- Home

- News

- Maize and Soy area rebounds as US wheat area falls to lowest on record: Grain Market Daily

Maize and Soy area rebounds as US wheat area falls to lowest on record: Grain Market Daily

Wednesday, 1 April 2020

Market commentary

-

May-20 Chicago maize futures continued to come under pressure, falling again yesterday, closing at $134.15/t, down $0.20/t with further losses this morning. Reduced oil consumption and knock on pressure from minimal ethanol demand has pressure maize. Further pressure from higher than expected US prospective plantings for 2020 has added to the bearish maize outlook.

-

May-20 US Chicago wheat continued to retreat from the highs on 25 March, closing at $208.98/t yesterday, down $0.28/t from Mondays close and down 2% from the highs on 25 March. With maize markets continuing under pressure, global wheat markets gains are being somewhat eroded.

-

May-20 UK feed wheat futures closed at £157.75/t yesterday, while Nov-20 new crop futures closed at £167.70/t, both fractionally up in a brief pause from the retreat form the highs recorded on 25 March. A recovery in the value of the pound relative to the euro continues to pressure to domestic markets, with sterling gaining 6% relative to the euro since lows on 18 March, reaching £1 = €1.1259, by close yesterday.

-

Following a spike in meal demand due to lower availability of grain distilling by products and concern over South American logistics, global oilseed markets found a degree of support. May-20 Chicago soyabeans have traded between $324.82 - $325.55/t since the 23 March, however the overall crude and fuel market remains under pressure.

Maize and Soy area rebounds as US wheat area falls to lowest on record

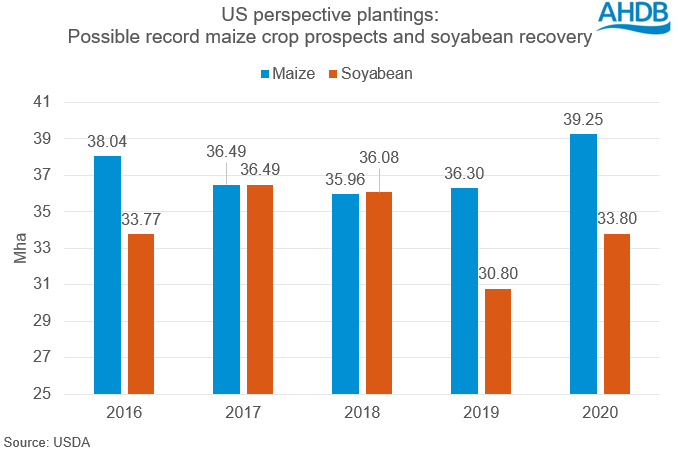

Maize: The planted area for maize in the US in 2020 is estimated at 39.3 million hectares, up 2.95Mha (8%) from last year and the largest planted area since 2012. While maize has been under pressure already with falling crude markets, the prospects for an increased planted area has further added to the bearish tone in US maize markets.

May-20 Chicago maize has fallen from a peak of $151.57/t on 4 March to close yesterday at $134.15/t, down 11.5%, with further falls possible. As maize demand for ethanol has fallen, not only are ending stocks likely to be revised upwards, but with an increased planted area, there may well be a record US maize crop. With between 90 - 92% of the planted area harvested for grain, applying a 5 year average yield of 10.84t/ha would equate to production between 383.2 – 391.7Mt.

Soyabean: The planted area for soyabeans in 2020 is estimated at 33.8Mha, up 10% from last year. However 2019 planting was impacted by the very wet US planting window, and the 2020 prospective plantings sit below the 2017 and 2018 area and in line with 2014 to 2016 planted areas. Taking a 1 – 2 % loss in area, and 5 year average yields of 3.32t/ha, 2020 US soyabean production could end in the region of 110.1 – 111.2Mt, down 10Mt on the 2018/19 record.

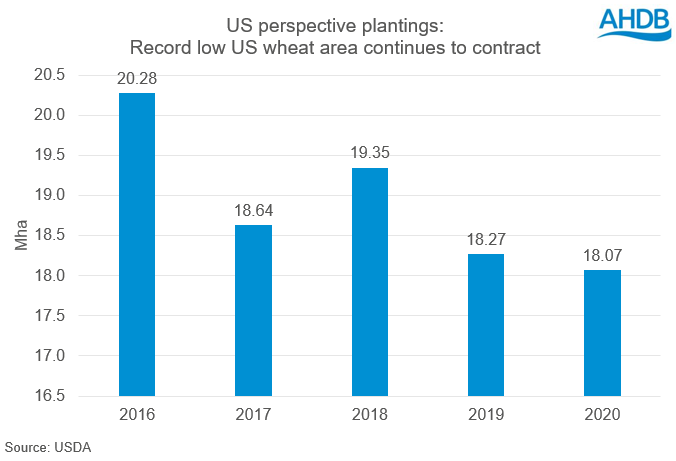

Wheat: The total wheat planted area for 2020 is estimated at just 18.1Mha, down a further 1% from 2019, the lowest all wheat planted area since records began in 1919. The 2020 winter wheat planted area, at 12.46Mha, is down 1% from 2019. The area expected to be planted to spring wheat for 2020 is estimated at 5.09Mha, also down 1% from 2019.

Using winter wheat losses from planting to harvest, between 76 – 85% of the planted area is harvested, and with a 5 year average yield of 3.36t/ha, winter production could be between 31.8 – 35.5Mt. US spring wheat with 92 – 98% of the planted area harvested and average yield of 3.11t/ha leaves production between 14.56 – 15.51Mt leaving total US wheat production between 46.3 – 51.0Mt.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.