Arable Market Report – 9 June 2025

Monday, 9 June 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

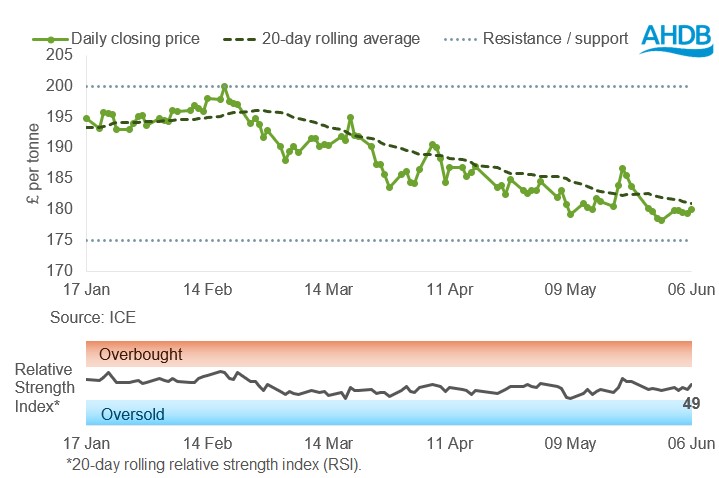

UK feed wheat futures (Nov-25)

Nov-25 UK feed wheat futures rose last week (Friday–Friday) but remained below the 20-day moving average. The RSI increased from 42 to 49 which does not indicate any significant momentum in the market.

Find out more about the graphs in this report and how to use them here.

Market drivers

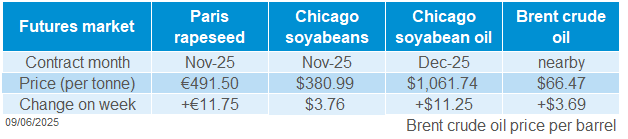

UK feed wheat futures (Nov-25) gained £1.85/t (1.0%) last week (30 May–6 June), closing at £180.05/t on Friday. Domestic prices followed global markets up, with Chicago wheat and Paris milling wheat futures (Dec-25) rising by 3.3% and 1.5% respectively. UK domestic feed wheat futures showed limited upside support due to sterling's strength against the US dollar and the euro.

Chicago wheat futures closed last week with a strong upward trend, supported by export demand for the 2025/26 crop, as well as managed money funds covering short positions. Additionally, wheat futures were supported by the escalating war between Russia and Ukraine, as well as dry weather threatening yields in China.

Egypt's state grain-buying agency, Mostakbal Misr, has secured major wheat contracts with strategic partners in France and Romania. This is part of a broader push to diversify supply and stabilise imports amid global uncertainty (LSEG).

FranceAgriMer estimated that 69% of French soft wheat was in good or excellent condition as of 2 June, down from 70% the previous week. For winter and spring barley, crops rated as good or excellent both fell by 1%. Market participants are monitoring weather in the EU with tight wheat ending stocks forecast in the 2025/26 season.

For maize, the Brazilian crop is in focus. Last week, agribusiness consultancy Agroconsult announced Brazil's 2024/25 second corn crop is expected to reach a record 112.9 Mt, which is 10.5% higher than the previous season.

The agricultural consultancy firm APK-Inform reduced its forecast for Ukraine’s 2025 grain harvest forecast for by 4.3% to 52.9 Mt, primarily due to lower-than-expected maize and wheat production. Last Friday's reintroduction of EU quotas for Ukrainian wheat and barley did not have a significant impact on Paris futures, as Ukraine looks for alternative export destinations.

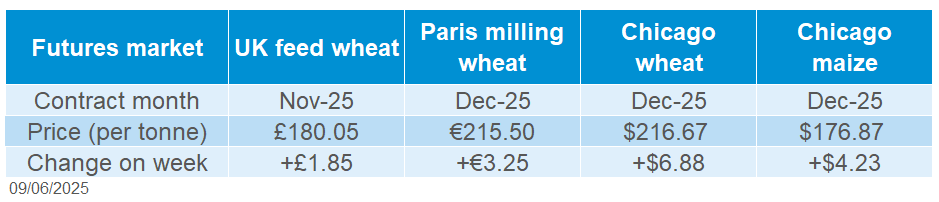

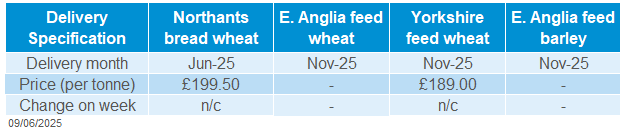

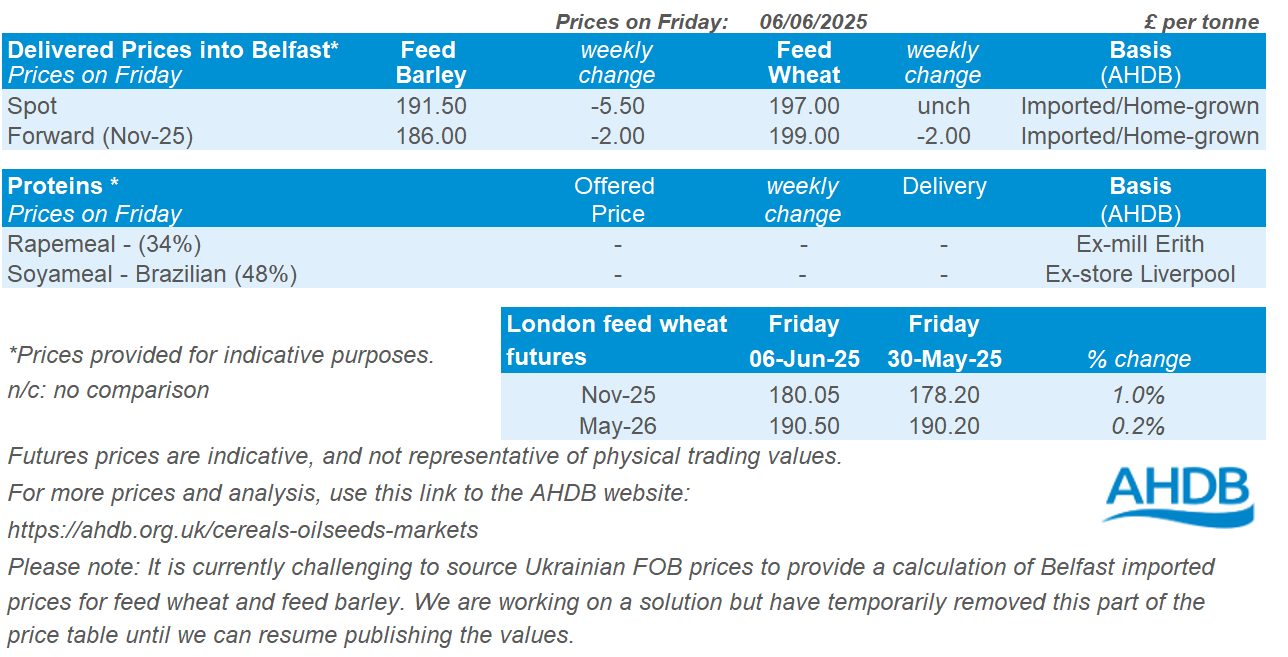

UK delivered cereal prices

Bread wheat delivered into Northamptonshire for June 2025 was quoted at £199.50/t. Feed wheat for delivery in Yorkshire for Nov 2025 was quoted at £189.00/t.

Rapeseed

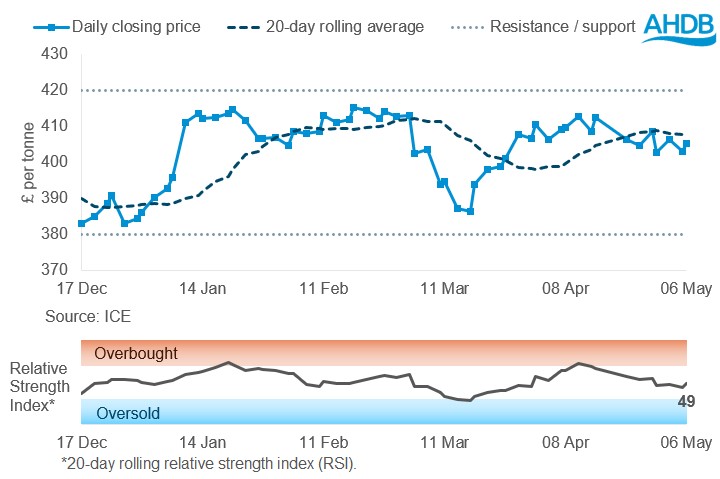

Paris rapeseed futures in £/t (Nov-25)

Nov-25 Paris rapeseed futures were up last week (30 May–6 June) but remained below the 20-day moving average. The RSI edged up marginally to 49 from 48 in the previous week showing little buying or selling activity.

Find out more about the graphs in this report and how to use them here.

Market drivers

Paris rapeseed futures edged up last week (Friday–Friday), with the Nov-25 contract up by €11.75/t (2.5%) to €491.50/t. This followed global markets, with Nov-25 Chicago soya bean futures and Dec-25 Chicago soybean oil futures up 1.0% and 1.1% respectively.

The upward trend in rapeseed and other oilseeds was partly due to a rise in crude oil, with Aug-25 futures up 5.9% on the week at Friday’s close. Renewed optimism around US–China trade relations lifted market sentiment, fuelling expectations for stronger global demand.

Last week saw an update on potential oilseed supplies from Ukraine. Figures from the Ministry of Agrarian Policy of Ukraine predict the oilseed harvest to fall by 5% to around 20.16 Mt, down from 21.18 Mt in 2024. This includes a 600 Kt decline in rapeseed output, amid difficult weather conditions. An unusually warm winter, initial dryness, and prolonged rains have all contributed to a delayed and uncertain planting season.

The USDA’s first soya bean crop condition rating covering the US came in with 67% of the crop rated as in good to excellent condition, slightly below trade expectations. This provided some support to prices last week, with another update due out tonight. Meanwhile, Argentina’s soya bean harvest is progressing more slowly than normal due to rainfall, though yields continue to exceed initial expectations with harvest 88.7% complete as of 4 June.

China's soya bean imports surged to a record 13.92 Mt in May, rebounding from April’s 10-year low of 6.08 Mt. Imports in May were 36.2% higher than a year ago, with Brazil remaining the dominant supplier, exporting 14.10 Mt in the month. This increase in demand supporting global soya bean prices currently.

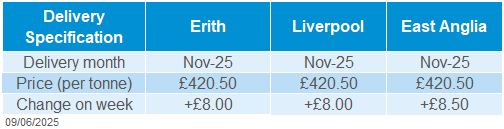

UK delivered rapeseed prices

Delivered rapeseed into Erith for November was quoted at £420.50/t on Friday, up £8.00/t (1.9%) from the previous week. Delivery into Liverpool tracked this movement. Delivered prices followed the upward trend seen in futures over the same period.

Extra information

AHDB released the latest data on UK human and industrial consumption, as well as GB animal feed production last week, including figures up to the end of April. Last Thursday’s Grain market daily looks at demand for animal feed across the sectors, showing strong production of cattle and sheep feed continues.

The Planting and Variety Survey results are out this week (10 June) with full analysis to come at this year’s Cereals event.

Trade data covering UK cereals and oilseeds is to be released this week (12 June) by HMRC.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.