North premiums capped in spite of deficit: Grain Market Daily

Wednesday, 15 April 2020

Market Commentary

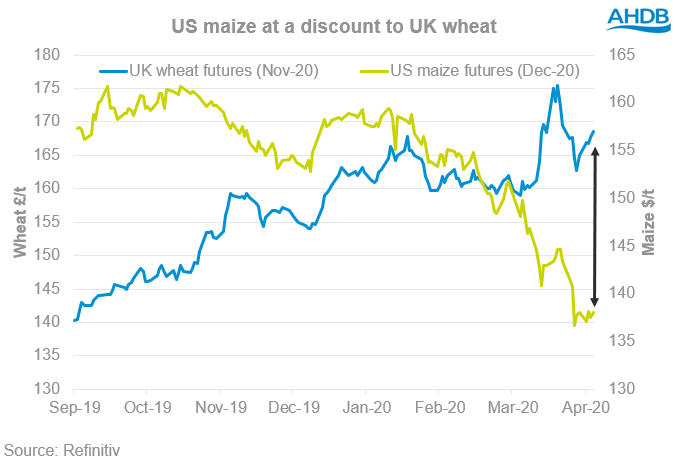

- UK wheat futures (May-20) closed yesterday at £154.15/t, down £4.05/t on last Thursday’s close. The November contract closed at £166.00/t, down £2.50/t on last Thursday’s close. As global supplies of wheat and maize increase, UK wheat futures are pressured.

- At yesterday’s close, new crop US maize futures (Dec-20) were at a £57.93/t discount to UK wheat futures (Nov-20). The downturn of the global economy has severally pressured US maize, which is looking increasingly attractive in the UK domestic market.

North premiums capped in spite of deficit

Next year we are facing a wheat deficit as the UK’s new crop is trading at import parity. It’s critical to give an overview for how this may affect delivered premiums going into the 2020/21 marketing year.

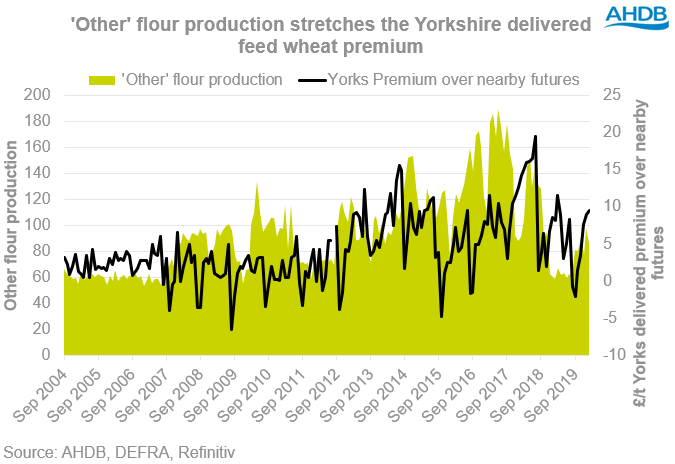

For Yorkshire and the North East, delivered premiums are heavily dictated by consumption for ethanol production.

At this moment Ensus is the only bio-ethanol plant that is operating. As such, premiums for wheat delivered into Yorkshire have been limited compared to when both plants are running.

With tight UK wheat production expected for the 2020/21 marketing year, delivered premiums in deficit regions, such as the North East, will extend, depending on relative demand levels.

We have already seen a degree of extension in new crop Yorkshire feed wheat premiums, quoted last Thursday at £9.85/t over futures.

However, the ability for feed wheat premiums to continue extending in the North East depends on a number of factors, including the price of imported products and ethanol demand. With the UK in lockdown because of coronavirus, the demand for fuel has fallen and subsequently ethanol for blending has likely reduced.

Furthermore, with the knowledge that wheat is already likely to be tight in the North East, the ability of premiums to extend will be dependent on how much tighter the picture gets, and the relative import price and usability of substitutable products.

Due to the current global economic climate, there is a bearish outlook for US maize as demand has also been subdued from lacklustre US bio-ethanol demand. As a result, global maize ending stocks are forecast to grow. Further to that, the USDA latest planting intentions forecast a record maize crop for next year.

Therefore, new crop US maize futures (Dec-20) are at a large discount to new crop UK wheat futures (Nov-20). This discount could potentially allow maize to be utilised in the UK industrially. We know that the Ensus plant is able to use a proportion of maize and has been using maize this season. However, the volume by which they could increase maize consumption is less clear.

What we do know is that the path of imported grain prices, including maize, will be pivotal to the direction of domestic wheat premiums going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.