Arable Market Report - 19 June 2023

Monday, 19 June 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

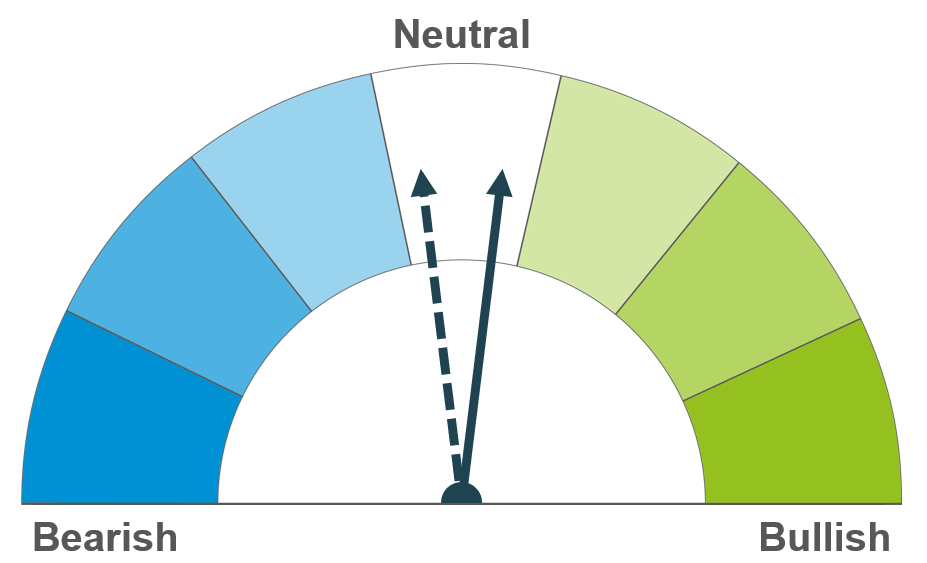

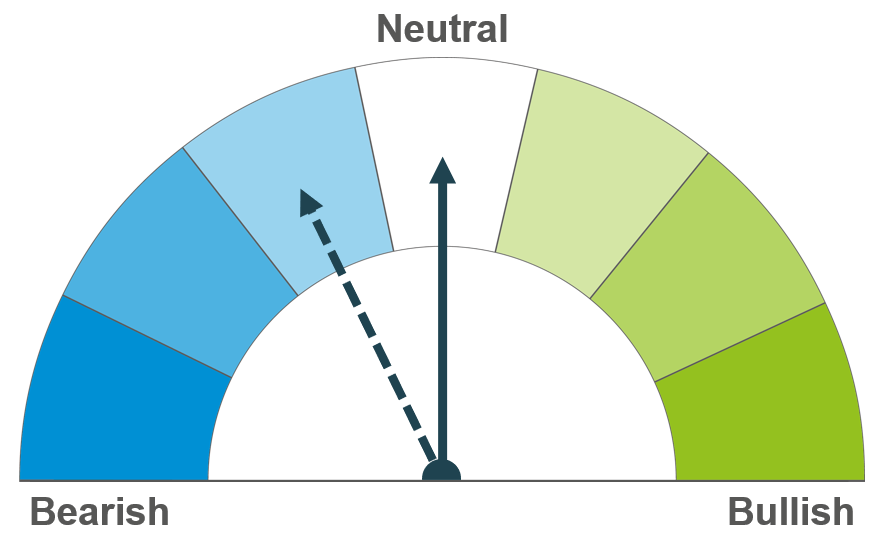

Nerves over crops and the Black Sea situation are supporting prices currently. These will continue to drive markets in the coming weeks.

Hot, dry weather in the US is casting doubt on the forecast global grain surplus in 2023/24. The longer-term price direction is now uncertain as it largely depends on the extent of any damage to crops.

Winter barley harvesting has now reached France but worries persist about spring barley in Europe. Longer-term, the market direction for barley will depend on maize (and wheat).

Global grain markets

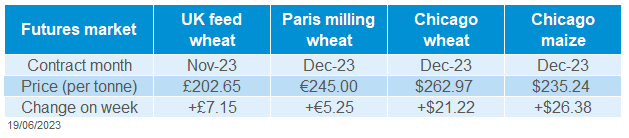

Global grain futures

Nerves over the potential impact of dry weather and if the Black Sea Initiative (Ukrainian export corridor) will be extended pushed up prices last week. Russia continues to state that it is unhappy with how the current deal is being implemented and is unlikely to be extended (Refinitiv).

Re-positioning by speculative traders ahead of a long weekend in the US also contributed to the rise in prices. The US futures markets are closed today for Juneteenth. The largest gains were record in Chicago maize futures, where the Dec-23 contract gained nearly 13% Friday – Friday.

Dry weather across the US Midwest, the top US maize producing region, is creating worries for 2023 yields. The forecast of a big US maize crop is a key part of the global grain surplus in 2023/24 and recent pressure on prices. If the US maize yield shrinks, it will also reduce the global surplus, so risk premium is being built into prices. But the market needs to see continued adverse weather forecasts or evidence of crop damage for prices to continue to rise.

Dry and warm weather has also affected crops in Europe. Last week Stratègie Grains reduced its forecasts for EU-27 wheat (exc. Durum), barley, and maize output as a result. In France, winter crop potential is still good, and the winter barley harvest is in its early stages says FranceAgriMer. But the organisation worries about spring crops such as maize and spring barley. Rain over the weekend will benefit spring crops, and more is forecast this week.

UK focus

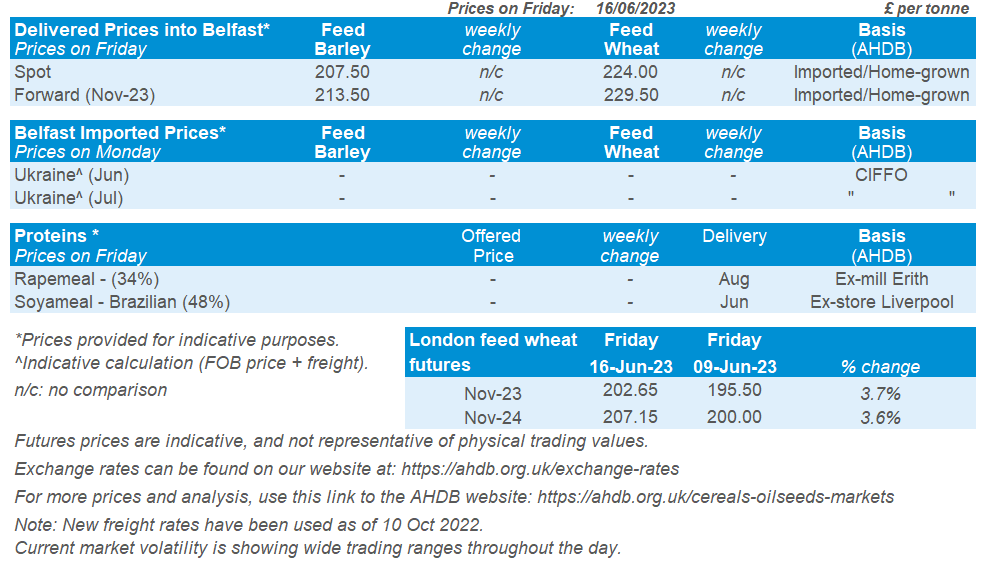

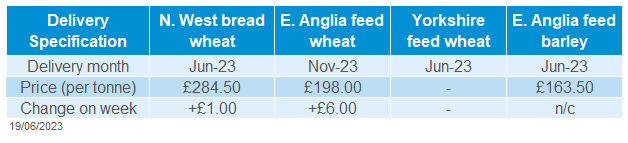

Delivered cereals

UK feed wheat futures (Nov-23) gained £7.15/t last week, ending the week at £202.65/t. This is the highest price since 26 April.

Many areas of the UK received rain over the weekend, though there are also questions about the impact it will have and if some areas received enough. So, AHDB will release its next crop progress and conditions report sooner than originally planned. Look out for highlights in next week’s Market Report.

Grass growth has slowed down according to AHDB’s Forage for Knowledge. Recent rain will help but there may still be some implications for animal feed demand for cereals come winter.

The latest UK trade data from HMRC shows that in April 2023 the UK exported:

- 168.6 Kt wheat, taking the season to date (Jul-Apr) total to 1.31 Mt,

- 82.6 Kt barley, taking the season to date (Jul-Apr) total to 959.9 Kt,

- 7.6 Kt of oats, taking the season to date (Jul-Apr) total to 143.7 Kt.

These figures suggest the UK remains generally on course for the export totals forecast in May by AHDB. April’s wheat imports were up from March levels to 111.1 Kt, mainly due to larger volumes from Germany. This likely reflects the tightness reported in UK Group 1 supplies recently. Meanwhile, maize imports fell to 113.3 Kt in April, from 217.0 Kt in March.

Oilseeds

Rapeseed

Soyabeans

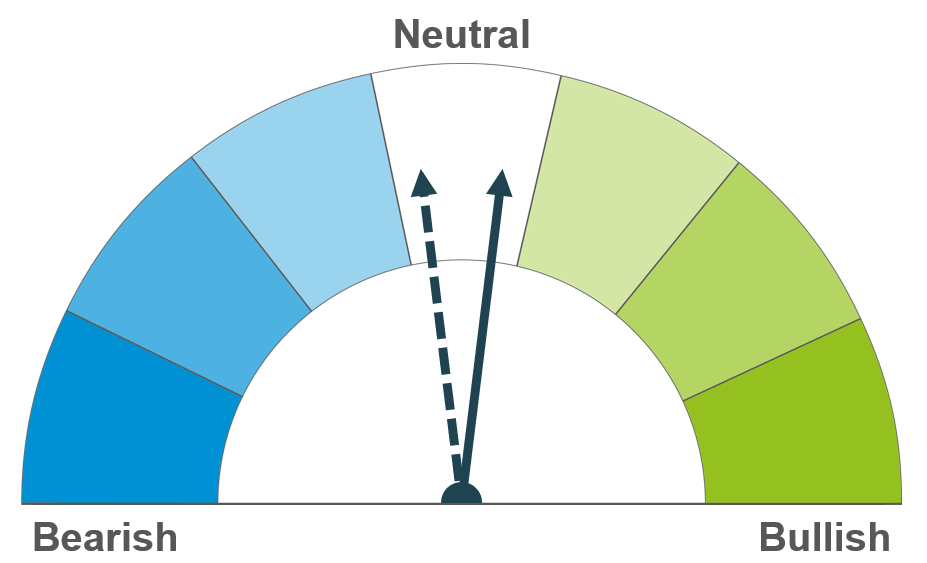

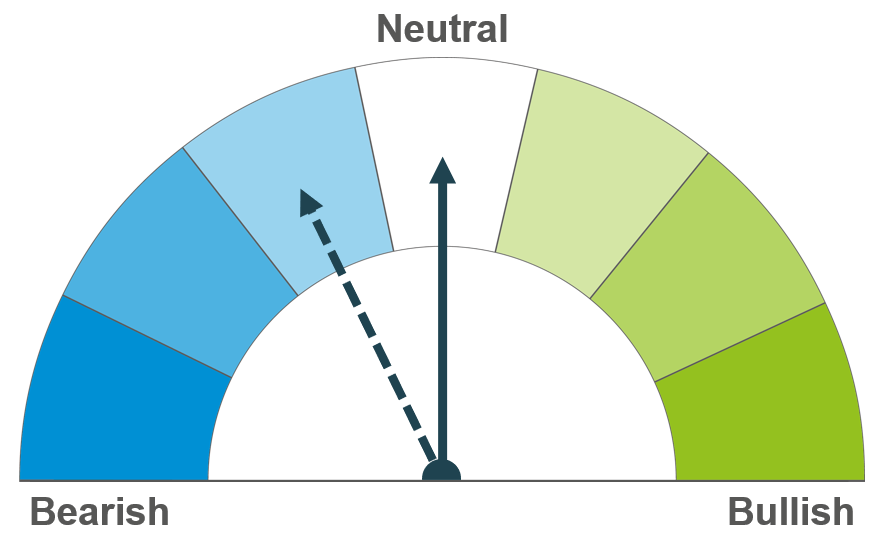

US soyabean concerns support markets short-term. Longer term, a large EU crop is still expected to weigh on prices, considering the large balance on the continent.

US dryness concerns support markets short term, with uncertainty for the much-needed US crop. This will be watched closely to understand the impact longer-term, with potential to tighten the global supply and demand balance. A large Brazilian crop is still expected to weigh on prices in the new season.

Global oilseed markets

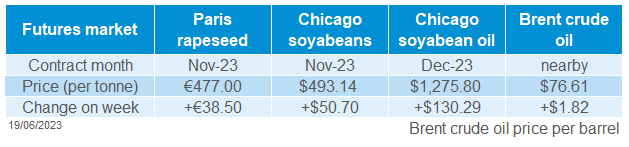

Global oilseed futures

Last week saw substantial support for Chicago soyabeans (Nov-23) futures prices, closing on Friday at $493.14/t, up $50.70/t Friday to Friday. This is the highest close since early March. Thursday and Friday each recorded a 4% rise, with Friday also seeing traders positioning ahead of a long weekend. Managed money movements have been an important factor in Chicago soyabeans and Chicago soyoil movements week-on-week.

The key factor supporting Chicago soyabeans last week is the continued dryness across the US Midwest. On Thursday, the latest US drought map showed widespread moderate drought and dry conditions continues across much of the Midwest and High Plains, with some areas of extreme drought too. The forecasts show some rain is due over the next two weeks, but below average for much of these two areas.

The impact of an El Niño on palm oil production too remains a focus, considering current water stress on palm oil tress in Malaysia. Malaysian palm oil futures (September delivery) continue to see support on dryness concerns and potential yield cuts in Malaysia, with Friday’s close the highest in over five weeks. Though Indonesia keeps a cap on gains with its competitive pricing.

A bounce in nearby Brent crude oil futures on Thursday and Friday also helped oilseed markets to close higher on Friday. Brent crude gained on refinery demand and an interest rate cut in China.

Rapeseed focus

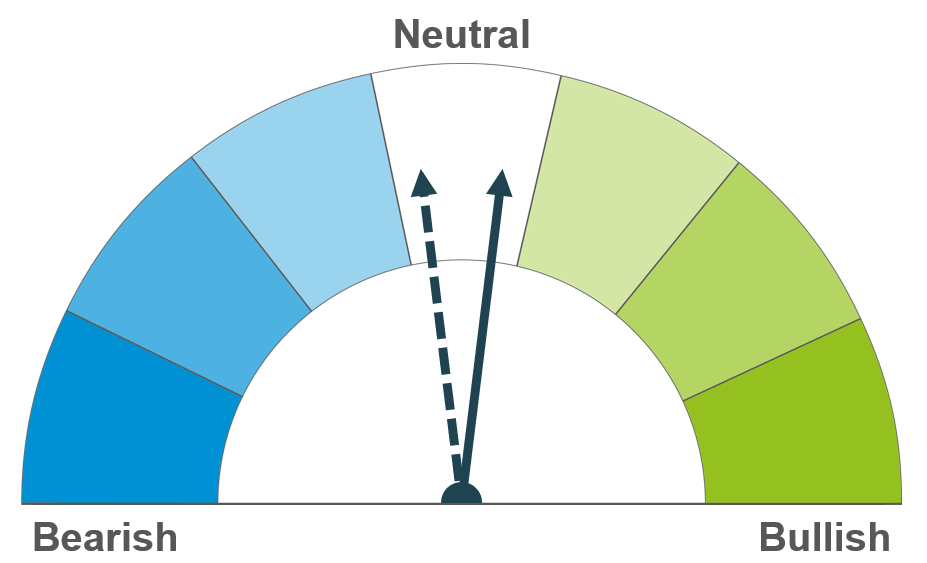

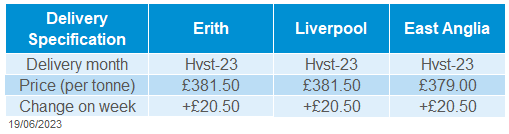

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) closed on Friday at €477.00/t, up €38.50/t across the week (Friday to Friday). Rapeseed contracts gained alongside the wider oilseed market, especially soyabeans.

Domestic delivered prices into Erith (harvest delivery) were quoted on Friday at £381.50/t, up £20.50/t on the week. Domestic prices did not capture the full extent of futures price rises on Friday, as the survey is taken around midday.

The latest UK trade data released by HMRC shows UK imports of rapeseed in the season to date (July to April) totalled 647 Kt, back 23% from the same period last season (2021/22). The EU accounted for 61% of rapeseed imported this season to date.

In Canada, the latest Manitoba crop report was released for week ending 13 June, describing heavy rain and hail in the southwest. A watchpoint for canola crops impacted by heavy rains.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.