Analyst Insight: What’s the current situation for UK grains?

Thursday, 17 October 2019

Market Commentary

- After almost a week of losses, UK feed wheat (Nov-19) closed yesterday at £134.50/t, up £0.90/t.

- Egypt’s state grain buyer GASC, bought 405Kt of wheat from Russia, Ukraine and France at an average CIF price of $230.55/t. While Russia offered the lowest priced wheat on a CIF basis, the French offer was the lowest FoB offer at $210.61/t.

- Sterling has been rallying against both the US dollar and the euro for the last week on Brexit progress. This morning it dipped to £1= €1.1545 at 10.00am but has subsequently recovered.

What’s the current situation for grains?

Defra’s release of the provisional crop estimate for the 2019 harvest was discussed in an article last Thursday. Following the release of the Defra production numbers the Early Balance Sheet was published on Monday.

The estimates have confirmed large cereal crops and a heightened need to export significant volumes of grain.

Early Balance Sheet

There has been an increase in area grown to wheat and barley for 2019 harvest from the previous season. Additionally, increased yields due to a relatively favourable growing season have resulted in large production forecasts.

Wheat production is estimated at 16.283Mt, a 20% increase from last season and nearing that of 2015. Barley crops are predicted by Defra to be the largest since 1988 at 8.180Mt. Defra’s estimate is higher than trade expectations which ranged from 7.5Mt to 7.7Mt. Even so, we are still in line for large exportable surpluses in both crops.

The balance sheet also shows a slight rise for both crops opening stocks into the 2019/20 season which, despite a lower import estimate, adds to large availability. Wheat and barley availability is predicted at a 12% and 22% increase from 2018/19 respectively.

Domestic consumption for both crops is expected to rise slightly this season, but not to the extent of availability. With Vivergo (biofuels plant) assumed to remain offline throughout 2019/20 it limits Human and Industrial wheat usage which is expected to drop. Although animal feed usage overall is predicted to drop the inclusion of wheat and barley is expected to rise.

The low uptick in consumption, outweighed by the jump in availability has resulted in a huge jump in surplus grain available for either export or free stock. The wheat surplus is estimated at 2.885Mt, up 301% from last season. Barley surplus is estimated at 2.355Mt, up 101% from last season.

Corn Returns

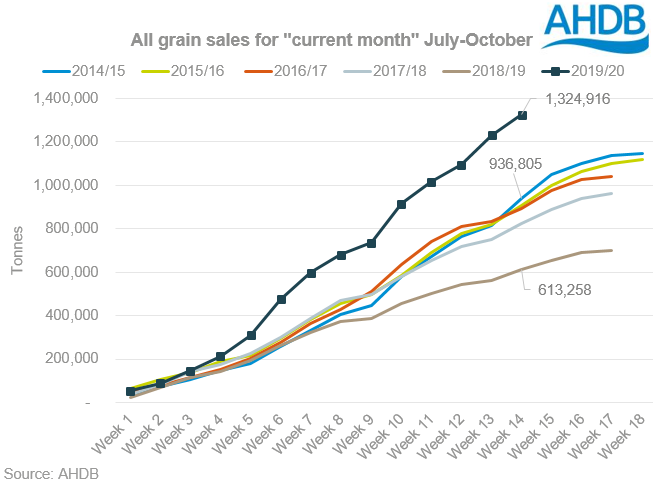

With the expectation of huge crops and the unknown trade situation come 1 November, it is unsurprising that farmer selling has been significant for movement up to October-end. Sales of all grains (wheat, barley and oats) has been huge up to week 14 (10 October). Accumulated sales for spot movement from July totalled 1.325Mt. In the past five years, 2014/15 sales were the next closest at 0.937Mt. These sales aren’t necessarily all destined for export. However, from the first two months of export data available it is clear a lot has been moved early on.

Exports

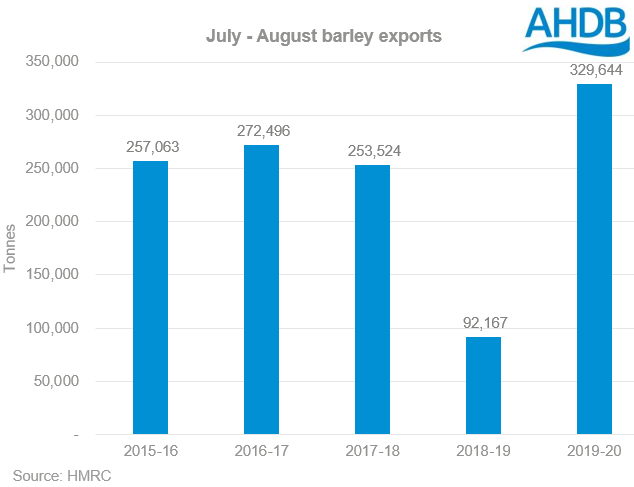

Based on the first two months’ worth of export data available, grain exported from the UK has more than tripled compared to last year, at 485,925 tonnes, 99% of which has moved within the EU. Barley was the predominant mover for these exports making up 68% of the export volume.

With a huge increase in exportable surplus the need for trade to continue with the EU is heightened. Based on a five-year average, 94% of barley and 90% of wheat exports are to EU countries. The limitations and potential opportunities have been previously highlighted in an earlier series of analyst insights. With no known progress of a trade deal for grains post 1 November the export opportunities are likely to be limited and access to non-EU destinations essential.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.