- Home

- News

- Analyst Insight: What is the Impact of coronavirus on wheat demand for starch and bioethanol?

Analyst Insight: What is the Impact of coronavirus on wheat demand for starch and bioethanol?

Thursday, 30 April 2020

What is the Impact of coronavirus on wheat demand for starch and bioethanol?

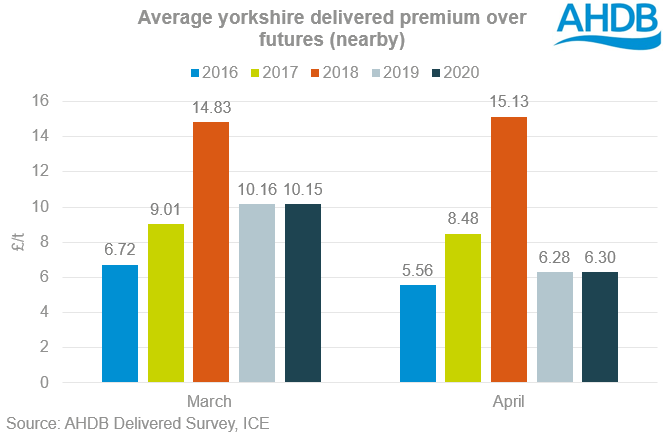

For an indication of bioethanol demand, we can look at the premium of North East delivered feed wheat over UK feed wheat futures (nearby). While there was an initial, small pick-up in delivered premiums into the North East, they have subsequently fallen back, once more suggesting limited demand.

At present only one bioethanol plant is running, yet through March and April delivered premiums are in line with the same point last year, when neither plant was consuming wheat. This reflects both the increased availability of wheat this season, the attractiveness of maize and the lack of demand for bioethanol.

Ethanol demand moving lower

Ethanol demand shifts have been a major focus of global grain markets, the continued reduction in US ethanol output has resulted in a large decline to maize prices. What has been mentioned less is the impact on UK ethanol production.

We covered this briefly a fortnight ago, looking at whether corn was an option for ethanol manufacture in the UK – you can read this here.

Statistics on UK fuel consumption are limited, and as such a number of assumptions have to be drawn using historical data.

Information in one of the recent Government briefings suggests that there are currently 60% less vehicles on the road; this can be crudely equated with fuel consumption. We know that circa 5% of every litre of petrol sold in the UK is bioethanol. However, this figure does not directly correlate to wheat consumption and as such, wheat consumption for bioethanol production will not be down 60%. In fact, according to data from the Department for Transport, in April-December 2018 just 6.6% of UK fuel consumption was wheat based, of which 4.1% was of UK origin.

It is harder to calculate the volume of reduction in demand based on historic averages, with those averages accounting for a period when both ethanol plants were running. With this in mind, I have calculated an approximate reduction in wheat demand, against this season’s trend in “other flour” production.

Since December 2019, there has been an observable shift higher, year-on-year, in both total wheat milled and in “other flour” production, with an average increase of 44% across December-February. Of course, this cannot be directly apportioned to bioethanol production, with “other flour” comprised of both starch and bioethanol, however it does give us a point from which to estimate losses in demand for wheat.

If we carry the 44% increase in year-on-year “other flour” production through the remainder of 2019/20, we set a baseline for March-June wheat usage for other flour production of around 450Kt, under “normal” circumstances. This would take season-end wheat consumption for other flour production to 1.25Mt, down 2% year-on-year.

Using the same scenarios for other flour as we did for milling consumption and scaling back usage over the April-June period by 5-15%, through to the end of the season suggests a loss of demand of up to 50Kt. It is assumed that were “other flour” production to be scaled down and lockdown to end in May, June production would not be restored to pre-lockdown levels immediately.

It is worth noting that there are more external factors at play in UK bioethanol demand, including maize prices and the impact of coronavirus and global geopolitics on crude oil.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.