Arable Market Report - 06 March 2023

Monday, 6 March 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

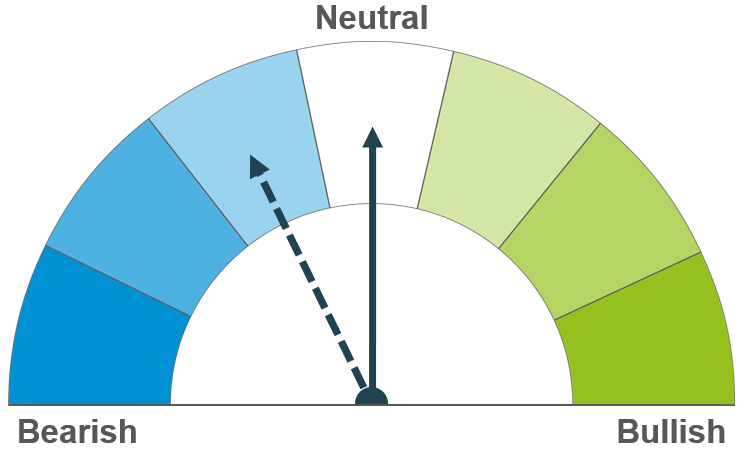

Short-term volatility is expected as the Ukrainian grain corridor deal renewal date approaches. Currently, optimism surrounding the agreement and cheap Russian supplies weighs on prices, though South American weather issues could limit any major losses to grain markets.

Argentinian crop concerns could add some support to prices though generally a big South American crop can still be expected. Maize prices could also be impacted by demand news, with the latest WASDE due this week.

Barley prices continue to follow the wider grains complex.

Global grain markets

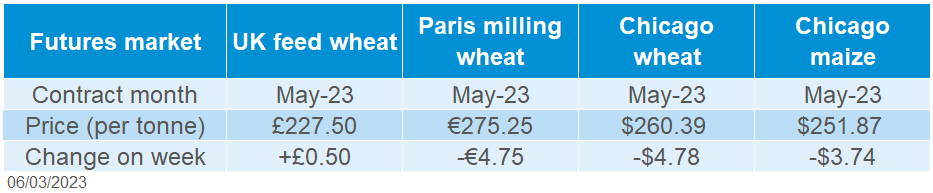

Global grain futures

Global grain prices generally came under slight pressure last week, though volatility remains as we approach the 19 March deadline for the Black Sea Initiative renewal. However, the ongoing drought in Argentina capped any major losses in grain markets last week.

Chicago wheat and Paris wheat markets (May-23) fell 1.8% and 1.7% respectively over the week (Friday-Friday) as expectations that the deal in the Black Sea region to export grain from Ukraine will be extended. The Turkish Foreign Minister said yesterday that Ankara is working hard to extend the UN-brokered grain deal, though Russia has signalled it is unhappy with certain aspects of the agreement. Any news surrounding the deal will be a key driver in global grain markets over the next couple of weeks.

This morning, Ukraine’s Academy of Agricultural Science said that between 92% and 97% (depending on the predecessor and sowing date) of its winter wheat crop was in relatively good condition (APK-Inform, Refinitiv). Ukraine’s wheat harvest declined to 20.2Mt in 2022, from 32.2Mt in 2021. According to an official from Ukraine’s Agriculture Ministry, next harvest’s estimate is currently expected to be between 16Mt and 18Mt, though Ukraine currently does not see a need to limit wheat exports next season (2023/24).

Weather in Argentina remains a watchpoint moving forward. In their latest report released on Thursday, the Buenos Aires Grain Exchange reported 6% of the maize crop as being in excellent/good condition, down from 9% the previous week. While production estimates have already been slashed over the season so far, CREA (an Argentinian agriculture consortium) have said they believe estimates could be cut further in the coming weeks. While there is some rain forecast in Argentina over the next seven days, it is still minimal in the key producing region, something to monitor over the next few days.

UK focus

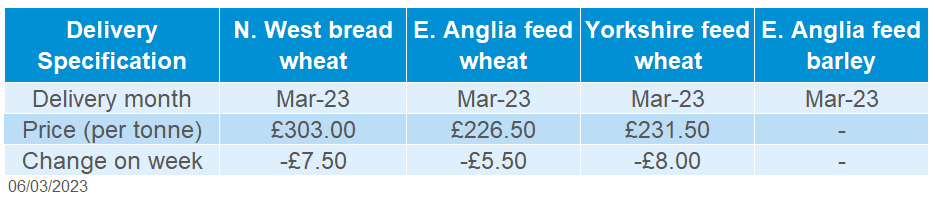

Delivered cereals

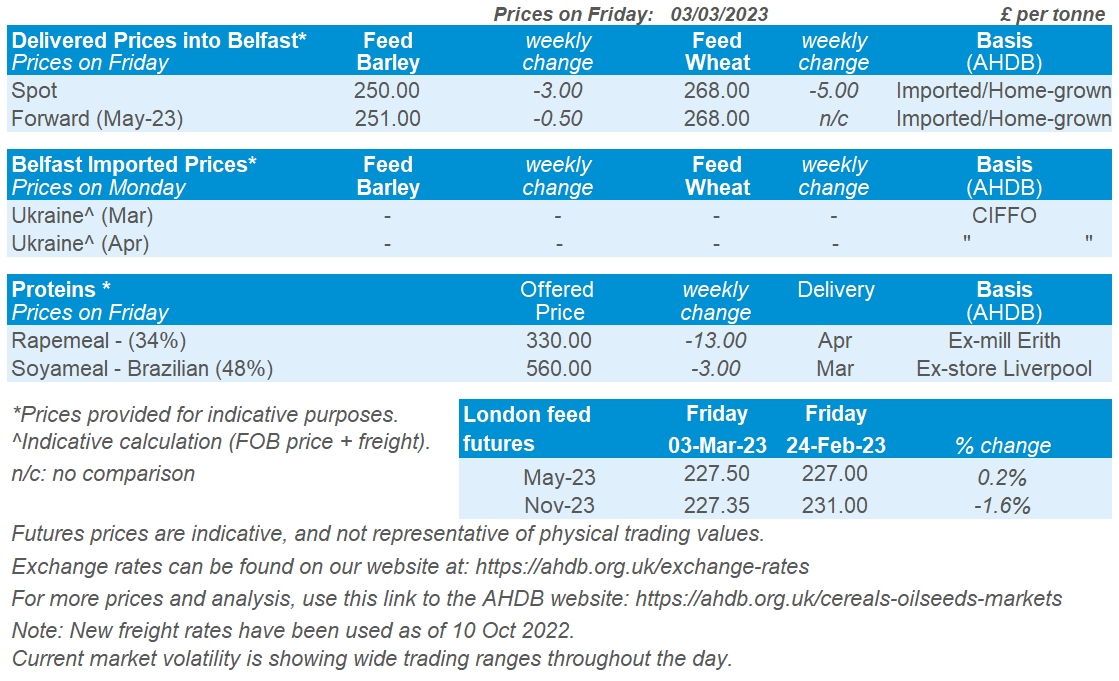

New crop UK feed wheat futures were trading at a premium to old crop prices for much of last week. However, over the week (Friday-Friday), the May-23 contract climbed 0.2%, while the Nov-23 contract was down 1.6%, seeing old crop prices creep back up higher than new crop on Friday.

Domestic delivered prices followed futures movements (Thursday to Thursday). Feed wheat delivered into East Anglia (Mar-23 delivery) was quoted at £226.50/t on Thursday, down £5.50/t on the week. Bread wheat delivered into the North West (Mar-23 delivery) fell £7.50/t over the week, quoted at £303.00/t on Thursday.

On Thursday, AHDB released the most recent UK human and industrial cereal usage data, as well as updated GB animal feed production figures. Reduced feed production continues to see cereal demand decline in the sector, with total cereal usage for compounders (wheat, barley, oats and maize), back 9% this season-to-date. For more information, read Thursday’s Grain Market Daily here.

Oilseeds

Rapeseed

Soyabeans

Short-term rapeseed will maintain an element of support from Argentina’s weather issues. Long-term though once the Brazilian soyabean crop is online, this could pressure rapeseed prices.

Argentina’s soyabean crop has had a disastrous growing cycle, with more cuts expected. Long-term though there is still a colossal Brazilian soyabean crop coming to market, which could weigh on prices.

Global oilseed markets

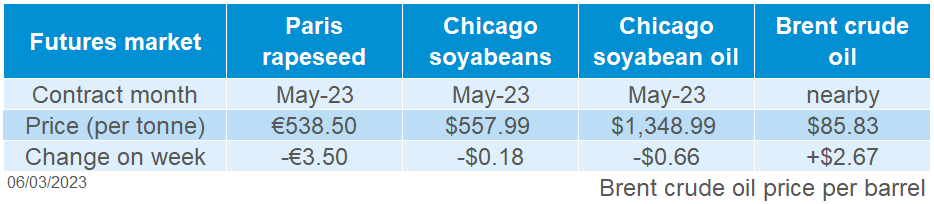

Global oilseed futures

Chicago soyabean futures (May-23) were only marginally pressured across the week, closing at $557.99/t. There was quite a bit of volatility as the contract dropped to the lowest price since the start of January on Tuesday (28 Feb), from the Brazilian soyabean harvest pressure and as commodity funds liquidated positions before the end of the month.

According to Brazilian agricultural consultancy AgRural, Brazil’s soyabean harvest as of last week is estimated to be 43% complete, progressing 10% from the previous week. This is one of the weighing factors on the oilseed complex currently.

However, there was support at the end of the week, as concerns over Argentinian weather ignited strength for soyabeans again. As the crop enters later stages of development, drought continues to impact soyabeans. Buenos Aires Grain Exchange announced last Thursday (02 Mar) that there will be further cuts to Argentina’s soyabean crop from drought impact – currently the Exchange forecast the crop at 33.5Mt, down from the 48Mt estimated at the start of the cropping cycle.

All eyes will be on the USDA March World Agricultural Supply & Demand Estimates out this Wednesday (08 Mar). Analysts expect the USDA to lower Argentina’s soyabean crop by 4.35Mt, which will peg the crop at 36.65Mt, this is still higher than Argentinian consultancies. Other than that, changes the US ending stocks of soyabeans are expected to marginally decrease.

Over the next week, Argentinian weather will be a market driver. Rains are expected over the next 7 days in the Northern Agricultural region of the country. Please note though, this is minimal in places and drought stress will continue. The market to some extent has priced in Buenos Aires Grain Exchanges’ unannounced revision from 33.5Mt, but if higher than expected, this will further drive the soyabean market up.

Rapeseed focus

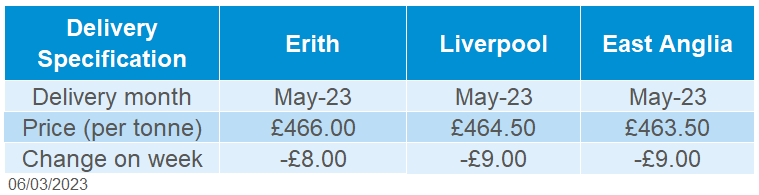

UK delivered oilseed prices

Similar to soyabeans, Paris rapeseed prices (May-23) were pressured at the start of the week but supported at the end. However, overall, the contract did close down €3.50/t across the week to close on Friday at €538.50/t.

Delivered rapeseed (into Erith, Mar-23 delivery) was quoted at £464.00/t on Friday, down £8.00/t across the week. Friday to Friday sterling was much unchanged (-0.04%) against the euro, closing Friday at £1 = €1.1322. Greater pressure was captured on our domestic market as Paris rapeseed futures gained on Friday afternoon (03 Mar), after the AHDB delivered survey was conducted.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.