Is there still some fire left in rapeseed prices? Grain Market Daily

Tuesday, 21 January 2020

Market Commentary

- UK feed wheat futures continued to gain yesterday, old crop (May-20) futures jumped £0.90/t from Friday’s close, to end the day at £157.25/t. Meanwhile, new crop (Nov-20) prices gained £0.85/t, to close at £165.75/t.

- The price rises in UK wheat follows the global uptick. Russian export prices have seen considerable growth of late, attributed to strong demand, market intervention (read more here) and a weaker Ruble.

Is there still some fire left in rapeseed prices?

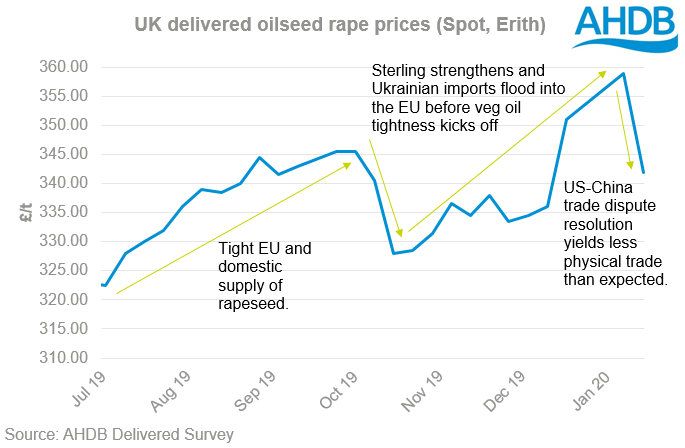

In recent weeks the value of UK rapeseed prices had risen considerably. However, in the latest AHDB delivered survey, oilseed rape (spot, Erith) was down £17.00/t, at £348.00/t. The fall was in part driven by the lack of trade guarantees, following the signing of a phase-one trade deal between the US and China, and partially by the growth in the value of sterling.

There are still some important drivers for rapeseed prices from soya, palm and sterling which could see support continue.

Soyabeans

The signing of a trade deal between China and the US unsurprisingly came with few trade guarantees. With China requiring less volume this season, short term support from the nation’s purchases is likely to be lacking.

However, US domestic demand appears to be strong with December soyabean crush statistics comfortably topping trade expectations, according to Reuters.

Support from soyabeans will be borne out of demand statistics in the short to medium term, with US export figures and crush statistics likely to prove key.

Palm oil

Palm has been a key driver of the vegetable oil complex across the past couple of months. Tight supply and demand in Malaysia and Indonesia has resulted in a firming of prices. However, the ongoing political disputes between India and Malaysia, and the EU and Indonesia, have resulted in a capping of demand and some heat coming out of the palm oil market.

While prices have cooled lately, strong biodiesel mandates in Indonesia and Malaysia, as well as a continued supply tightness in early 2020, could well offer support.

Currency

Sterling gained some strength last week but the outlook is uncertain. With the UK set to formally leave the EU on 31 January, the path of the economy will be crucial.

The Bank of England has said before that it does not rule out using exchange rate controls in order to support the UK economy. A cut in interest rates would reduce the demand for sterling weakening the currency and supporting domestic prices. The next publication from the Bank of England Monetary Policy Committee is due on 30 January.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.