EU cuts maize yield outlook after hot, dry July weather: Grain market daily

Tuesday, 26 July 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £257.30/t yesterday, up £2.05/t on Friday’s close. Prices tracked the global market after weekend shelling at the port of Odessa heightened Black Sea supply concerns.

- Nov-22 Paris maize futures closed at €306.25/t on Monday, up €4.25/t on Friday’s close amid heightened yield and quality concerns in the EU and US following prolonged hot, dry weather.

- US maize conditions have been revised lower this week by the USDA, with 61% of the crop being rated in good/excellent condition, down by three percentage points on a week earlier. Read more below about the impact of July weather on EU maize yields.

EU cuts maize yield outlook after hot, dry July weather

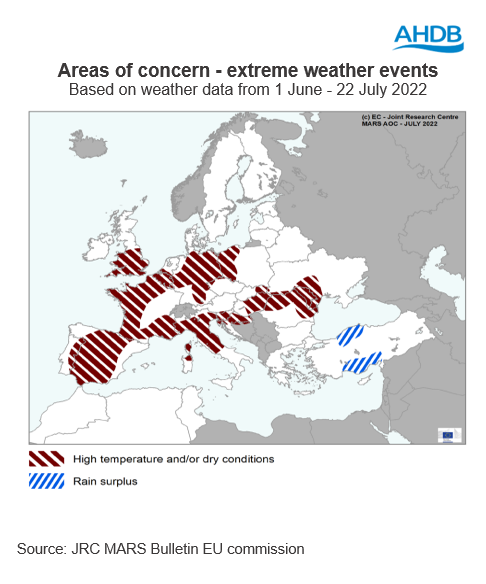

The European Commission has sharply reduced its yield forecast for maize and other summer crops, following prolonged hot and dry weather conditions in the bloc during 1 June – 18 July, according to its latest crop monitoring report. Yield reductions from previous estimates for winter crops were more modest as the majority of the heat/drought stress would have already been factored in.

The latest forecast pegs average EU maize yields at 7.25t/ha. This is 7.9% lower than June’s forecast, which was in line with the five-year average of 7.87t/ha. The reductions follow recent drought and heat stress across large parts of France, Italy, Romania and elsewhere.

At the end of June, the EU commission had forecast maize production for the bloc at 71.71Mt based off a projected area of 9.13Mha and yield of 7.85t/ha. If we take the latest maize yield forecast from the MARS report and apply it to the EU commission area, EU maize production would be 66.22Mt. This is nearly 5.5Mt lower than the current projection and 1.75Mt lower than in 2021/22. It is important to note that these two data sources do not completely align. However, this does give an indication on what maize output may look like for the EU this season.

Over the past five seasons (2016/17-2020/21) around 43% of total UK maize imports have come from the EU. If there is a reduction in EU maize availability this season then the UK may look to importing from alternative origins, such as the US (now the tariff has been lifted).

That said, maize inclusions in animal feed rations is very much dependant on domestic grain availability and how price competitive maize is. If maize becomes less price competitive to import, then we could also see support for domestic feed grain demand. Furthermore, with maize acting as the price floor for grain markets, a tighter supply may support domestic feed grain markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.