Arable Market Report 25 July 2022

Monday, 25 July 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

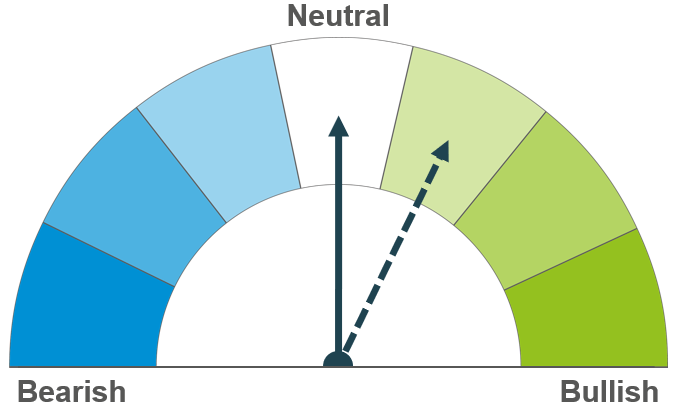

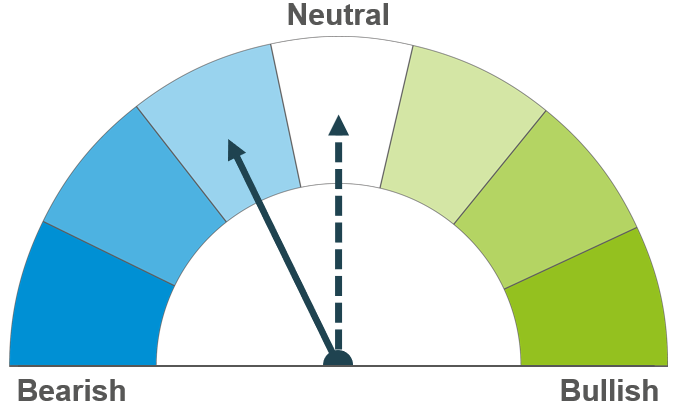

While a deal has been met for the Ukrainian export corridor, recent port bombing leaves the market concerned. Though should we see exports start to leave, we could see further pressure. Longer term, global demand remains strong, and questions remain over the EU crop production.

The global supply outlook remains boosted, but the supply and demand balance tight. Volatility is expected to continue short term on Ukrainian news. Longer term, EU supply remains a watchpoint.

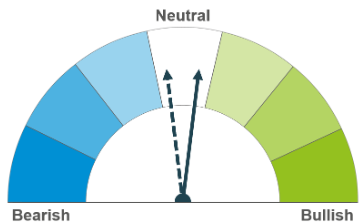

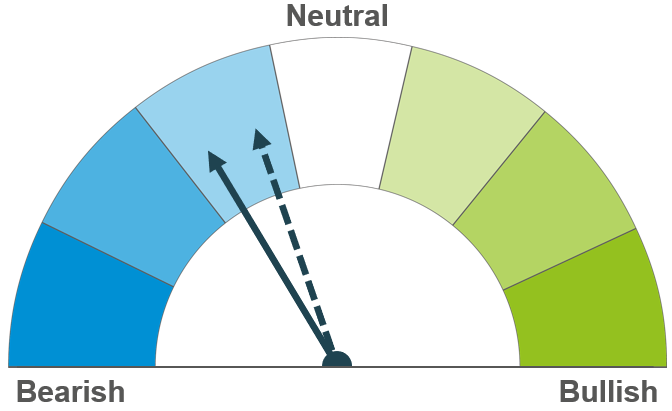

The global and domestic balance is expected to remain tight into next season. Prices continue to follow wider international grain markets.

Global grain markets

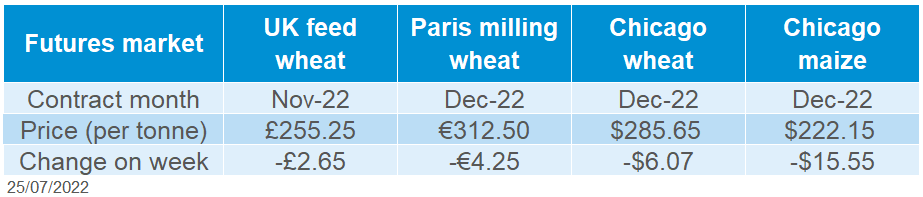

Global grain futures

Last week, volatility continued in global grain markets. Hot weather and strong demand supported prices to Thursday. Though on Friday, global grain markets felt significant pressure from the deal struck between Ukraine and Russia securing a grain export corridor.

A deal was signed between Ukraine, Russia, Turkey, and the United Nations on Friday to allow grain and fertiliser exports from Odessa and two other ports nearby. This deal is valid for 120 days, though is expected to be renewed should the war continue past this point. The corridor would allow movement through Turkey’s Bosphorus strait and vessels to be inspected by Turkish ports. It is expected Ukrainian ports will need around 10 days to prepare before we see vessels start moving (Refinitiv).

Though Russian strikes on the port of Odessa on Saturday have dampened some hopes of a quick start to exporting the 20Mt of grain at Odessa. This is something to watch.

At lower levels of prices, we are seeing relatively strong global wheat demand. Last week we saw the purchase of 760Kt of wheat by Egypt’s state purchaser, with the main origins French and Russian. Today, we have seen Pakistan have offers submitted for a 200Kt wheat tender.

On Thursday, the International Grains Council trimmed their total grain production forecast for 2022/23 by 3Mt to 2,252Mt in their latest monthly report. This is down to wheat, barley, and maize drought stress in the EU. Global consumption was revised down 3Mt too.

UK focus

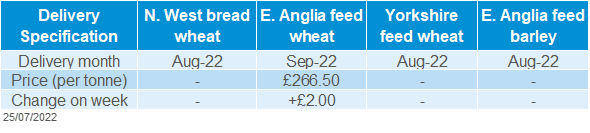

Delivered cereals

On Friday, UK feed wheat futures (Nov-22) closed at £255.25/t, down £2.65/t from the previous Friday. Despite support earlier in the week considering strong EU demand and hot EU weather, Friday saw prices drop £16.75/t due to the Ukrainian export corridor. Though prices rally higher this morning on concerns of conflict at port.

The Nov-23 contract closed on Friday at £229.15/t, down £2.85/t on the week.

Domestic delivered prices followed futures price movement to Thursday. Feed wheat delivered into East Anglia for November was quoted at £266.50/t on Thursday, up £2.00/t week on week.

Bread wheat delivered into Northamptonshire for harvest delivery was quoted at £310.50/t as at Thursday.

The first GB harvest report was released on Friday, showing that dry weather has allowed farmers to make a good start to the winter barley and winter oilseed rape harvest in Southern and Eastern regions of England. In data up to 19 July, winter barley harvest progress has been exceptionally rapid with 69% of the English, Welsh and Scottish harvest already complete. Though combine and crops fire remain a problem. For the full report, follow this link.

Oilseeds

Rapeseed

Soyabeans

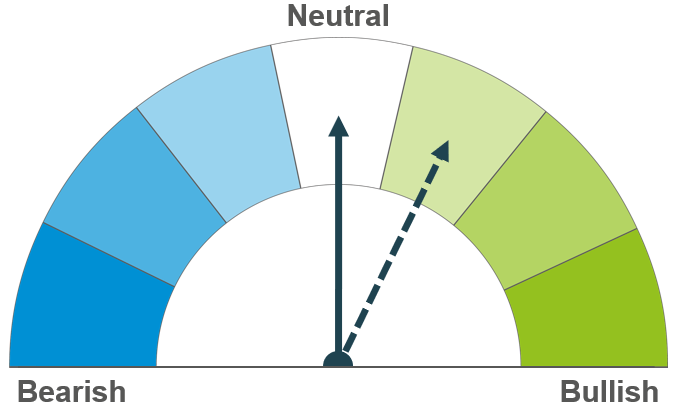

Hopes of shipments out of the Black Sea region puts pressure on prices short-term. Rapeseed prices continue to track the wider oilseed complex. Looking ahead, Canada can expect a sizeable production increase year-on-year from improved weather. However global demand looks to remain strong.

Favourable US weather means that a decent sized crop is looking more likely, putting pressure on prices both short and long term. Global demand currently looks to be picked up from competitively priced South American soyabeans.

Global oilseed markets

Global oilseed futures

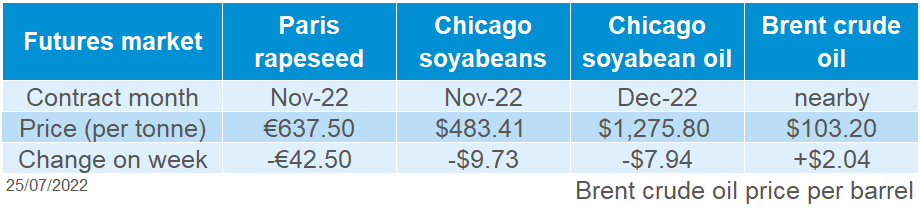

Chicago soyabeans futures (Nov-22) were down 2% last week, losing $9.73/t to close at $483.41/t on Friday. This price drop reflects better US weather conditions, with welcomed rain expected across the corn belt over the next few days. As well as weaker domestic demand in US markets.

Old crop US soyabean purchases have reportedly slowed, as processors wait for the autumn harvest. Falling export demand due to abundant South American supplies is also pressuring prices. Overseas buyers are looking to Argentina for cheaper soymeal supplies.

The wider oilseeds complex also continues to track palm oil prices. Malaysia’s commodities minister has stated that Malaysian palm oil prices are likely to remain weak for the majority of the third quarter (to September). This is following the news that Indonesia scrapped their export levy until 31 August, to boost exports and ease high stocks.

Having said this, Malaysian palm oil futures (Oct-22) have bounced back slightly this morning, ahead of the release of the country’s export figures. Though gains are likely to be capped due to the export situation in Indonesia.

US weather will be a watchpoint this week as the forecasted rain could boost soyabean crop conditions, considering US soyabeans are in a key development phase. Combined with the palm oil outlook, the global oilseed complex is looking more bearish over the coming week.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-22) closed at €637.50/t on Friday, down €42.50/t across the week. The news that an export deal was to be signed between the UN, Russia, Ukraine, and Turkey saw prices lose support over the week, with hopes that shipments of rapeseed out of the black sea region will begin in due course.

The favourable weather forecasted over North America boosting the soyabean outlook also added some pressure on rapeseed futures. Canadian canola crop conditions also look improved after suffering from heat and humidity earlier on in the season.

UK rapeseed harvest is underway with 28% of the GB WOSR area estimated to have been harvested by 19 July. This is slightly ahead of recent years, where typically 4-15% is complete by the end of week 2. For more information see last week’s harvest progress report.

Last Friday we were unable to publish delivered oilseed prices due to insufficient quotes to calculate the published average.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.