Arable Market Report - 19 December 2022

Monday, 19 December 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

Competitive Black Sea supplies and large Australian crops remain bearish factors short-term. Though the ongoing conflict in Ukraine keeps some support levels in prices. Long-term, recessionary concerns remain a watchpoint.

Global maize markets have felt some support from demand optimism short term, though COVID-19 cases and global economic performance remain key factors to watch. Longer term, Argentinian weather remains a key watchpoint for production.

Barley markets continue to track the wider grain complex, with prices supported by a tight grain supply and demand balance.

Global grain markets

Global grain futures

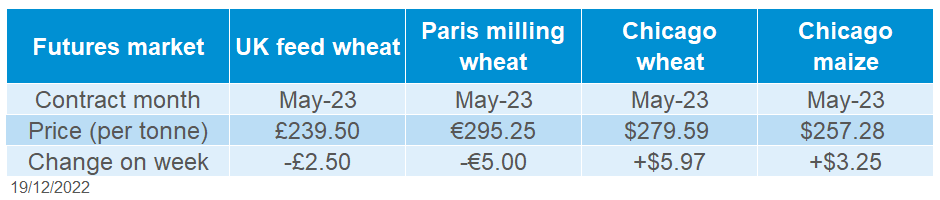

Global grain contracts were mixed last week, with Paris wheat weighed on by competitive Black Sea supplies picking up global demand, and a strengthening Euro against the US dollar.

Whereas some gains were seen for Chicago wheat and maize on positive reported US export sales in week ending 08 December, as well as further trims to the Argentinian wheat crop and concerns of what current dryness may mean for their maize crop.

Competitive Russian wheat on the global market continues to add pressure to European wheat prices. Last week, Algeria’s state grains agency OAIC is believed to have purchased around 480-540Kt of milling wheat (Refinitiv). Origins are expected by traders to be Bulgaria, Romania, Russia, and France.

Syria too is expected to have imported just over 500Kt of wheat this year from the Black Sea peninsula of Crimea, in which Russia annexed from Ukraine in 2014. Wheat leaving the Black Sea port of Sevastopol in Crimea, on sanctioned Syrian ships, increased by 17-fold this year according to Refinitiv. Ukrainian officials also report some of this grain to be stolen from occupied areas.

Ukrainian grain continues to move from Ukraine, shown in the latest export data released by UkrAgroConsult. In November 2.53Mt of maize was exported (up from 2.21Mt in October). However, 1.77Mt of wheat was exported in November, down from 1.96Mt in October. Season-to-date, total wheat exports are 54% behind last season (Jul- Nov).

Though an escalating conflict in Ukraine continues to support global price levels, particularly for wheat considering how much is still expected to leave Ukraine for this marketing year. On Friday, Russia fired more than 70 missiles during a rush hour attack, one of the biggest since the start of the war. The result saw emergency power cuts nationwide.

Colder temperatures across parts of Europe are not expected to cause much harm to winter grains and may even benefit ‘sturdiness’ of some French crops (Refinitiv). Though -10°C to -14°C temperatures in central and east Germany remains a watchpoint for barley due to little snow cover.

UK focus

Delivered cereals

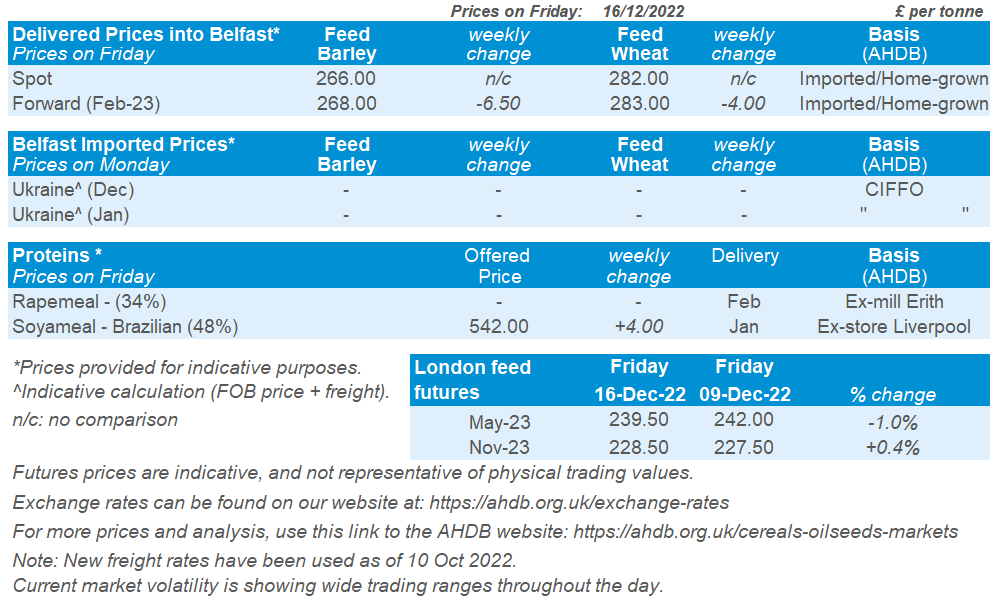

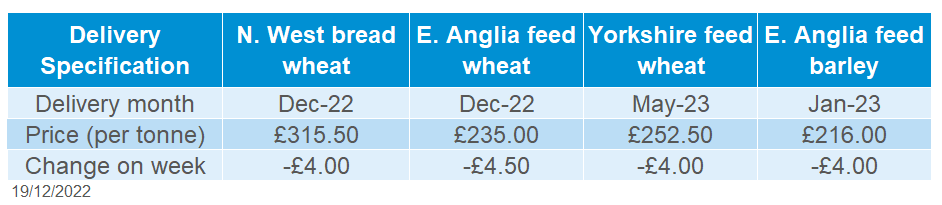

UK feed wheat futures (May-23) fell £2.50/t last week (Friday to Friday), to close on Friday at £239.50/t. Whereas, new crop futures (Nov-23) gained £1.00/t over the same period, to close at £228.50/t.

Domestic delivered prices followed UK feed wheat futures price movement last week (Thursday to Thursday). Feed wheat delivered into East Anglia (December delivery) was quoted on Thursday at £235.00/t, down £4.50/t.

North-west bread wheat was quoted at £315.50/t for December delivery on Thursday, down £4.00/t.

Last week saw the release of Defra’s final estimates for 2022 UK cereal and oilseed production. Despite the hot and dry conditions experienced this summer impacting some crops on lighter land, wheat, barley, oat and oilseed rape yields are up on the year. UK production is estimated for wheat at 15.540Mt (up 11% year-on-year), total barley production at 7.385Mt (up 6%) and oat production at 1.007Mt (down 10%). For more information, use this link.

The Bank of England also confirmed another interest rate rise last week, increased by 0.5 percentage points to take the base rate to 3.5%. Important for interest earned on money in the bank as well as loans.

Oilseeds

Rapeseed

Soyabeans

In the short-term, the wider oilseed complex continues to influence rapeseed prices. Longer term, the large supply from Canada and pressure on soyabean prices will weigh on rapeseed markets.

Soyabean markets remain mixed in the short-term, influenced by Chinese demand and Argentina’s dry conditions. Long-term large South American crops are forecasted, but Argentina’s weather remains a watchpoint.

Global oilseed markets

Global oilseed futures

Chicago soyabean futures (May-23) felt overall pressure across last week, falling $2.39/t Friday-Friday to close at $546.32/t on Friday.

Volatility remains in soyabean markets as on Tuesday, prices were supported by strong US export demand and bargain buying. Yet towards the end of the week rising COVID-19 cases in China increased concerns for reduced US export demand going forward. Worries of a weakened global economy and recession also weighed on prices after the UK, EU and US central banks signalled further interest rate rises to tackle inflation.

Across the week soyameal and soy oil price movement diverged, as Chicago soyameal (May-23) lost $12.90/t across the week closing on Friday at $498.43/t. Feeling pressure from soyabeans on demand concerns. Whilst Chicago soy oil gained $57.76/t to close at $1,364.43/t on Friday. Soyabean oil tracked crude oil upwards at the start of the week, where gains were made, boosted by a weaker dollar. Though dropped lower as the week progressed, on recessionary concerns.

Crude oil was supported across the week due to reduced supplies following the shutdown of the Keystone pipeline running from Canada to the US, due to a leak. It is unclear when this pipeline will be back in operation.

Argentinian weather remains a key watchpoint considering recent dry conditions for their soyabean crop. Much needed rains at the start of last week benefitted crop development, with soil moisture conditions improving 2 percentage points (pp) on the week, now at 68% ‘optimum-favourable’. Crop condition scores improved 8pp, now at 19% good-excellent (Buenos Aires Grains Exchange). Looking ahead, key producing regions Cordoba and Santa Fe are forecast to broadly receive up to 2.5 inches of rainfall over the next week in many areas, which could improve soil moisture and benefit crop planting progression.

Rapeseed focus

UK delivered oilseed prices

Rapeseed prices tracked the wider oilseed complex lower. Paris rapeseed futures (May-23) closed at €566.75/t on Friday, losing €4.50/t Friday-Friday.

Delivered rapeseed into Erith (Jan-23) was quoted at £486.00/t, down £4.50/t Friday-Friday. This was broadly tracking the movement of continental prices. However, over the week, the pound sterling weakened 1.43% against the Euro, to close on Friday at £1 = €1.147.

Cold weather in France and in other parts of Europe is not expected to cause much harm to rapeseed crops according to Refinitiv, due to good crop development during the warmer weather in October and well-established crops.

On Thursday, Defra released their final estimates for 2022 UK cereal and oilseed production. Oilseed rape yields are up 16% year-on-year despite dry weather experienced this year. Oilseed rape production is estimated up 39% year-on-year at 1.361Mt for harvest 2022, yet this is down 14% from the previous five-year average (2017-2021).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.