Analyst Insight: Zero wheat import tariffs – an impact assessment

Thursday, 19 September 2019

Market Commentary

- UK feed wheat futures (Nov-19) pushed slightly higher yesterday, closing at £135.35/t, the highest level since 22 August. Support for UK wheat futures was provided by marginal gains in both Paris and Chicago wheat futures.

- Support to global wheat markets has continued to come from dryness concerns in Australia, as lowered production forecasts have reduced the on paper global surplus.

- Oilseed markets have slid back following a brief spike in global crude oil prices. Disappointing sales of US soyabeans to China further added pressure to markets and Paris rapeseed futures closed €1.25/t down yesterday.

Zero wheat import tariffs – an impact assessment

In a world of (fairly) rational economies, buyers will always look to purchase from the cheapest origin. Yet while remaining part of the EU, there have been trade barriers to the number of possible import origins.

On the face of it, and instinctively, a removal of the protectionist tariff measures would expose the UK cereal market to global prices. But looking back, would the domestic market have looked any different?

Supply and demand

The starting point for determining any potential impact of zero tariffs on imports is, what are the actual import requirements?

In years of greater supply, the UK needs to prices more competitively against other markets. It is only in years of deficit and relatively higher domestic prices that imports can set the ceiling for the domestic market.

Current import options

Although a proposal for zero tariffs on imports opens up the UK market to “third countries”, we currently have free trade wheat imports from the EU. Additionally, there are currently no plans for reciprocal trade barriers with the EU post Brexit.

As such, any wheat to be imported would have to price below EU origins by a significant enough margin to negate higher freight costs.

Additionally, as part of a quota system, Ukraine already has a near 1Mt volume that can be imported into the EU without being subject to a tariff, and the EU member state of Romania already competes against the Black Sea market.

Further, from a demand perspective, there exists an ability to often substitute wheat for maize, as was recorded in 2018/19. While there are variable tariffs that can be applied to maize imports, these are very rarely enacted, and again, Ukraine has a quota volume for free access.

Lastly, for high quality wheat, above 14.6% protein there are no tariff barriers from any origin.

This leaves low to medium quality bread milling wheat as the most open to new origins and greater competition.

Prices relative to global markets

The UK market is generally in a greater relative surplus position for feed wheat than bread making wheat. How have French, US HRW and Black Sea milling prices stacked up relative to one another and the domestic market over recent years?

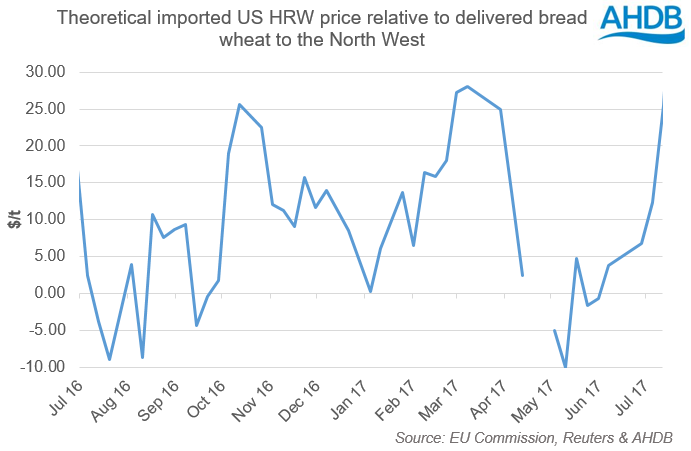

The North West delivered bread wheat market is one of the largest centres for demand with an ability to import. It is this major market that imports could likely impact the UK market to the greatest extent.

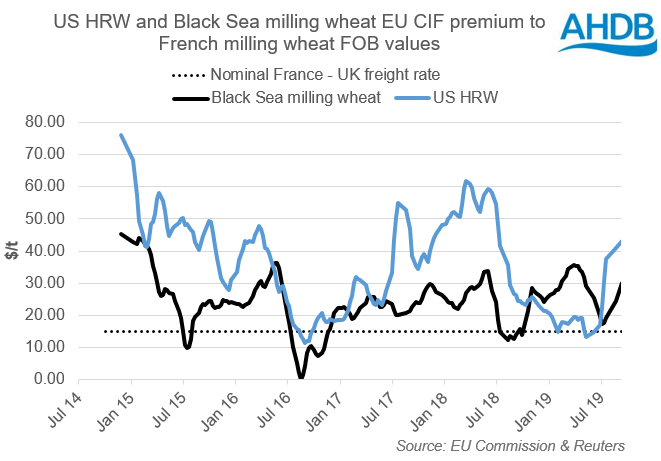

From an import origin view, taking Black Sea milling wheat FOB values and freight costs, an EU CIF price can be calculated. Similarly US Hard Red Winter FOB values, combined with freight costs provide an historic price series for alternative import origins.

Relative to French milling wheat FOB values, there are few instances where alternative import origins would be more attractive than the EU. Adding a nominal $15/t freight cost from France to UK ports, then from July 2014 onwards, only during 2016/17 would non-EU milling wheat have been the cheaper import origin.

Yet during 2016/17, the domestic market for delivered bread wheat to the North West would still not have incentivised the import of non-EU bread making wheat. With a maximum discount to delivered bread wheat in 2016/17 of between $5-10t/t, imports of US HRW would likely not have been a rational economic decision. Further US HRW, while globally competitive may not fully meet the requirements for UK mills.

Conclusion

There are circumstances where a removal of tariffs could lead to greater competition in the UK marketplace. However, these are limited to circumstances where the UK is in an import position and that European origins such as France and Germany are elevated to such a level that the increased freight rates from the Black Sea or US are negated.

As such, a removal of tariffs post Brexit, while setting a ceiling for domestic prices, may well be of minimal impact, relative to the larger trade barriers faced through export challenges.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.