Analyst Insight: What is the Impact of coronavirus on wheat demand for flour?

Thursday, 30 April 2020

Market Commentary

- UK feed wheat futures lost further ground yesterday. New crop (Nov-20) closed £1.45/t lower, at £161.80 echoing trends seen in the corresponding Chicago and Paris wheat contracts.

- There have been further improvements in the weather outlook in the Black Sea region with further rain forecast for Southern Russia and Ukraine.

- Oilseed rape futures (Nov-20) ended yesterday €1.50/t higher, at €368.75/t, following moves in crude and vegetable oils. Crude oil prices have continued to climb for the past three days.

What is the Impact of coronavirus on wheat demand for flour?

In unprecedented circumstances, it becomes increasingly important to draw out the implication of coronavirus for the UK market. One of the biggest talking points from a domestic consumer perspective has been the lack of flour on supermarket shelves. It is all too easy to assume that demand for wheat from the human and industrial (H&I) sectors is on the rise.

However, as nabim have been quick to highlight, the supermarket or pre-pack flour market only represents a small volume of domestic flour trade. To understand the true impact on H&I demand we need to consider a myriad of other factors including bread demand and food service demand.

As with work we have previously published on brewing demand in the wake of coronavirus, here I will present a range of scenarios to consider the impact of the pandemic on the domestic market, using the AHDB balance sheets as a baseline.

Summary

Below is the detail of my thoughts behind the impact of coronavirus on consumption of flour and subsequently wheat. In summary, there is still a relatively wide range of possibilities and data behind some of the drivers of consumption is lacking.

That said, based on currently available data it is my view that the change to wheat consumption for flour production (excluding starch and bioethanol) in April-June could be down by as much as 152Kt (-13% on 5-year average levels).

Dependent on how much wheat was contracted to be exported during the window of weak currency in March, this fall in consumption is added back into the balance sheet as carry-over stocks. This in turn could add a modicum of pressure to late season prices.

The current price environment

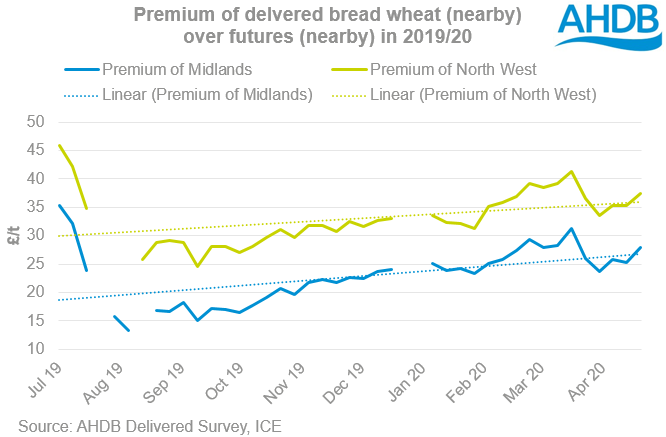

The first point to consider, in order to draw some clarity on the impact of the virus is to look at prices. Global and domestic markets have been understandably volatile over the past 5 weeks, to try to draw out some of the noise and consider the impact of the virus on grain demand we can look at the premium of delivered cereals over futures.

Looking first at milling wheat premiums over feed wheat futures, there was a clear extension away from the trend during early to mid-March, as concerns over coronavirus and the impact on demand grew. However, this subsequently fell back as food service demand was limited.

As we have moved through April, we have seen premiums extend over trend again. It would appear some optimism for demand is returning or there is a challenge in originating physical wheat as futures prices have fallen.

This would suggest that overall milling wheat consumption, whilst spiking earlier in the month, has fallen back.

What does this mean for physical milling wheat demand?

At present and in the context of this work, it makes sense to split milling wheat consumption into three separate categories;

- pre-pack/ household consumption,

- retail bread consumption,

- foodservice consumption.

The easiest of these categories in which to pinpoint coronavirus demand impacts is the pre-pack flour market. During the course of the coronavirus pandemic nabim have provided multiple pieces of information pinpointing the implications for demand.

Piecing this information together, we know that the pre-pack market represents around 3-4% of all flour production (excluding that for starch and bioethanol). We also know that there has been a rough doubling of output of small bags of pre-pack flour over the past five weeks.

It is important to highlight that the doubling of output does not necessarily directly translate to an increase in demand for flour or wheat. A proportion of the increase in operations for millers will be to accommodate the increase in consumption of small bags of flour; this will be displacing a proportion of 10kg and 16kg bags.

Extrapolating the AHDB human and industrial consumption (Jul-Feb and historic 5-year averages) would suggest that over the five weeks of lockdown so far an additional 14.5Kt of flour has been produced for retail sale, equivalent to an additional 18.2Kt of wheat consumed. Assuming this trend continues to the end of the season, an additional 37.9Kt of flour would in theory be produced for retail sale, equivalent to approximately 47.3Kt of wheat.

In reality, the increase is unlikely to be this great given that many mills producing small bag flour will have seen a drop off in demand for larger bags. Furthermore, dependent on the time frame for ending lockdown measures the trend for increased in home consumption could also reduce.

Retail bread and foodservice consumption

Other elements of flour consumption are harder to estimate, including that of flour used in retail bread production. Using data from Kantar Worldpanel we can see that there was an initial spike in consumption of bread, although conversations with the wider industry suggest that this may have fallen back following the initial surge.

According to nabim estimates, in 2018/19 71% of all flour milled (excluding starch and bioethanol) in the UK was destined for bread manufacture. What is less clear is the end market this bread is destined for, retail or food service.

Industry conversations suggest that even within retail bakery sales there is a mixed picture. Convenience stores are reportedly performing well, whilst supermarkets, in-store bakeries and high street bakers reportedly have seen a dip in trading.

Similarly, it is hard to gauge the impact of the loss of food service demand in the UK, with some chains remaining open for delivery, whilst some of the larger outlets have stopped trading.

One thing that has been apparent whilst trying to calculate the shift in flour demand is that there is a consensus over declining flour demand in the last month, but less clarity over the volume of that decline.

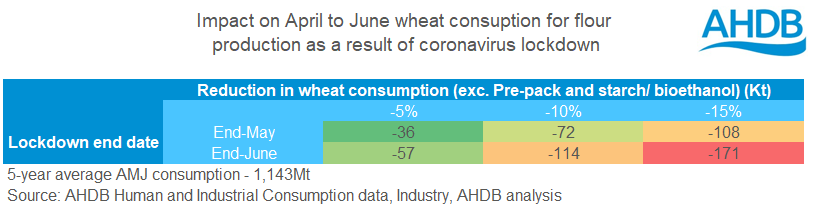

With this in mind, it seems most prudent to present a number of scenarios for the dip in consumption, using a range of cuts to demand and time periods. Using data for the season so far from AHDB H&I usage statistics and assuming 5-year average flour production in March to June gives a baseline production figure of 3.6Mt (less household and other flour).

Given the UK, lockdown came towards the end of March, consumption in the month is assumed at the 5-year average level (338Kt).

Using a range of consumption reductions between 5% and 15%, and varying the lockdown end-date between May and June, suggests overall wheat consumption for milling, less pre-packed flour and bioethanol/starch is likely to down between 36Kt and 171Kt. My personal view would lean toward the higher end of that estimate.

Adding this figure to the projected packaged flour consumption figure would suggest that the change to over consumption of wheat during April-June could be down by as much as 152Kt (-13% on 5-year average levels). Industry suggestions point to a reduction in the region of 10%.

What does this mean for prices?

Dependent on how much wheat was exported during the window of weak currency in March, this fall in consumption is added back into the balance sheet as carry-over stocks. This in turn could add a modicum of pressure to late season prices, and reduce new crop demand early next season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.