Analyst Insight: What is the future of futures?

Thursday, 23 January 2020

Market Commentary

- In the wake of the Phase one trade deal between the US and China, global market sentiment will be largely driven by export volumes and expectations.

- Chicago soyabeans (May-20) have been consistently losing value throughout January, and until China purchases a large volume of US beans will lack support. This has also been weighing on Paris rapeseed markets.

- Global wheat markets have found support of late from gains in Chicago wheat futures, rising on the back of Black Sea prices and a tightening supply outlook. However, further domestic gains could be hard to achieve. May-20 UK feed wheat fell back yesterday from season highs to close at £156.65/t, down £2.05/t.

What is the future of futures?

With the prospect of leaving the European Union looming, there is the possibility for greater divergence in terms of market pricing between the UK and across the channel as free trade may be impinged. As such, the transparency of domestic prices will become increasingly important and pricing volatility may well increase.

The best current day-to-day indicator of domestic prices remains the ICE UK feed wheat futures market, providing both a transparent domestic price indicator and an ability to mitigate risk.

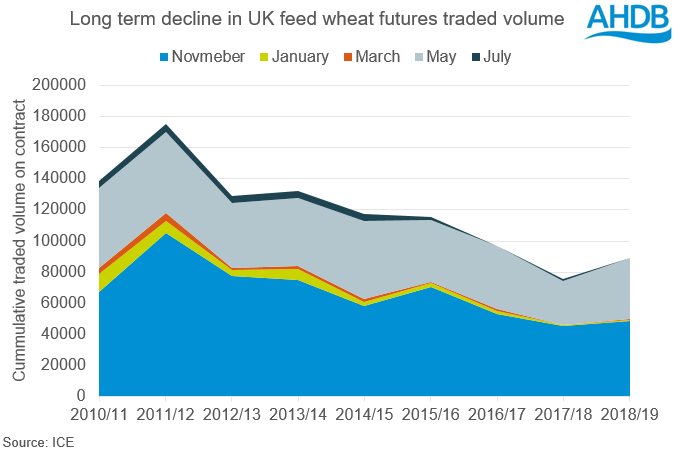

However, there has been a long term reduction in traded volume on this domestically important futures market. As traded volumes decrease, the ease at which trades can happen also falls, leading to a Catch-22 situation of reducing engagement. This has already been seen in the ICE futures market where the traded volumes have concentrated into just two contracts, November and May.

Should the traded volume continue this trend for reduced liquidity, then the futures of UK futures may well be at risk.

With a long term risk of the UK losing its futures market, why has liquidity continued to fall? And how could this trend be reversed?

Farming perspective

From a farming perspective, while some may choose to actively engage in the futures market, the time taken to manage positions and the risk of being margined called will, for many, outweigh any benefits. Further, engaging in futures markets should only be done in a consider way with a full understanding of the risks.

With farming directly engaging in the futures market not a mass option, there remains two alternatives: using options, and/or registering your grain store as a futures store.

Options: Through what is essentially a risk premium paid to set a minimum price, options can be an easily accessible and transparent price insurance tool, reducing risk and increasing engagement.

However, it is not clear that a more widespread usage would actually lead to any greater engagement in ICE UK feed wheat futures. In part due to the greater liquidity and ease of pricing options against Paris milling wheat.

Registering as a futures store: Registering as a futures store could for some be a viable business decision. The ability to effectively deliver against an ICE feed wheat futures contracts could prove beneficial. Additionally, receiving rent for the volume in store could provide additional income. The appeal to create a store could well be in regions where the ex-farm basis to futures is widest, however rates may be a substantial barrier to registering.

While this could provide a methodology for increasing activity in UK feed wheat futures markets, there needs to be engagement from consumers as well as producers.

Consumer perspective

From a consumer perspective, bar accounting complications, two of the barriers to trading are the degree to which futures represent the physical market and the lack of liquidity to easily trade.

While the use of ICE feed wheat futures represents the best currently available financial product in the UK to hedge wheat, it is not a perfect hedge for two related but distinct reasons.

Basis: Due to economic, agronomic and environmental reasons, over the last few years the UK has swung between being a net-exporter and net-importer. The change in supply and demand dynamics in the UK alters the regional pricing structure and indeed the relationship to UK feed wheat futures.

Although an increase in the number of stores could provide greater producer engagement, the nature of multiple registered futures stores can lead to a lack of clarity as to where is being represented. Taking an import year, a large proportion of wheat can be in futures stores located at portside locations. This widens the relationship between physical and futures markets. Breaking down the relationship between physical and futures markets reduces the ability to effectively hedge risk or indeed price grain. This further reduces the incentive to engage especially with limited liquidity.

Liquidity: There is likely to be no quick fix or immediate change to contract specifications. The UK feed wheat market can only increase engagement with greater participation by those on all sides of the trade.

Price transparency

For market transparency, we will continue to provide domestic price surveys. In order to provide price transparency going forward, the current offering of price series including UK delivered, export and import prices and global trade are being reviewed and revised for this spring.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.