Arable Market Report - 09 October 2023

Monday, 9 October 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

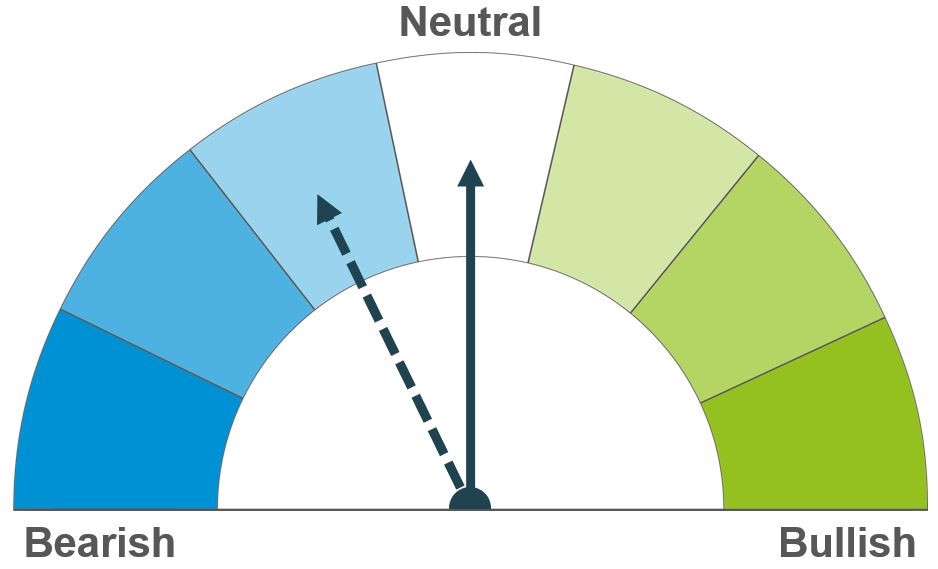

Wheat

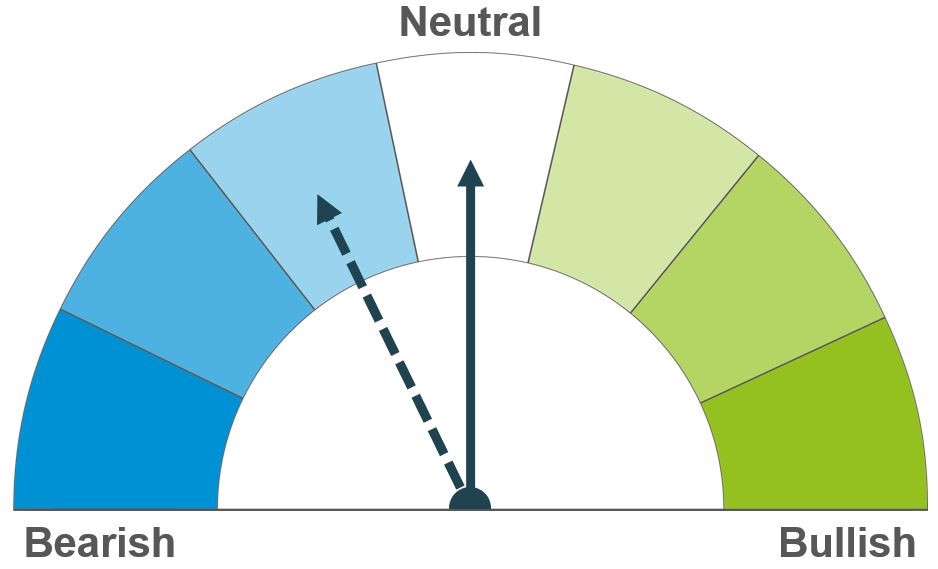

The strong Russian export pace is still a factor for markets. But for now, this is being offset by the threat of smaller Southern Hemisphere, plus higher crude oil prices. The size of Southern Hemisphere crops, including maize, is key to the longer-term outlook.

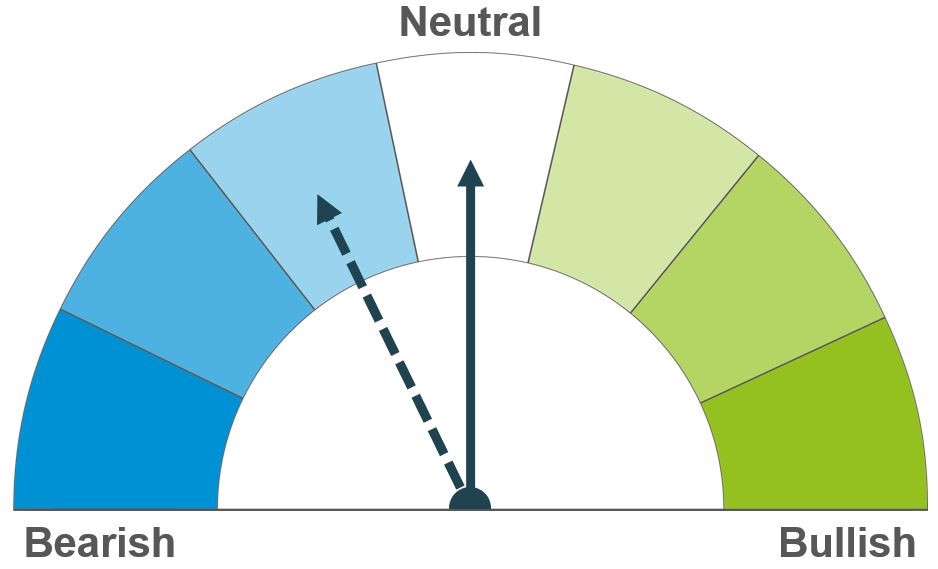

Maize

Forecasts for large crops are still the key factor in global maize markets, but there’s nervousness starting to build due to dry weather. If there are delays or reductions to plantings, the outlook for the market is likely to shift.

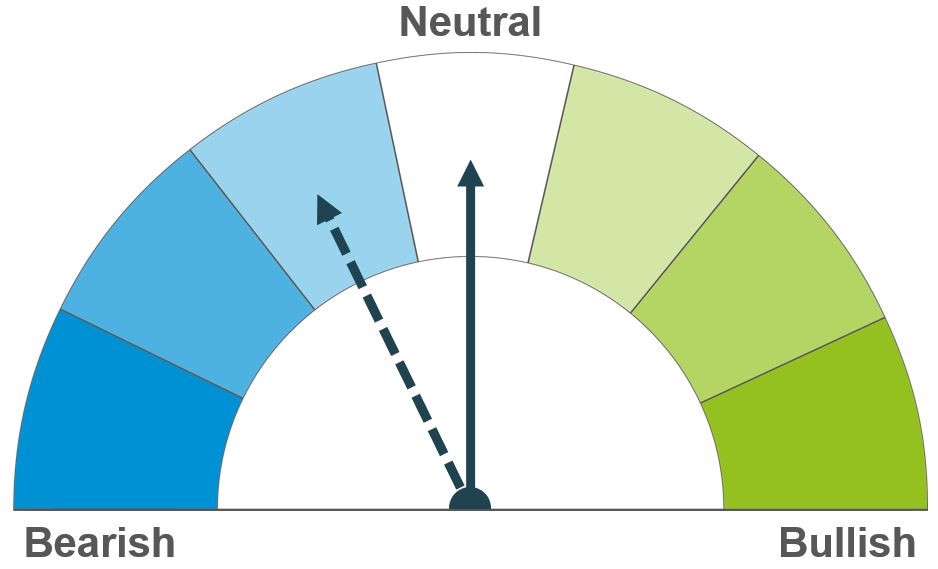

Barley

Barley continues to follow the same influences as wider global grain markets. Argentina and Australia are forecast to account for a third (34%) of global barley exports (USDA) so smaller crops could affect barley’s relationship to other grains.

Global grain markets

Global grain futures

US grain futures rallied last week on weather concerns, Black Sea tensions and short covering by speculative traders.

Also, towards the end of the week the US dollar weakened against most currencies. This made US grain comparatively more competitive in export markets and helped support prices. In contrast, European futures ended the week down slightly. The shift in exchange rates made European grain less competitive in export markets.

Data out on Friday showed far higher employment in the US than had been expected. As a result, the US dollar is trading higher again this morning (Refinitiv, an LSEG Business). If it persists, it could pressure or limit gains for US grain futures prices in the days ahead.

Dry weather in the Southern Hemisphere threatens to reduce the Argentine maize area and wheat yields. Any area lost to maize would likely switch to soyabeans. Meanwhile, rain in Australia has reportedly helped to stabilise conditions in many areas, though dryness is still a risk. If grain output in the Southern Hemisphere is reduced, this could cap supplies into export markets in the second half of the 2023/24 season.

Black Sea tensions are likely to stay in focus. Another Russian air strike against a grain facility in the Odesa region was reported over the weekend. Strong Russian exports continue to weigh on prices. Russian consultancy IKAR this morning added another 0.5 Mt to its Russian grain export forecast due to a larger crop estimate.

A rise in crude oil prices due to conflict between Israel and Hamas is also supporting grain markets short term. Another key factor this week will be Thursday afternoon’s monthly USDA World Agricultural Supply and Demand Estimates (WASDE).

UK focus

Delivered cereals

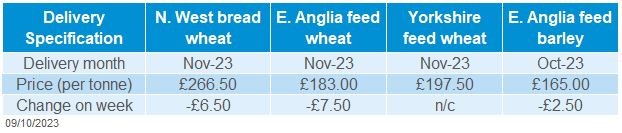

A partial recovery in sterling offset the gains in the US futures markets, meaning UK feed wheat futures (Nov-23) ended the week down £0.85/t at £185.25/t. Sterling lifted from £1 = $1.2197 on 29 September to £1 = $1.2238 on 06 October. But as of 11:00am today (09 October) £1 was trading back down around US$1.2172 (Refinitiv, an LSEG Business). If sustained this could help support UK prices compared to US prices.

UK delivered prices generally followed the futures market last week, with Nov-23 futures down £5.00/t Thursday to Thursday. Reportedly, the physical market was fairly quiet again, as farmers focused on drilling with lower prices not inspiring sales.

The gap between feed wheat and feed barley prices (delivered East Anglia, Oct-23) was reported at £16.50/t. This is down from £18.00/t a month ago and could start to curb barley demand in animal feed. Delivered bread wheat premiums over Nov-23 and May-24 futures edged back a little last week but remain very high.

Defra and the Scottish government are due to release their first estimates of 2023 crops on Thursday (12 October). Look out for highlights in Thursday’s Grain Market Daily, or subscribe via our Preference Centre.

Oilseeds

Higher Brent crude oil prices and the USDA forecasts will be a key watchpoint for price action in the short term. Ultimately though, global soyabean markets look well-supplied, with global rapeseed supplies plentiful.

USDA forecasts due this week will be a watchpoint for US and global availability going forward, but US harvest progression still lends some bearish sentiment short term. Looking longer term, large South American crops being planted now will boost the supply outlook if realised.

Global oilseed markets

Global oilseed futures

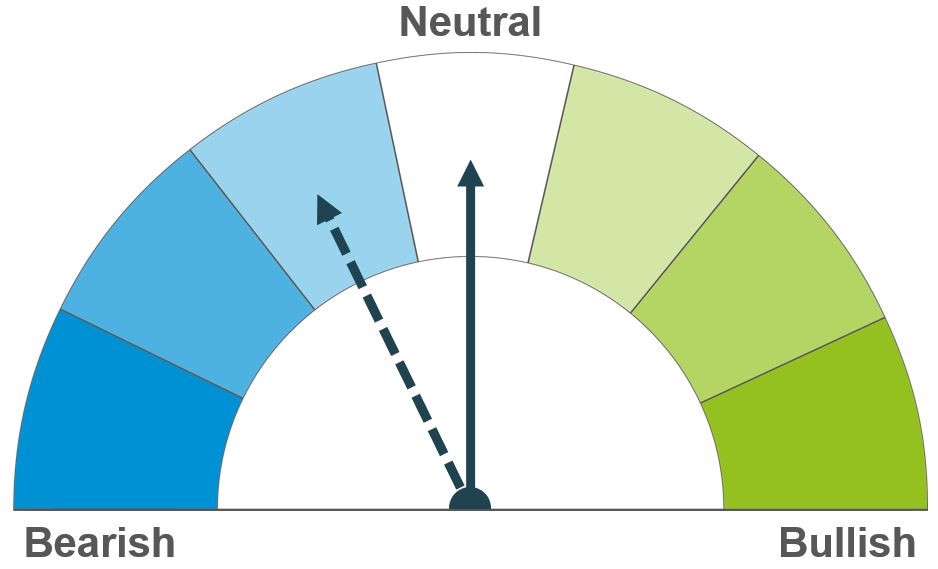

Global oilseed markets saw overall pressure last week, weighed on by expectations of ample global soyabean supply with the US harvest progressing, and falling Brent crude oil futures.

Chicago soyabean futures (Nov-23) fell $3.31/t last week, to close on Friday at $465.13/t. Helped by the strengthening of the US dollar, soyabean markets saw the most significant pressure on Wednesday and Friday. Friday also saw pressure from clear weather forecasts, expected to aid the US soyabean harvest over this weekend. In the latest data released by the USDA, 23% of US soyabeans had been harvested to 01 October. The next update is due tomorrow. Looking ahead to this week, a band of patchy rain is due across some areas of the Midwest and High Plains.

A key watchpoint this week for oilseed markets is the release of the next USDA World Supply and Demand Estimates on Thursday (12 October). A Reuter’s survey shows analyst and trade expectations for a trim to the US crop yield this month to 3.36 t/ha. The USDA in September forecast the US average yield at 3.37 t/ha. Also in focus will be the size of the South American soyabean crops. According to StoneX, Brazil’s soyabean crop could reach 164.1 Mt in 2023/24, this estimate is 1.1 Mt above the USDA. Though it is early days, Brazil’s planting is off to a record pace.

Movement of nearby Brent crude oil futures contributed to the pressure seen across oilseed prices last week. On Wednesday, nearby Brent crude oil futures fell 6% to close at $85.81/ barrel. A further fall was seen on Thursday, with Thursday’s close the lowest since late August. Forecasts of weaker oil demand, and reports Russia might soon lift its ban on diesel exports were behind the fall. However, oil prices have jumped up this morning on concerns about whether the conflict in Gaza might impact oil output from the Middle East.

Rapeseed focus

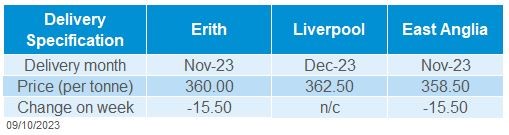

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) closed on Friday at €426.25/t, down €16.25/t from the previous Friday. The downward movement followed pressure across Chicago soyabean futures, plus Malaysian palm oil, and Brent crude oil futures. In contrast, Winnipeg canola futures saw a rise last week.

Domestic delivered rapeseed prices followed futures movements down last week. On Friday, delivered rapeseed into Erith (October delivery) was quoted at £357.50/t, down £16.50/t from the previous Friday. Delivered prices quoted for May-24 into Erith saw lower losses on the week, quoted on Friday at £376.50, down £5.00/t over the same period.

Last week Coceral, the grain trade association, forecast EU-27 rapeseed production for 2023 at 19.2 Mt. This comes in below both current estimates for both Stratégie Grains and the EU Commission. Coceral also estimated the UK rapeseed crop at 1.17 Mt. On Thursday (12 October) Defra and the Scottish government are due to release their first estimates of 2023 crops.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.