Arable Market Report - 01 August 2022

Monday, 1 August 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

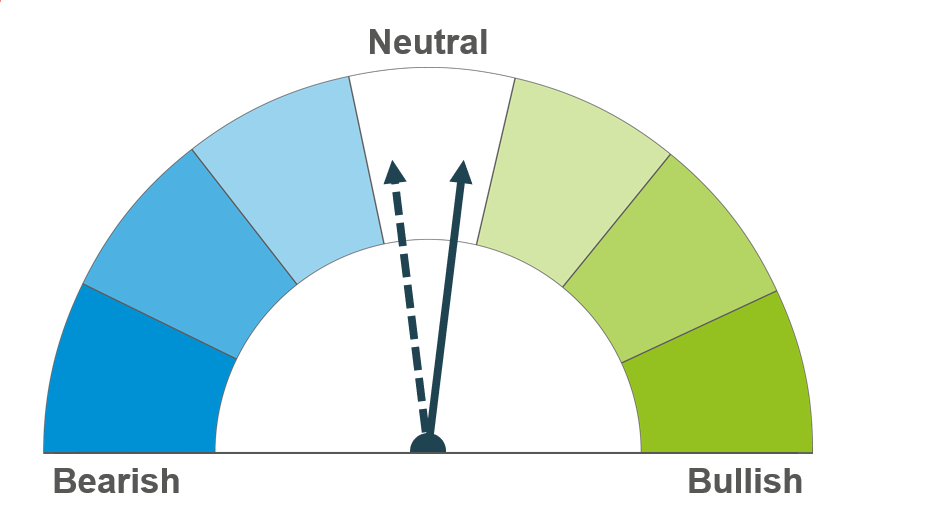

Grains

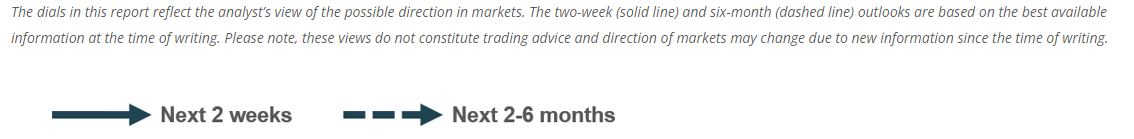

Wheat

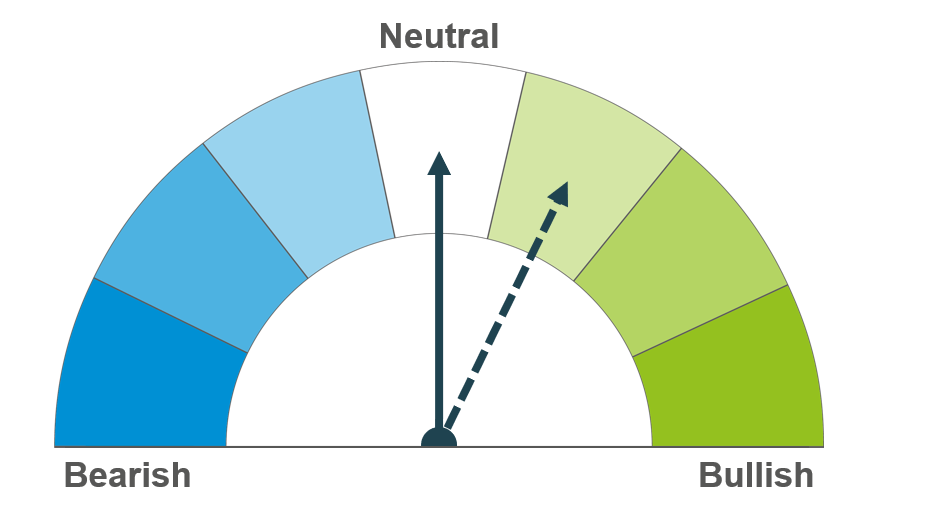

Maize

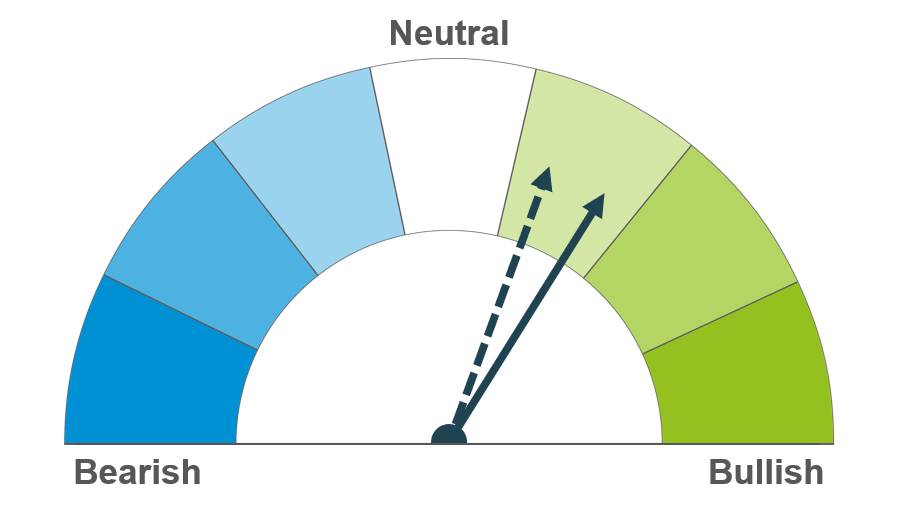

Barley

Short term price volatility continues as the first grain ship leaves Ukrainian port Odessa. Longer term, dry and hot weather remains a watchpoint for harvest 22 and strong demand continues supporting prices.

News of hot weather trimming yields in the EU has tightened the supply outlook for maize, supporting prices short and longer term. US weather remains important for yields.

The global and domestic barley balance remains tight into next season. Prices continue to follow wider international grain markets.

Global grain markets

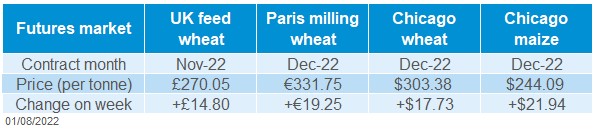

Global grain futures

Global grain markets remained supported last week, finding fresh strength from dry and hot conditions across the EU and US.

News on Ukrainian grain exports continues to dominate market movements. Today, the first grain ship has left the Ukrainian port Odessa. This is the first ship to do so since signing a deal with Turkey, Russia, and the UN on 22 July. It is thought insurance on grain moving will remain costly considering the ongoing conflict. Sunday morning saw intense shelling in the southern city of Mykolaiv, another port city. Price volatility is expected to continue as the situation progresses.

The maize supply outlook looks to be tightening, following the hot and dry weather in the EU. The yield outlook for EU maize has been trimmed by the European Commission down 7.9% from June’s outlook, to below the 5-year average. This is down to heat stress in France, Italy, and Romania especially. French maize ‘good to excellent’ conditions have been trimmed by FranceAgriMer by 7 percentage points (pp) to 68% in the week ending 25 July.

Dry conditions remain a key watchpoint for grain markets. Hungary’s early harvest has reportedly seen wheat yields 25% lower than the 5-year average due to drought.

US weather too will be watched closely as maize is in its critical development stage. The outlook for August looks hot, though some moisture is forecasted across the Midwest over the next two weeks.

Strong demand continues to support European wheat markets, strengthening Paris wheat futures (Dec 22) on Friday. This follows demand for French origin wheat in recent global tenders from Pakistan and China. Demand is being picked up by the EU from usual Black Sea trade.

UK focus

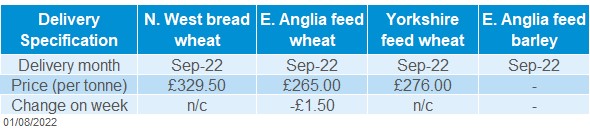

Delivered cereals

Domestic market movements continue to follow global contracts upwards. UK feed wheat futures (Nov-22) closed on Friday at £270.05/t, up £14.80/t Friday to Friday. Nov-23 futures gained £15.60/t over the same period, to close at £244.75/t. Nov-24 futures gained £15.35/t to close at £242.15/t on Friday.

UK delivered prices are seeing some harvest pressure as combines roll for wheat crops. On Thursday, feed wheat delivered into East Anglia (for September delivery) was quoted at £265.00/t, down £1.50/t week on week.

Bread wheat delivered into the North West (for September delivery) was quoted at £329.50/t on Thursday. For the same delivery month, bread wheat into Northamptonshire is quoted at £310.50/t, down £2.00/t on the week.

Drought remains a watchpoint across the UK, with the National Drought Group convening last week.

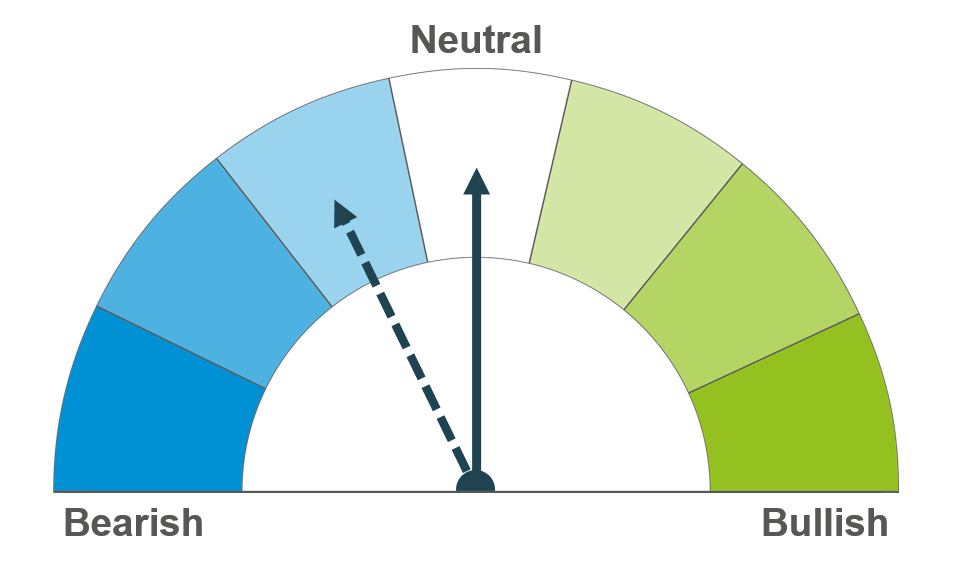

Oilseeds

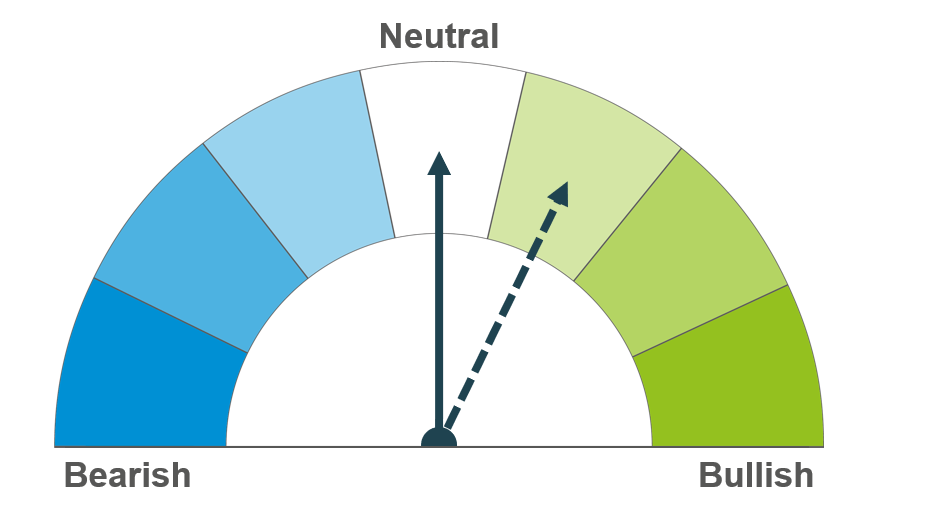

Rapeseed

Soyabeans

Rapeseed prices continue to track the wider oilseed complex, with additional support coming from delayed exports out of the Black Sea. But Canada’s larger expected crop could weigh on the long-term outlook.

Hotter and drier August weather forecasts across the US could support soyabean prices in the short term. US yields remain something to watch. Longer term, large South American crops could weigh on prices.

Global oilseed markets

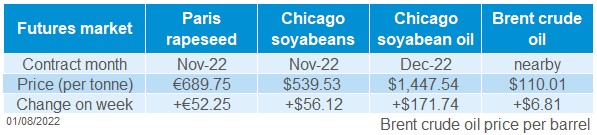

Global oilseed futures

Chicago soyabeans futures (Nov-22) rallied to four-week highs on Friday, closing at $539.53 /t. This is up $56.12/t Friday-Friday. The sharp rise was largely driven by hotter and drier weather conditions forecast for the US during the first half of August, which has heightened crop quality concerns as soyabeans enter the pod setting phase.

US net sales of new crop (2022/23) soyabeans totalled 748.8Kt in the week ending 21 July. These were dominated by purchases from China (+538Kt) and unknown destinations (+199Kt). Full season Chinese imports for 2022/23 are forecasted by the USDA as 8Mt stronger than last year (at 98Mt), though July estimates are down 1Mt from June. Last week’s downward revision to China’s pig herd (down 6.3%) and sow herd (down 1.9%) projections to June (down year-on-year), may slightly temper purchases.

In the wider oilseed complex EU sunflower yield prospects have also been hampered by recent drought conditions. European consultancy Stratégie grains has lowered its sunflower output projection for 2022/23 to 10.35Mt for the bloc. This is down from 10.87Mt projected last month and brings output expectations back in line with last year’s levels.

Looking ahead, US weather will remain a key watchpoint for soyabean prices. The seven-day outlook remains for hotter and drier than usual conditions across key growing regions in the Midwest, with some expected rains but these currently look limited.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures tracked soyabean futures higher. The Nov-22 contract closed on Friday at €689.75/t, up €52.25/t Friday-Friday. This was the contracts highest close since 11 July.

The firming also reflected continued uncertainty about resuming Ukrainian exports, despite the UN’s signed agreement between Russia, Turkey, and Ukraine for shipments to restart.

European consultancy Stratégie grains has increased its forecasted EU rapeseed output to 18.47Mt, up from 18.33Mt previously estimated. This would raise output by 8.8% on last year’s levels on a larger acreage and some better-than-expected yields.

Last Friday we were unable to publish delivered oilseed prices due to insufficient quotes to calculate the published average.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.