Arable Market Report – 02 June 2025

Monday, 2 June 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

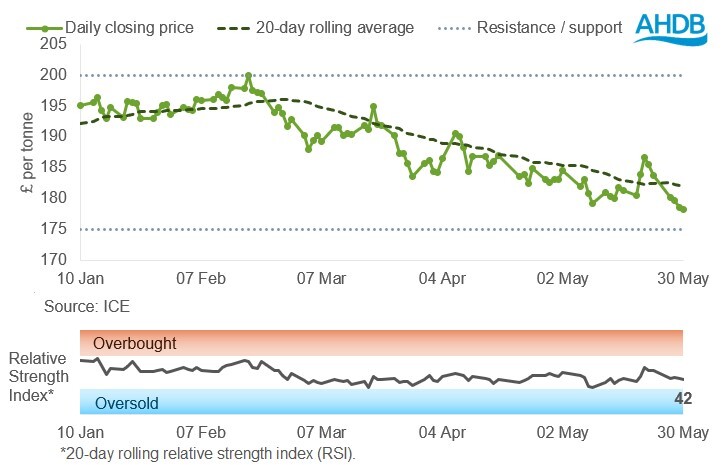

UK feed wheat futures (Nov-25)

Nov-25 UK feed wheat futures fell last week (Friday–Friday), falling back below the 20-day moving average. Prices are now approaching the £175/t support line.

Find out more about the graphs in this report and how to use them here.

Market drivers

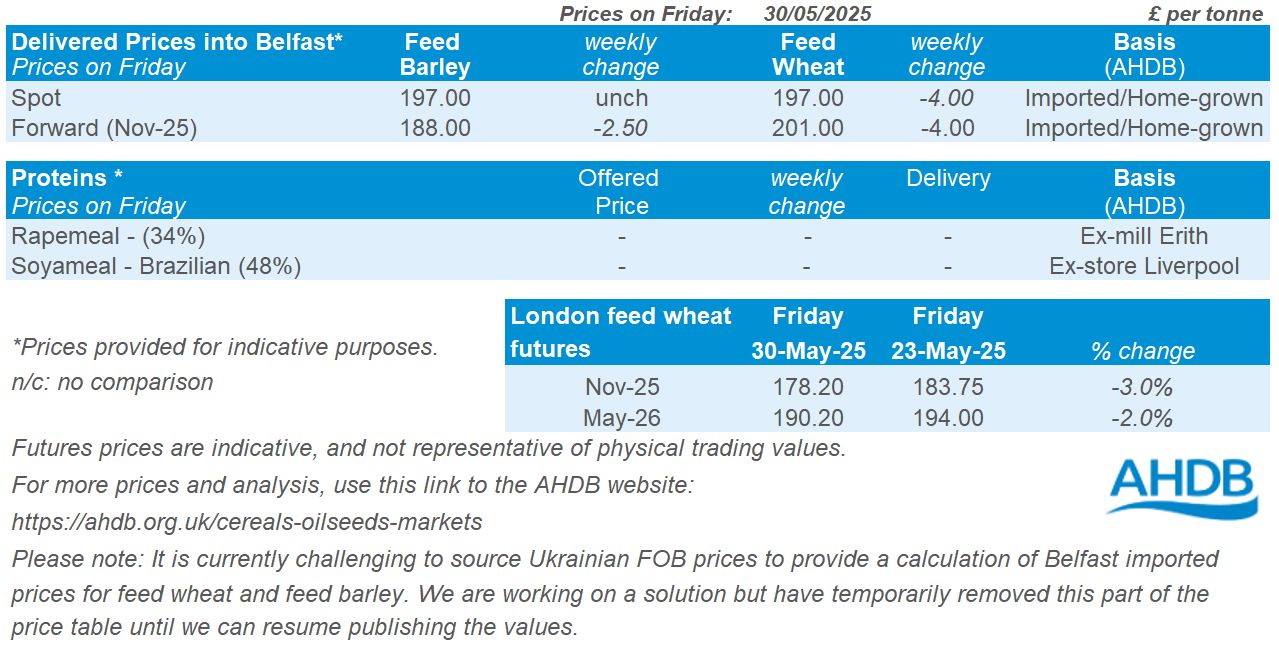

UK feed wheat futures (Nov-25) decreased by £5.55/t (3.0%) last week (23–30 May), closing at £178.20/t on Friday. Domestic prices followed global markets down, with Chicago wheat and Paris milling wheat futures (Dec-25) falling by 1.8% and 2.6% respectively. The improvement in the weather forecast for the coming weeks put additional pressure on domestic feed wheat futures.

At the start of last week, the price of global wheat futures showed a strong decrease due to improved weather forecasts in the US and Europe, and the prospect of the 2025 planting campaign in the Northern Hemisphere. However, wheat crop condition ratings in the US and France have decreased in recent reports.

The EU Commission updated it’s 2025/26 common wheat production estimate to 126.6 Mt, up 0.3 Mt from 126.3 Mt estimated last month. EU wheat exports are estimated at 29.8 Mt, unchanged from the previous month. The EU ending stocks estimate is pegged at 9.05 Mt, up from 8.5 Mt last month.

The Association of German Farm Cooperatives is forecasting 2025 wheat production at 21.01 Mt, down from last month's figure of 21.41 Mt, but up 13.6% from the previous season.

Consultancy firm ASAP Agri has predicted that Ukraine’s exports could fall to around 15 Mt (USDA 16.5 Mt) in the 2025/26 season, down from 16.2 Mt in the 2024/25 season. This is due to potential changes in EU import policies, uncertain harvest prospects in Ukraine, and higher EU production.

Sovecon increased its estimate of Russia’s 2025 wheat crop to 81.0 Mt, up 1.2 Mt from the previous forecast, compared to 82.6 Mt in 2024, due to favourable weather conditions. At the same time, the export estimate reached 40.8 Mt (USDA 45 Mt), up 1.1 Mt from the previous forecast.

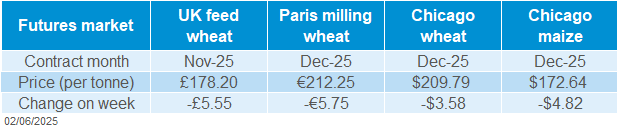

UK delivered cereal prices

Domestic delivered wheat prices gained Thursday to Thursday, following domestic futures. Bread wheat delivered into Northamptonshire for November 2025 was quoted at £219.50/t, down £7.00/t. Feed wheat for delivery in East Anglia for Nov 2025 was quoted at £180.50/t.

Despite significantly decreasing winter and spring crop conditions due to dry weather, domestic wheat prices for the 2025 crop continue to track global market movement.

Rapeseed

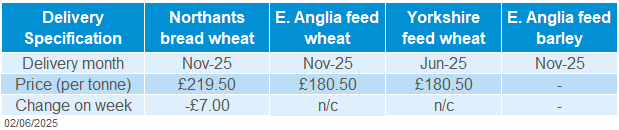

Paris rapeseed futures in £/t (Nov-25)

Nov-25 Paris rapeseed futures (in £/t) dipped below the 20-day moving average last week but remained within the resistance and support levels. The RSI fell slightly from 52 to 48, suggesting the market is losing a bit of momentum, but not showing any strong buying or selling signals.

Find out more about the graphs in this report and how to use them here.

Market drivers

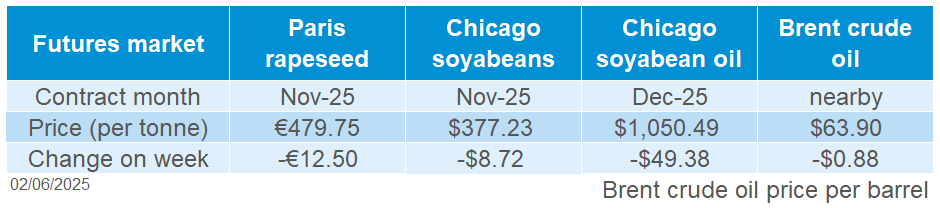

Paris rapeseed futures declined last week (Friday to Friday), with the Nov-25 contract falling by €12.50/t (-2.5%) to €479.75/t. This drop followed a broader weakness in US oilseed markets. Nov-25 Chicago soyabean futures and Dec-25 soyabean oil futures fell by 2.3% and 4.5% respectively, driven largely by rapid planting progress and weak demand. However, mixed crop forecasts continued to underpin rapeseed prices.

According to the USDA, 76% of the US soyabean crop had been planted by 25 May, well ahead of the five-year average of 68%, due to improved weather. More rain expected in the US central region should also support growth, according to Commodity Weather Group. Next week’s crop condition ratings will be a key watchpoint.

US soyabean export sales dropped to 146 Kt in the week ending 22 May, down 53% from the previous week and below market expectations (150–500 Kt). On top of that, Energy Information Administration (EIA) data shows soyabean oil use for biofuel in March was lower year-on-year, with ongoing uncertainty around US biofuel policy adding to concerns.

In Brazil, Datagro raised its 2024/25 soyabean production forecast to 172 Mt, due to increased area and yields. The USDA’s estimate currently stands at 169 Mt.

Rapeseed fundamentals remain mixed. According to the latest LSEG data, Canada’s 2025/26 outlook is down 1% due to low soil moisture in Saskatchewan and Manitoba. Meanwhile, EU plus UK output is forecast to rise slightly to 20.4 Mt, supported by favourable rainfall. Germany’s winter rapeseed crop is projected at 3.82 Mt, up 5.6% year-on-year but slightly below earlier estimates, according to the German Association of Farm Cooperatives. The EU Commission and Strategie Grains revised their EU forecasts to 18.8 Mt and 18.6 Mt respectively, both above 2024/25 levels.

UK delivered rapeseed prices

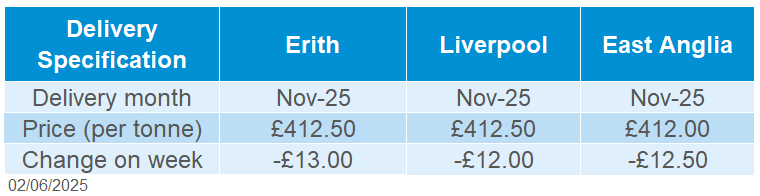

Rapeseed to be delivered into Erith in November was quoted at £412.50/t on Friday, down £13.00/t (-3.1%) from the previous week. Delivery to Liverpool in November was also quoted at £412.50/t, gaining £12.00/t (-2.8%). Domestic delivered prices tracked the downward movement in Paris rapeseed futures.

Extra information

AHDBs latest UK cereals supply and demand estimates were released last week as well as the latest crop condition report. The latest report shows a significant decline in crop conditions compared to a month earlier. For winter wheat, 36% of the crop was rated as being in good or excellent condition, down from 60% at the end of April.

Resistant winter wheat varieties show unexpected levels of yellow rust, Jason Pole’s article goes into detail.

AHDB has launched a new risk assessment tool for fusarium mycotoxins to help maintain safe levels and promote best practice.

Cereal usage data for April, covering UK human and industrial, and GB animal feed production figures, will be released this Thursday (5th).

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.