soyabean (Nov-22) futures climbed $4.34/t and $27.92/t, respectively. This came as falling US supplies surprised the market.

For maize, US production was pulled back 10.5Mt this month to 354.2Mt, on lower harvested area and yield. EU production was reduced by 1.2Mt in this report, to 58.8Mt. Could we see further reductions to EU forecasts? Stratégie Grains currently pegs EU maize production at 55.4Mt, 3.4Mt lower than the current USDA forecast.

These production trims follow reducing US and EU crop conditions over the past few months. In the US, demand too was pulled back for maize used for ethanol and feed use, as well as reduced exports. These reductions counteracted increases to Ukrainian and Chinese production forecasts.

For soyabeans, forecasted US production was reduced 4.1Mt to 119.2Mt on lower area and yield. US yield forecasts dropped to the lowest since 2019/20. This led to a fall in forecasted global ending stocks, back below 100Mt for this season.

Wheat global production raised

Whereas global wheat production saw a boost in this September report, on higher forecasted Russian and Ukrainian production. The USDA increased the Russian crop to be forecasted at 91Mt and Ukrainian crop at 20.5Mt. Though Russian exports remained pegged at 42Mt.

On higher production and imports, higher global domestic use is expected this season for wheat and global ending stocks forecasted slightly higher. Though global ending stocks are still forecasted the smallest since 2016/17.

What does this mean?

Maize acts as a ‘floor’ of support for wider grains, therefore strong maize prices strengthen other feed grain prices. Despite a more bearish report for wheat yesterday, the supply and demand balance remain tight. Yesterday little movement was made on the UK feed wheat contracts, supported by this tight maize picture, and moving on ‘new’ news on Ukrainian exports.

For soyabeans, the reduction of the US supplies surprised the market and is something to watch going forward in vegetable oil availability. Though South American supplies are still expected to be large, longer term. For now, demand remains key for price direction with recessionary behaviour something to watch.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.