Arable Market Report - 12 December 2022

Monday, 12 December 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

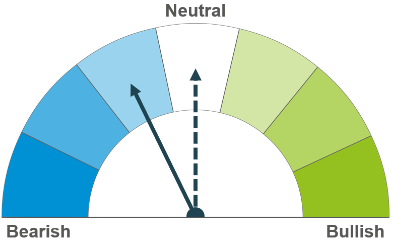

Competitive Black Sea supplies and large Australian crops continue to pressure prices short-term. Long-term, recessionary concerns and Chinese demand for grain remain a watchpoint moving forward.

Maize

Weakening wheat prices weigh on global maize markets in the short-term. Argentinian weather remains a key watchpoint for production longer term, though the Brazilian crop is forecasted to be large.

Barley

Barley markets continue to track the wider grain complex. Prices remain elevated by a tight supply and demand balance.

Global grain markets

Global grain futures

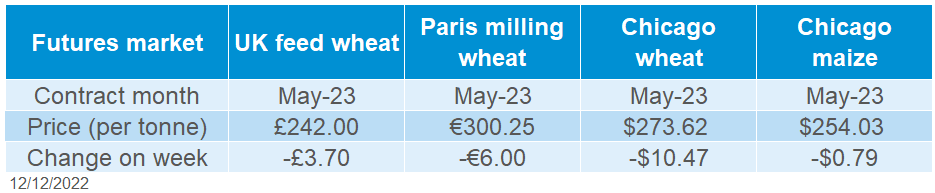

Global grain markets felt overall pressure last week (Friday – Friday) due to increasing competitive supplies from the Black Sea region and large production forecasts for Australia, as well as continued recessionary fears. Though concerns over Argentinian grain production, and speculation over increased Chinese demand, limited any major losses in global grain prices.

On Friday, the USDA released this month’s World Agricultural Supply and Demand Estimates (WASDE). The results were fairly unsurprising, and markets closed on Friday with little price reaction. Global wheat supplies for the 2022/23 season were lowered 2.1Mt (now pegged at 780.6Mt) from the previous month’s estimate, due to cuts in Argentinian and Canadian production figures. Cuts in production outweighed losses in consumption, with wheat global ending stocks down 0.5Mt from last month’s estimate.

As expected, global maize production was also revised down in the WASDE. Global maize production was cut 6.5Mt from November’s estimate, mainly due to drops in production for Ukraine, Russia, and the EU. Ukrainian harvest has been reportedly slow, with some over wintering of Ukrainian crops expected. While Ukraine production was slashed by 4.5Mt, the estimated export figure was revised up 2Mt, with the continuation of the grain corridor deal seeing more grain leaving the country.

According to Ukraine’s infrastructure ministry, since October, Russia has been targeting Ukraine’s energy infrastructure with various missile and drone attacks. An attack in the Odesa region saw operations temporarily halted at the port yesterday, though it’s been reported exports have resumed this morning. The grain leaving the Black Sea region is competitively priced, and will likely continue to weigh down on prices over the coming days.

Expectations of a record Australian wheat crop is also pressuring global prices. Last week, the Australian Bureau of Agricultural and Resources Economics and Sciences (ABARES) released their December crop report. Despite some heavy rainfall and subsequent flooding earlier in the season, the country is expecting a bumper wheat crop of 36.6Mt (up 1% on the year) as good soil moisture boosted the outlook for grains overall. For more information, read Wednesday’s analysis here.

Grain production in Argentina remains a concern for global supply. Maize plantings continue to be delayed by adverse weather. As at 07 December, 32.7% of maize had been planted compared to the 5-year average of 46.7%. Limited rain is forecast in the country over the coming week, which will further worsen the conditions for drilling and crop development.

UK focus

Delivered cereals

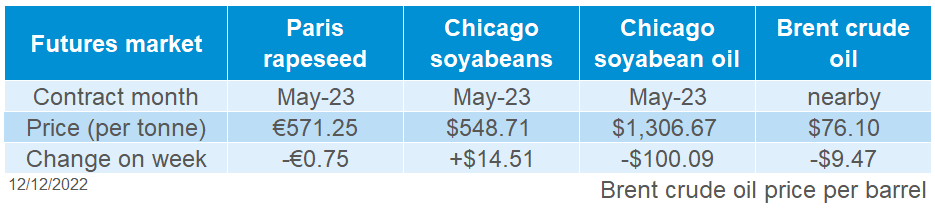

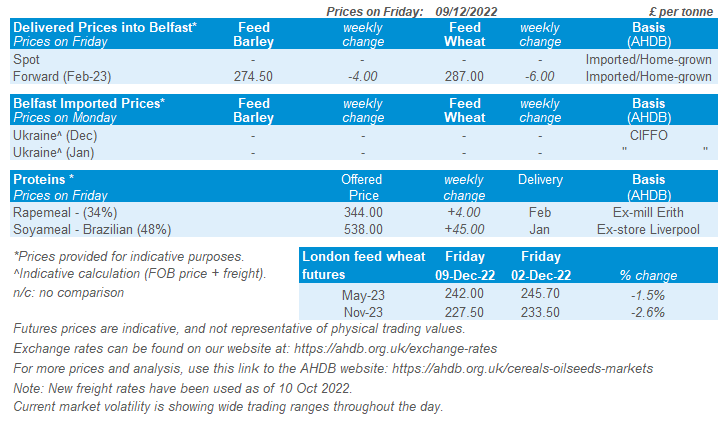

UK feed wheat futures tracked global prices down last week. The May-23 contract fell 1.5% over the week (Friday-Friday). New crop futures (Nov-23) were down 2.6% over the same period.

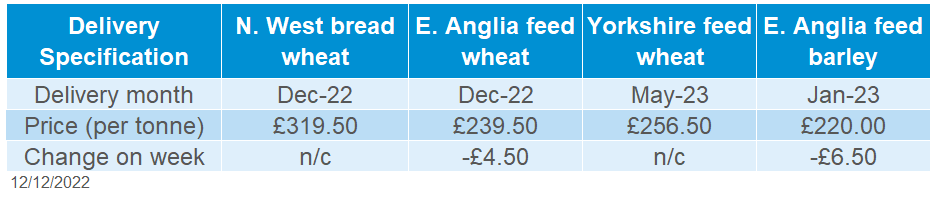

Domestic delivered prices followed futures price movement down. Feed wheat into East Anglia for December delivery was quoted at £239.50/t on Thursday, down £4.50/t on the week. Bread wheat for December delivery into the North West, was quoted at £319.50/t.

Last week, the UK agreed to double imports of US gas over the next year as an attempt to stabilise climbing energy prices. However, natural gas prices are currently climbing as colder weather sees increased demand. Front month ICE UK natural gas futures closed at 345.91p/therm on Friday, up 2.9% from the week before.

Oilseeds

Rapeseed

Soyabeans

Crude oil prices continue to weigh on rapeseed prices in the short term. Longer term market is well supplied with large Canadian crop and pressure on soyabeans will further pressure rapeseed prices going forward.

Chinese demand has been strong, however, global ending stocks for soyabeans have grown. Long-term large South American crops are forecasted, but Argentina’s weather is a critical watchpoint.

Global oilseed markets

Global oilseed futures

Support across the week (+2.7%) for Chicago soyabean futures (May-23) as the contract closed at $548.71/t on Friday, the highest price since the end of June. Spurring this support was Chinese demand, as US soyabean net export sales (in week ending 01 Dec) totalled 1.716Mt primarily to China, far exceeding trade expectations of 600Kt to 1.45Mt.

Through the USDA’s daily reporting system, 836kt of soyabeans sales were reported last Thursday (08 Dec), with China (118kt) and Unknown (718Kt) cited as destinations. This strong demand, which will be reflected in this Thursday’s report, brings optimism that there may be broader easing of COVID-19 restrictions in China.

On Friday evening, the December USDA World Agricultural Supply and Demand Estimates were released, broadly following market expectations. The global soyabean outlook includes marginally higher production, exports, and ending stocks. With global crush forecasts relatively unchanged, ending stocks were raised by 500Kt to 102.7Mt.

Within the USDA report, Argentina’s production was unchanged despite prolonged drought. However, last week Buenos Aires Grains Exchange announced that Argentina’s soyabean area could be revised down due to this drought. The soyabean area is still estimated at 16.7Mha and over the next week minimal rains are forecast. However, there are parts of Buenos Aires and Cordoba that will not receive a drop of rain. This is a critical watchpoint as large revisions to this crop could have the potential to change market sentiment.

Rapeseed focus

UK delivered oilseed prices

Despite strength in soyabeans this did not filter into rapeseed prices. Paris rapeseed futures (May-23) closed Friday at €571.25/t, down €0.75/t across the week.

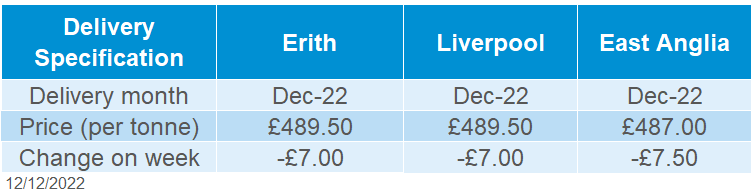

Delivered rapeseed (into Erith, Dec-23) was quoted at £489.50/t, down £7.00/t across the week. Greater losses were recorded on our domestic market as sterling was stronger against the euro on Friday, but, slightly weaker (-0.25%) across the week closing Friday at £1 = €1.1628.

Brent crude oil futures (nearby) closed Friday at $76.10/barrel, down 11.1% across the week. The large drops in brent crude oil have been weighing on rapeseed prices and vegetable oils in recent weeks.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.