Arable Market Report – 14 July 2025

Monday, 14 July 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (Nov-25)

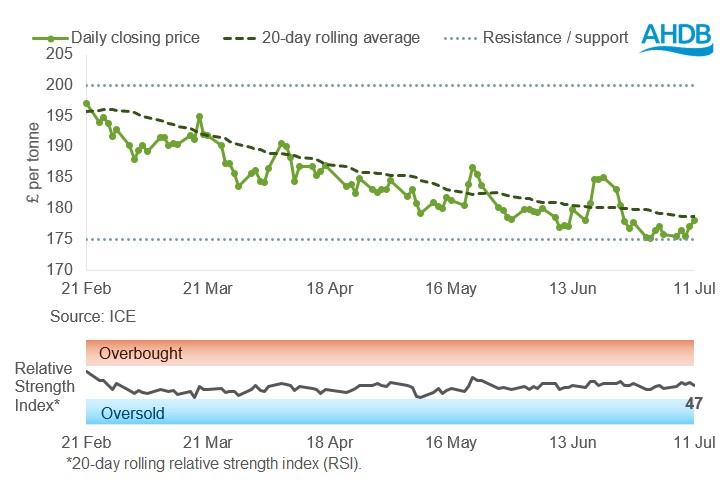

Last Friday, UK feed wheat futures almost reached the 20-day moving average of £178.66/t, having tested the key support level of £175/t in recent weeks. While the Relative Strength Index (RSI) increased from 43 to 47 (Friday–Friday), it still does not indicate any significant momentum in the market.

Find out more about the graphs in this report and how to use them here.

Market drivers

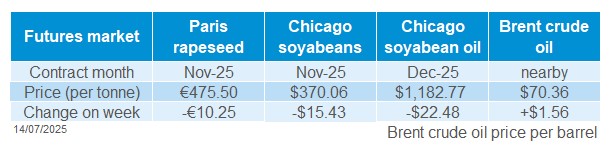

Nov-25 UK feed wheat futures gained £2.30/t (+1.3%) last week, closing at £178.00/t on Friday, while Paris milling futures rose by 1.6%. European grain futures were supported last week due to concerns about dry weather, short-covering by funds, and the weakening of the euro against the US dollar.

However, Chicago wheat futures (Dec-25) fell by 2.2%. The harvesting campaign in the US is putting pressure on the market and outweighing any supportive factors at present.

On Friday, the USDA published its World Agricultural Supply and Demand Estimates (WASDE) report, which showed global wheat ending stocks below the average trade estimate. Projected global wheat ending stocks for 2025/26 were lowered by 1.2 Mt to 261.5 Mt compared to June figures, mainly due to reductions in Canada and the EU. Compared to June, forecasted lower production in Canada, Ukraine and Iran offset higher production in the EU, Kazakhstan, Pakistan and Russia.

Last week, the Ukrainian Grain Traders Union (UGA) predicted 2025/26 wheat production at 22.5 Mt, with exports of 16.5 Mt (USDA 15.5 Mt). The forecast also predicted maize production of 29.3 Mt and exports of 24.0 Mt, as well as barley production of 4.9 Mt and exports of 2.3 Mt. There is import demand for Ukrainian barley from China.

SovEcon, an agricultural consultancy, increased its forecast for Russia's wheat exports in the 2025/26 season by 2.1 Mt to 42.9 Mt. However, the USDA's WASDE report forecasts much higher exports, at 46.0 Mt.

Meanwhile, the USDA's export sales report for the week ending 3 July showed net wheat sales of 567.8 kt, which was at the upper end of trade estimates. Maize export sales exceeded the highest estimates.

The winter wheat harvesting campaign in the US is accelerating, with 53% complete as of 6 July compared to a five-year average of 54% for the same time. Market participants are focusing on spring wheat crop conditions in the US due to them being lower than last year. Maize crop condition scores in the US are high, which is putting pressure on the feed grains market.

Stratégie Grains decreased its EU maize production forecast by 3.0 Mt to 57.4 Mt, compared to figures from the previous month, lowering domestic use and exports while increasing imports.

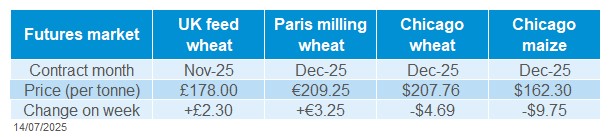

UK delivered cereal prices

Domestic delivered wheat prices did not change significantly from Thursday to Thursday. The price of feed wheat delivered to Yorkshire in September 2025 was quoted at £182.50/t, while the price for November 2025 delivery was quoted at £186.50/t, an increase of £0.50/t.

Rapeseed

Paris rapeseed futures in £/t (Nov-25)

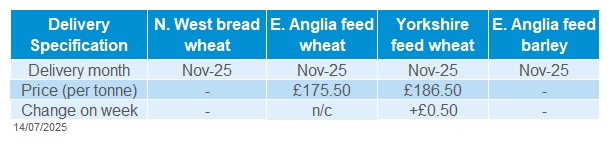

Last week (Friday–Friday), Paris rapeseed futures (in £/t) remained below the 20-day moving average and closed a little under £412/t. The relative strength index (RSI) also fell back again from 53 to 41 this week showing a drop in market momentum.

Find out more about the graphs in this report and how to use them here.

Market drivers

Paris rapeseed futures (Nov-25) finished last week at €475.50/t, down 2.1% on the week. This downward pressure came from positive crop reports in the US and Canada amid good weather over the week and positive weather forecasts looking forward.

Oil markets showed signs of stabilisation last week; nearby Brent crude oil futures hovered near $70/barrel.

The pound reached a three-week low against the dollar on Friday at $1.3499 and the lowest in a month against the euro €1.1540 (LSEG) this comes after signals that the Bank of England may make interest rate cuts.

Winnipeg canola futures fell sharply last week, pressured by widespread rainfall and technical selling. The Nov-25 contract fell 5.1% to close the week at CA$682.70/t, with prices hitting a one-month low mid-week. Forecasts of cooler weather and easing crop concerns prompted traders to scale back positions. While the market is said to remain “twitchy” as weather remains a key concern until at least late August, overall sentiment is currently bearish. Despite the retreat, current values remain above last year’s levels.

US soyabean futures also weakened last week, pressured by favourable Midwest weather, softer export demand, and escalating trade tensions. Rainfall and mild temperatures supported crop development, prompting fund selling and weighed down on prices, with the Chicago Nov-25 contracts closing 4.0% down on the week. Export uncertainty lingers amid US–China tariff strains and proposed US duties on Brazilian soybeans. A larger than expected increase to the forecast for US soyabean stocks at the end of 2025/26 on Friday by the USDA further dampened sentiment.

The USDA expects Ukraine’s oilseed output to rebound in 2025, supported by improved growing conditions and increased acreage. Sunflower production is expected to increase on last year to 14 Mt (+1.0 Mt) but still lower than local analysts. The rapeseed crop is expected to be down 0.1 Mt to 3.7 M but is still higher than local analysts’ estimates. Conflict-related disruptions continue to pose risks, particularly around labour availability and harvest logistic, factors that could limit export capacity despite strong production potential.

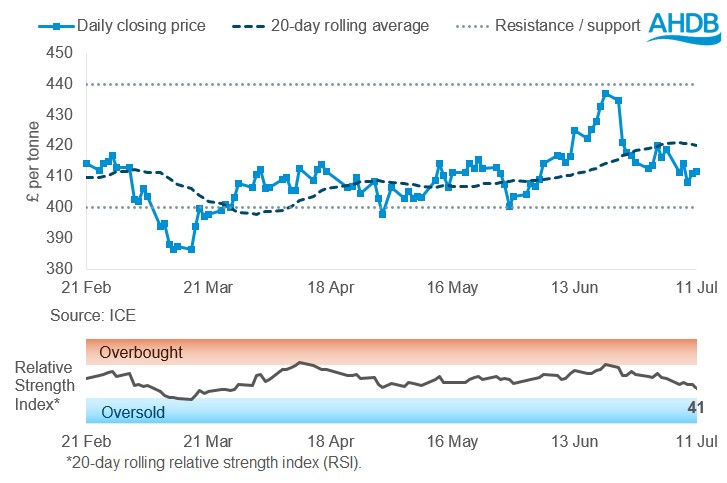

UK delivered rapeseed prices

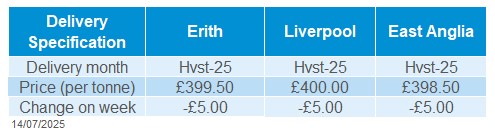

Rapeseed to be delivered into Erith in November was quoted at £412.00/t on Friday, down £7.50/t on the week. Liverpool and East Anglia delivery in November were quoted at £412.50/t and £411.00/t respectively, both down £7.50/t on the week.

Extra information

The first harvest report of the season was released on Friday by AHDB. The survey shows results up until 9 July and an early start to harvest with an estimated 10% of UK winter barley cut. The next report is scheduled for 25 July.

For top tips on straw, sampling and more this harvest, vist our Harvest Toolkit.

The latest trade figures from HMRC show UK maize imports slowed in May, while rapeseed and wheat imports picked up compared to April. See tomorrow’s grain market daily for more details.

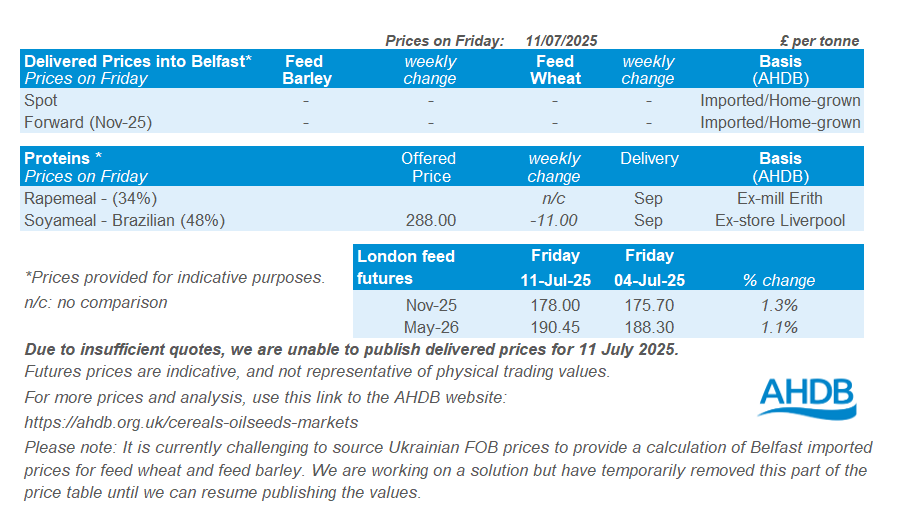

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.