Arable Market Report − 14 August 2023

Monday, 14 August 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

Black Sea news keeps the markets volatile and supported as they assess how accessible Ukrainian supplies are. Global supply remains finely balanced to demand, but if large maize supplies are realised and Black Sea wheat continues to be competitive, we could see prices pressured.

US weather watching continues short term for the US crop that is starting to dent. Though longer term, large South American crops and the second largest recorded US crop is due, boosting supplies.

With tight global barley supplies, feed barley prices find support from wider grains. However, like wheat, a large global maize supply could weigh on prices longer-term.

Global grain markets

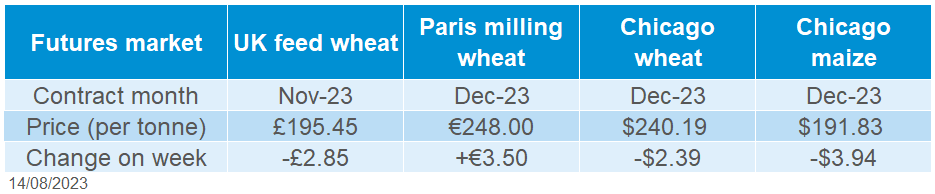

Global grain futures

Last week saw mixed movements across global grain contracts. Overall pressure was seen across Chicago wheat and maize contracts, though a price rise on Paris milling wheat futures. Despite some gains early last week on Black Sea supply, concerns from the ongoing war saw price losses later in the week due to news of competitive Russian wheat and the latest USDA World Agricultural Supply and Demand Estimates (WASDE) being released.

On Friday the latest USDA WASDE was released, trimming global ending stocks for 2023/24 for both wheat and maize, though this was expected by the market. Global wheat production was reduced 3.3 Mt from last month’s estimates, mostly on smaller crops in Canada, EU, and China despite a bigger Ukrainian crop forecast. Global consumption was also trimmed back, though global wheat ending stocks still fell on the month, now down 2.7 Mt on the year and at the lowest level since 2015/16 at 265.6 Mt. US wheat export forecasts were trimmed back for this season slightly by 680 Kt, this weighed on US wheat markets.

Global maize ending stocks for 2023/24 were trimmed to 311 Mt, with cuts made to both global production and consumption in comparison to last month’s estimates, though global maize ending stocks remain over 13 Mt higher year-on-year. The US maize crop was cut back 5.3 Mt to 383.8 Mt on account of using the first survey-based yield forecast, though the crop remains the second largest on record.

Competitive Russian wheat continues to weigh on global wheat markets. Last week, Egypt’s state buyer GASC purchased 235 Kt of Russian wheat, despite an increase in freight costs from the region over the week.

Markets remain reactive to news on Black Sea shipping, with the active war ongoing in Ukraine and larger crops forecast. Ukraine is looking to form safe shipping routes in the Black Sea and has started to register ships willing to use the corridor, as reported by a local news agency on Saturday. Though on Sunday, a Russian warship fired warning shots at a cargo ship in the southwestern Black Sea heading north.

EU quantity and quality concerns remain in focus, after heavy rain across northern Europe. Last week consultancy Stratégie Grains trimmed wheat and maize forecasts for harvest 2023.

UK focus

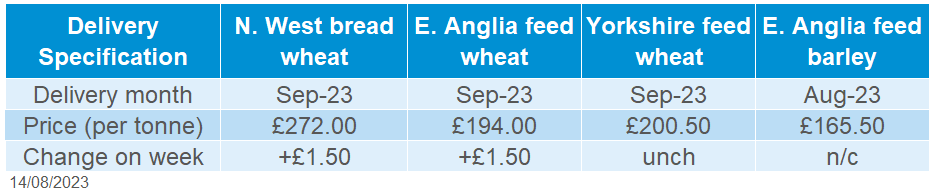

Delivered cereals

UK feed wheat futures (Nov-23) ended down £2.85/t last week, to close on Friday at £195.45/t. Following US contracts, gains early in the week were retraced at the end of the week. The Nov-24 contract closed at £201.20/t on Friday.

Domestic delivered prices followed futures movement (Thurs to Thurs) at a slight gain on the week. Feed wheat delivered into East Anglia (September delivery) was quoted on Thursday at £194/t, up £1.50/t on the week.

North West bread wheat (September delivery) also gained the same amount on the week, to be quoted on Thursday at £272/t.

GB harvest is progressing slowly, with mild and wet weather continuing for many. Winter barley harvest was 94% complete to week ending 8 August, about on par with the five-year average. Harvesting of winter wheat, spring barley and oats were all 5% complete to the same date, well behind the five-year averages. Overall crop quality is variable between regions. This past week we have seen some more favourable weather, and another report is provisionally forecast for this Friday to assess progress (18 August).

The latest GB fertiliser prices were released last week, quoting UK AN at £353/t for July, up £9/t from the previous month.

Oilseeds

Rapeseed

Soyabeans

Despite marginal cuts to Canada’s canola crop, the global rapeseed market is well supplied. Longer-term pressure on soyabeans will filter into the rapeseed market, but conflict in the Black Sea could offer short-term support.

Tighter US ending stocks could offer some support to markets in the short-term, but confidence is growing for the US soyabean production. Longer-term large South American crops are expected going into 2024 which will weigh on oilseed markets.

Global oilseed markets

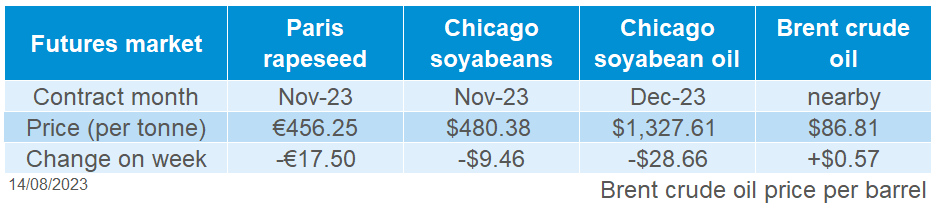

Global oilseed futures

Chicago soyabean futures (Nov-23) were pressured 2% across the week, closing Friday at $480.38/t, the third successive week of declines for the contract.

Pressuring the market at the start of the week was improving US soyabean crop conditions, combined with the forecast of better weather in the US. Last Monday’s USDA crop progress report (to week ending 6 Aug) estimated 54% of US soyabeans good-to-excellent, up from 52% the week before.

The contract then saw some support throughout the week due to demand for US origin soyabeans and traders squaring positions ahead of the USDA World Agricultural Supply and Demand Estimate (WASDE), which was released on Friday. The USDA reported US export sales of (old and new crop) soyabeans totalled 1.5 Mt (to week ending 3 Aug). A large proportion of new crop soyabean sales were to China, who purchased 753 Kt for the 2023/24 marketing year, with 314 Kt reported to unknown destinations.

Traders adjusted positions ahead of the August WASDE report. In the report, US soyabean production was trimmed by 2.6 Mt from last month, to 114.5 Mt. The downward revision was due to dry conditions early in the growing season, impacting yield potential. This revised estimate was below the average trade estimate at 115.6 Mt. This revision means that US ending stocks for 2023/24 are now estimated at an 8-year low of 6.7 Mt. Initially the market was supported on Friday from this news, but later settled as downward revisions were expected to this US soyabean crop.

The global oilseed outlook from the USDA WASDE update included lower exports, reduced crush, and higher ending stocks. Global oilseed production was near unchanged in the report. Ukrainian and Russian sunflower seed production is forecast higher from timely rains in July. However, there was downward (-1.3 Mt) revisions to Canada’s canola crop which is now estimated at 19 Mt, this is due to drought in the southwestern Prairies during July.

Looking forward, the Rosario Grain Exchange said Argentina’s 2023/24 soyabean production looks more promising on Wednesday, with the exchange predicting the crop at 48 Mt. This is up from 20 Mt last year, and plantings are expected to start in October. These large South American crops expected in 2024 could have the ability to weigh on global oilseed markets.

Rapeseed focus

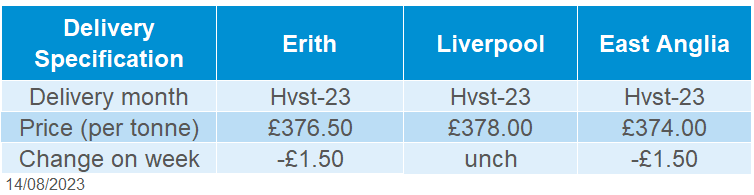

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) closed Friday at €456.25/t, down €17.50/t across the week. Following the pressure in Malaysian palm and US soyabean markets.

Domestic delivered rapeseed (into Erith, Hvst-23) was quoted at £376.50/t on Friday, down £1.50/t across the week. The domestic market prices do not match the futures weekly price movement due to Paris rapeseed futures being pressured on Friday afternoon, after the AHDB delivered survey was conducted.

The latest harvest progress in GB showed that winter oilseed rape harvest was 76% complete in the week ending 8 August, just below the 5-year average of 80%. Generally, the report notes that yields are poor. For more information, please follow this link.

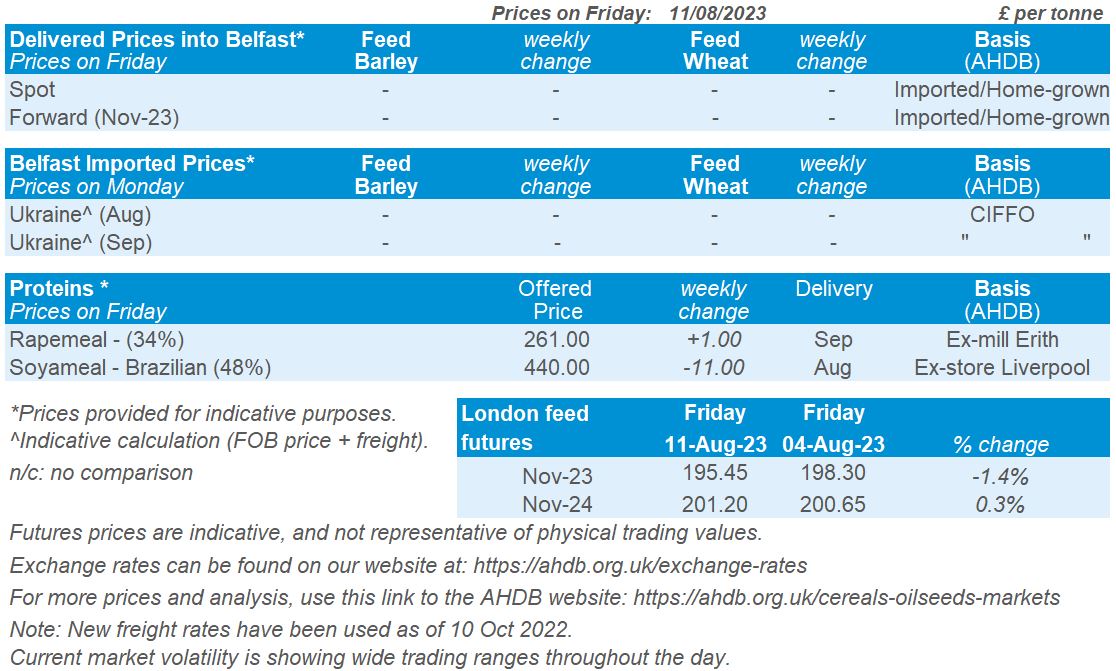

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.