Friday’s USDA WASDE and funds’ bets: Grain Market Daily

Thursday, 10 July 2025

Market commentary

- Nov-25 UK feed wheat futures fell £0.95/t (0.5%) yesterday to close at £175.50/t. The May-26 contract fell £0.65/t over the same period, to close at £188.25/t. Technically, the support level of £175/t is still in place, despite a few attempts to break through it during the downward movement.

- Chicago wheat futures (Dec-25) decreased by 0.2%, while Paris milling wheat futures rose by 0.1%. The market is trying to determine the direction of the next price movement while awaiting today's US weekly export sales report and Friday's July WASDE report.

- Nov-25 Paris rapeseed futures fell €5.75/t (1.2%) to €474.00/t. The Nov-25 futures Chicago soyabeans and Winnipeg canola down 1.0% and 3.3% respectively. Favourable rainfall in some Canadian regions eased concerns about the canola crop, resulting in a significant drop in Winnipeg futures.

Friday’s USDA WASDE and funds’ bets

During the harvest period, it is difficult to identify factors that could support cereal and oilseed prices. This is indeed a good time for buyers to purchase grain at low prices in anticipation of further declines, whereas sellers are trying to avoid selling at these low levels. Storage capacity is, of course, one of the factors influencing farmers' decisions about selling during harvest.

Could this Friday’s July World Agricultural Supply and Demand Estimates report (WASDE) provide some direction for prices over the coming days?

What to look out for in tomorrow’s WASDE

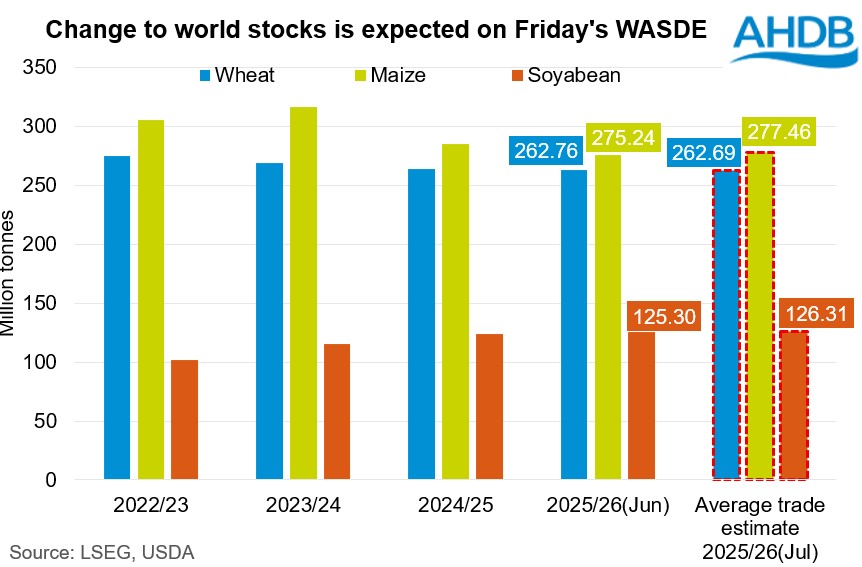

Traders had predicted an increase in maize stocks of 2.2 Mt and a 1.0 Mt increase in soyabean ending stocks for the 2025/26 season compared to the previous June report (LSEG). However, no significant changes are forecast for global wheat ending stocks, which could come as a surprise if the WASDE figures show otherwise.

Another interesting topic to watch out for in tomorrow's report could be the balance figures for US wheat, maize and soybeans for the 2024/25 and 2025/26 seasons. Following the unremarkable June USDA Acreage report, market participants will now turn their attention to crop progress estimates, paying particular attention to the historically high level of maize crop condition in the US.

According to average trade estimates, Brazilian maize production could increase by 2.5 Mt from the figures reported previously, with no significant changes to other numbers.

Taking weather influences and initial harvest results into account could lead to a revised forecast for grain and oilseed production in the EU, Ukraine, China and Russia.

Funds’ bets grains and oilseed prices changing

Managed money, often referred to as 'the funds', holds net-short positions in Chicago wheat and maize futures, as well as Paris milling wheat and maize futures. This indicates a bearish outlook for prices. This type of trader typically uses net-short positions to profit from falling prices. Conversely, funds have net-long positions in Chicago soyabean oil, Paris rapeseed and Winnipeg canola futures, meaning they plan to profit from rising prices.

Looking ahead

Ahead of the USDA's July WASDE report, traders' average estimates don't differ much from June's figures, and as such, any significant adjustments will likely drive prices over the coming days.

The cereals and oilseeds market is currently very sensitive to bearish news but less so to bullish news due to the harvesting campaign in the Northern Hemisphere.

However, Friday's WASDE report is always significant due to the limited time available for the market to react to it. This is why we could see reports having more influence next week. Net short positions held by funds are putting pressure on the market. At the same time, covering these positions could support prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.