Russia proposing a non-tariff export quota of 20Mt: Grain Market Daily

Friday, 17 January 2020

Market Commentary

- UK wheat futures (May-20) closed yesterday at £155.50/t, down £1.95/t on the day before. Furthermore, the November contract closed at £164.25/t, down by £1.45/t.

- Chicago soyabean futures (Mar-20) closed yesterday at $339.51/t, down $1.75/t on the day before. This contract has taken a downturn this week. Traders are speculating that the long-awaited trade deal between the US and China may not lead to large purchases of US produced soyabeans from China.

- Similar to the UK, France has been hit by heavy rain over the drilling season. According to a survey by Sigma Conseil the French wheat area is down 10% year-on-year at 4.47Mha, a 19-year low.

Russia proposing a non-tariff export quota of 20Mt

Wheat markets were supported this week as the global superpower Russia exerted their influence. The Russian Agriculture Ministry is proposing to set a non-tariff quota for grain exports of 20Mt from January to June 2020.

Throughout the 2019/20 season Russia is forecasting a production of 73.5Mt of wheat, and 34Mt of that is expected to be exported. Being one of the largest exporters of grain it’s not surprising that markets have reacted in such a bullish sentiment.

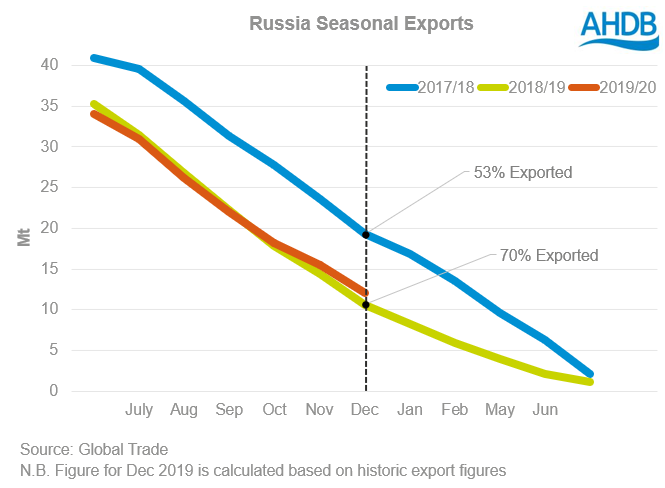

However, it’s critical to engage with previous exports and what this means going into the future. In 2017/18 Russia exported 53% of their exports between July and December, and last year that figure increased to 70%.

For this season, Russia had already exported nearly 18.5Mt of forecast exports for the season by November 2019. Considering the two previous years Russia usually exports approximately 10% of total exports in December. This means that they have already exported approximately 21.9Mt by December 2019.

Conventionally the busiest times for exporting is at the start of the season, and months succeeding harvest. A lot of this is driven by demand from depleted previous season stocks and lack of physical storage.

Therefore, the real question is how negative is this potential quota on global supplies? Not that negative. Russia theoretically has only 12Mt left to export this season. Furthermore, global wheat export supplies are plentiful currently. The EU still has over 50% of their forecast exports remaining, while the Ukraine has 30% as of December 2019. This is over 21.5Mt of wheat available for the rest of the world.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.